Here at Larkspur-RiXtrema, we firmly believe that our software tools are extremely powerful and can help out advisors in so many ways. Here are a few case studies we’ve done this year to demonstrate some of the cutting edge abilities of our software in action.

1. A huge potential to save

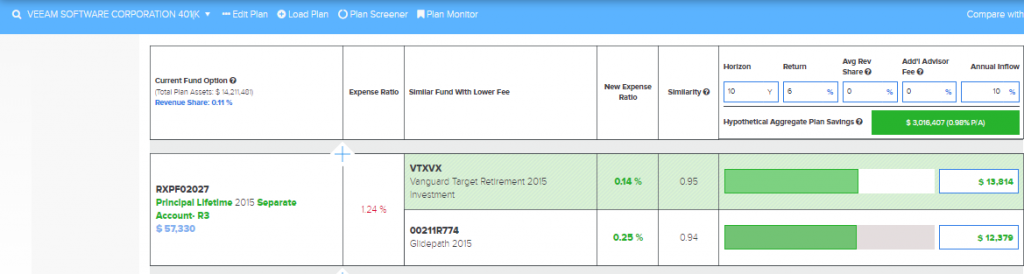

Lets examine one of the plans from the 401k FiduciaryOptimizer tool. For example, if we take a look at VEEAM SOFTWARE CORPORATION 401(K) PLAN, we can see a huge potential to save from taking another look at the alternative funds that the Plan Sponsor can choose from. In this example, the alternative funds are selected from the Open Architecture.

The amount of the saving is staggering as it can be seen on the Low Fee Alternative report:

It is about 3 million dollars for the plan of 14 million dollars. If I would be an advisor and a fiduciary, I would be calling the Plan Sponsor to discuss how to make the plan better for participants and to fulfil my fiduciary duty.

This and more analytical insight can be extracted from the 401kFiduciaryOptimizer practically with any retirement plan.

2. A look at hidden fees

Let us take a look at some of the hidden fees behind the LIFESPAN, INCORPORATED RETIREMENT SAVINGS PLAN.

To reconcile the extra fees like record keeping fees, advisory fees, etc. with the 401kFiduciaryOptimizer, we have two different strategies to make sure we get a good and fair comparison.

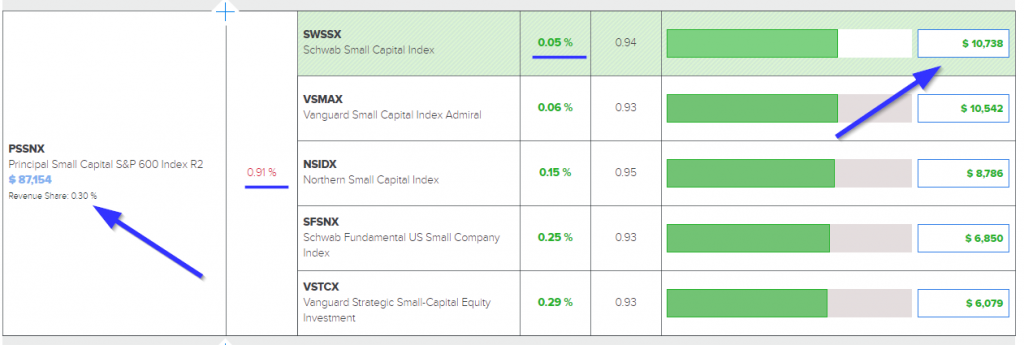

1) The easiest way to make sure you are taking into account any extra fees or revenue sharing structures, we have a default assumption that already accounts for rev sharing! We take the 12b-1 fees of each fund and then subtract it against any savings from a suggest lower feed alternative fund. See the screenshot below:

Figure 1

We can see in figure 1 that the Principal Small Cap S&P 600 Index R2 Fund has a .91% expense ratio, but .30% in revenue sharing (from its 12b-1). The 401kFiduciaryOptimizer will take this .30% and count it against the savings we would have if switching over to the far less expensive, but highly similar Schwab Small Cap Index. Therefore instead of comparing a .91% expense against the Schwab Small Cap Index’s .08% expense, we are comparing .61% vs. .08% to include rev sharing on the original fund. That’s still a lot of savings: $10,738 over 10 years!

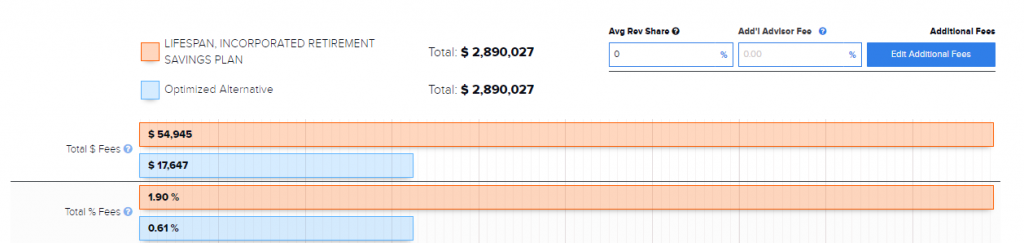

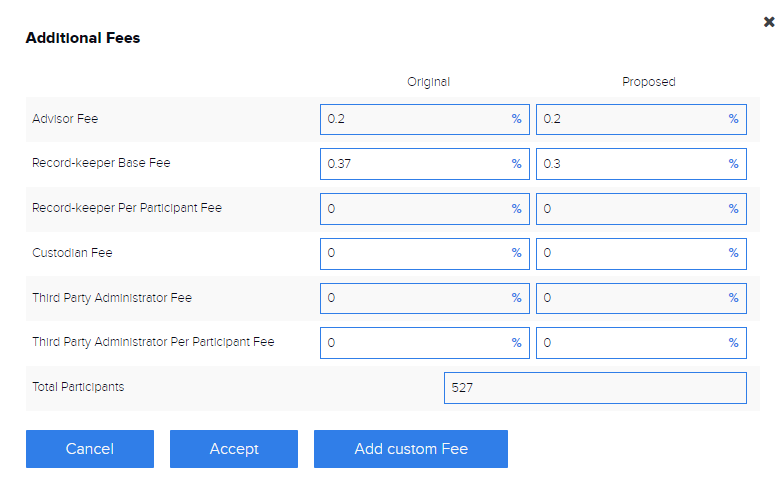

2) The second way we can account for hidden fees for a plan is by looking at the information in Schedule C of the plan. Let’s take a look at this plan below:

Figure 2

We can see here in figure 2, this plan is paying $10,805 (0.37%) to Principal life Insurance Company. In the 401kFiduciaryOptimizer we can take these fees and combine them with savings from fund expense to get a clear look at all the fees.

figures 3 & 4

We can take the fees that we found in the Schedule C and now directly compare them with our own proposed fees. Even after accounting for the original recording keeping fee of 0.37% in the original and a proposed 0.30%, as well as identical advisory fees of 0.20& (figure 3), we are still providing over $30,000 in savings to this plan per year by switching over the cheaper alternative funds found in the 401kFiduciaryOptimzer!

These are the two different strategies that we have for taking on ALL of the fees that are in retirement plans to show plan sponsors how much money they could be saving to their plan participants.

3. Ultimate Plan Optimization

Now let us shift the focus on plan optimization from the 401kFiduciaryOptimizer database. As to be expected, northwestern parts of US which have a predominantly mountainous terrain and subsequently low density population areas also have less and much more scattered retirement plans in comparison to the highly populated areas in the country. So finding the right retirement can be a tough process.

Fortunately, Larkspur-RiXtrema’s 401kFiduciaryOptimizer can become extremely useful in picking out rare gems in the less densely populated areas.

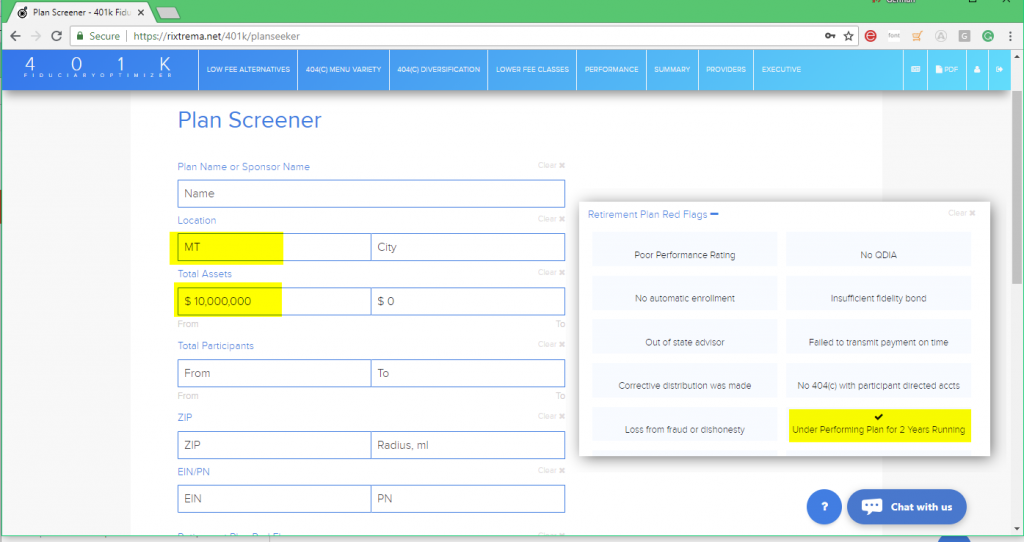

Let’s head straight to the Plan Screener, and filter our results in a state like Montana, with over $10M in assets, assuming that we are targeting an under performing plan, which is indicated by the presence of Under-Performing Plan for 2 Years Running red flag:

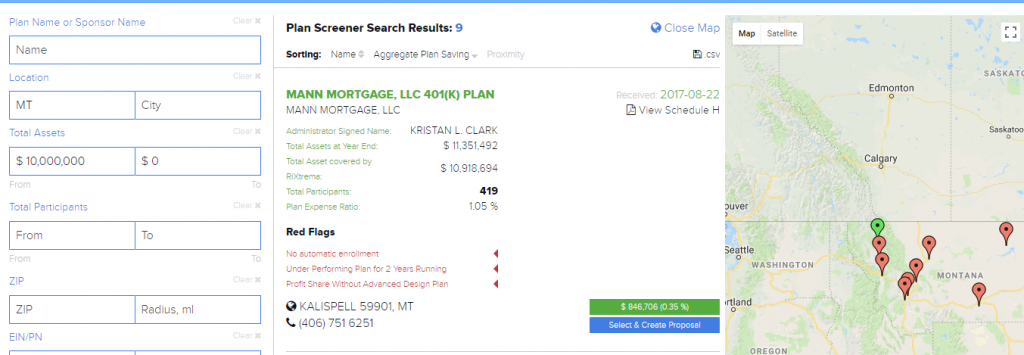

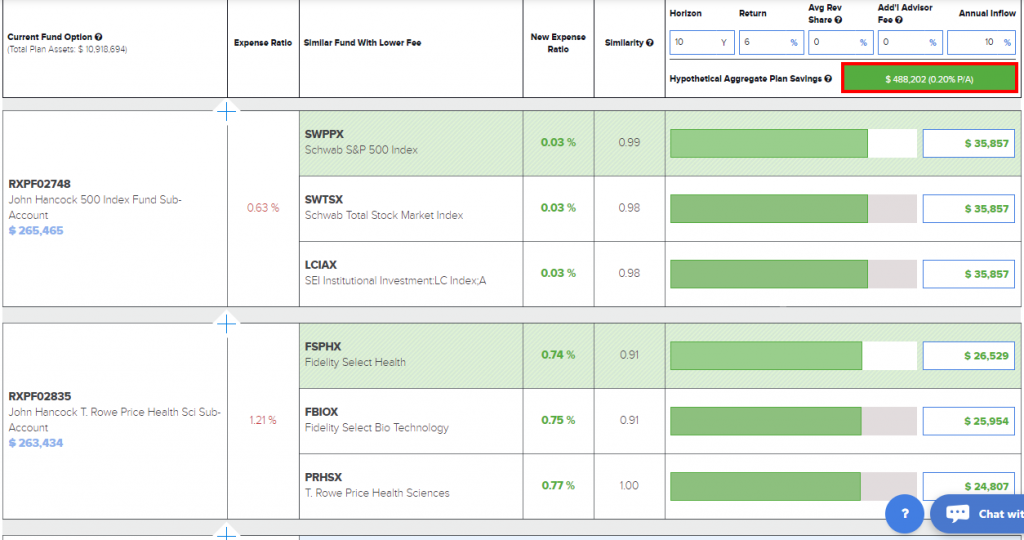

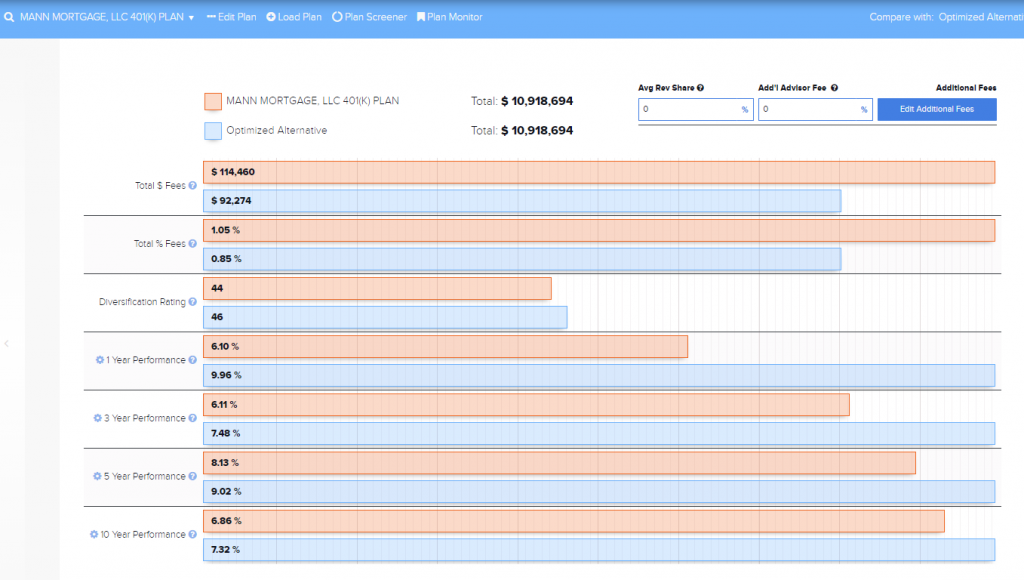

After pressing the search button we get a short list of plans, but each of the entries that has come up could be worth a shot and be a potential candidate for your portfolio. Let’s look at the MANN MORTGAGE, LLC 401(K) PLAN, with about $10M in assets:

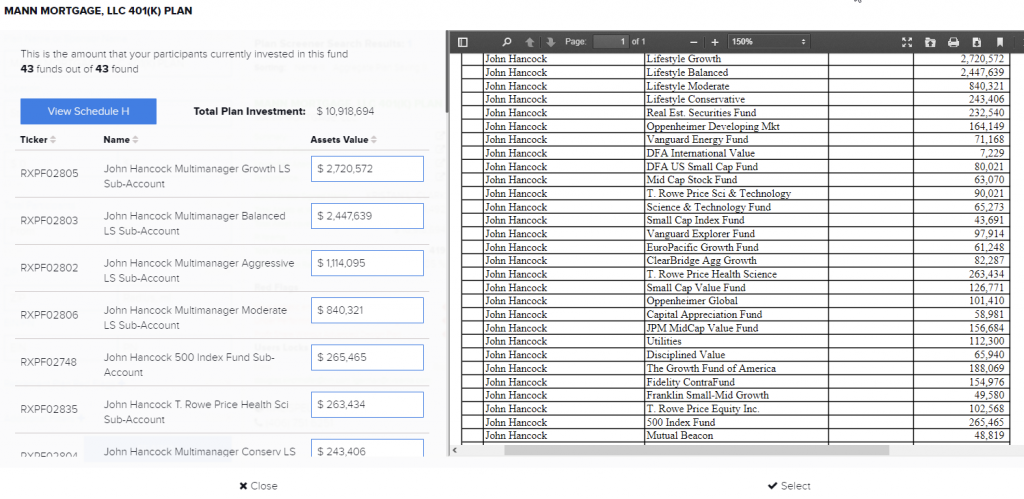

After pressing the blue button, and spot checking the original plan menu, we notice that this plan holds its assets in a large number of smaller Separate Accounts, provided by John Hancock.

A large number of poor performing funds could result in poor plan performance, and with default assumptions of a 10 year horizon, 6% of annual returns, 10% of annual inflow, and 10-year better-performing alternatives, which I quickly selected using Edit Plan section:

Here we can see that the plan could be optimized with better alternatives, saving nearly half a million in assets for the plan and its participants.

At the same time, it gives a much better track record to plan holdings which can be seen in the Summary report for the plan.

Even with some basic optimization, we have managed to get more from the plan optimized funds layout in order to save almost half of a million for the plan. This literally took us a minute but with more careful and in depth customization, this number could significantly increase! 401kFiduciaryOptimizer helps you to find and polish rare gems in any part of the country and grow your 401k retirement practice quickly and efficiently.

4. A Rollover to an IRA Account

Regardless if your clients are plan sponsors or individuals who invest in their retirement accounts, as the advisor you can be a great fiduciary by helping them to achieve their goals. You can accomplish this by diligently reviewing plan options, finding a more affordable plan administrator, screening for the best investment funds that will suit the participants or advise on the rollover, you as the advisor should have all necessary information to act in the best interest and to be a good fiduciary for your client.

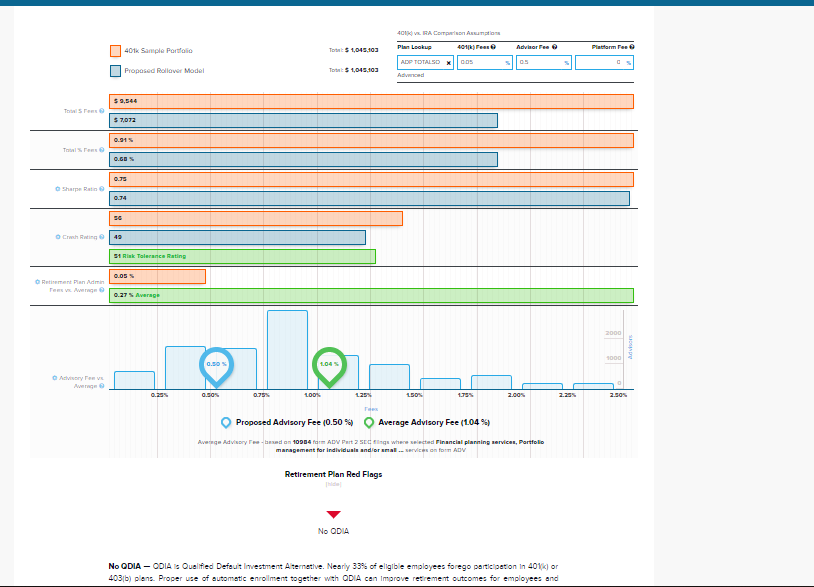

For example, if you are advising an individual who wants to rollover from a 401k plan to an IRA account, you can help them to see the benefit of such a move by comparing various fees like the admin fee vs. advisory fee, advisory fee vs. benchmark advisory fee, risk of investment vs. risk tolerance. The screenshot below illustrates that a rollover from a qualified plan to an IRA account is a good move for the participant because it reduces the cost of the retirement account to 68 bps (advisory fee of 50 bps and the cost of funds 18 bps) from 91 bps (admin fee of 5 bps and the cost of funds 86 bps). Also, the suggested rollover portfolio is better built to meet the client’s risk tolerance, which is very important, since risk management is the integral part of the retirement planning.

With the IRA Fiduciary Optimizer, the rollover becomes a guided step by step process which helps to facilitate and illustrate the rollover. More importantly, it helps to document the entire process to satisfy any compliance rules and to fulfil your role as a fiduciary. Detailed illustrations and diligent risk/financial planning questions will bring the best fiduciary practices to life. Advisors who follow the fiduciary rule would earn the respect and money of their clients because they prove themselves to be advocates of the best interest of their clients while using the best tools available to them.

5. Improving 404(c) Diversification

Now, we’re going to take a look at a plan’s investment menu and how we can improve on it’s diversification to satisfy 404(c) requirements. By default, the 401kFiduciaryOptimizer will build a proposed plan menu of quantitatively similar funds that are low cost. However, using the 404(c) Diversification report, we can build a plan menu that is not only lower cost, but improves on the original plan’s diversification.

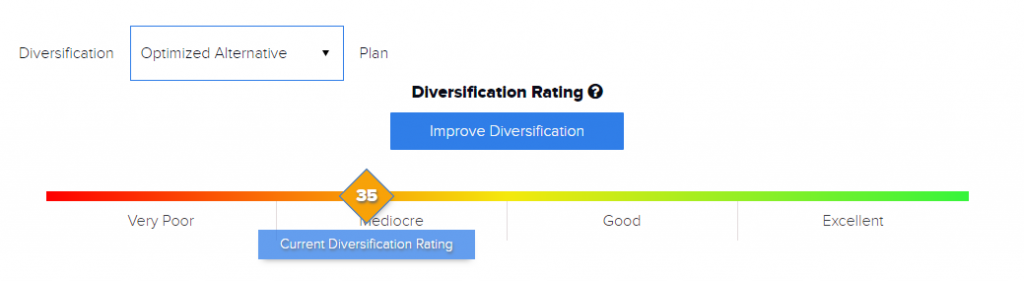

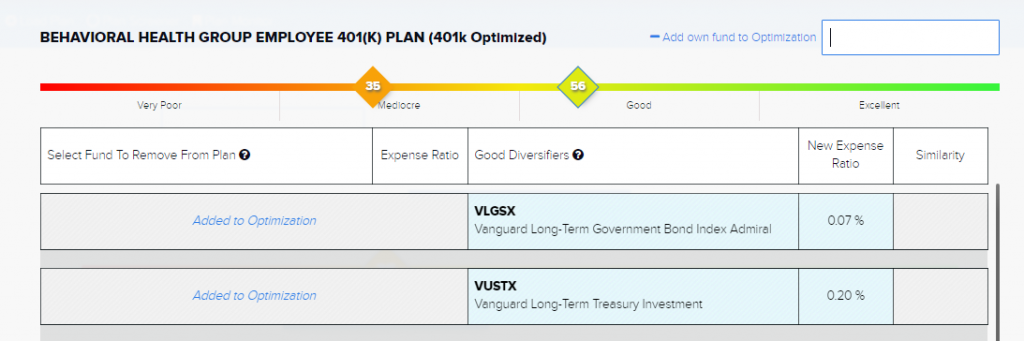

In our example, we are looking at a sample proposed plan for the BEHAVIORAL HEALTH GROUP EMPLOYEE 401(K) PLAN. Our starting point for diversification in this plan is a very low score of 35.

To improve the diversification for our proposed menu, all we need to do is press the “Improve Diversification” button to get started.

From this menu, we can see a list of funds in our proposed lineup that are the most positively correlated. This can give us some guidance for what to replace in our current menu. However, we are not just restricted to replacing funds, especially in the case of a smaller plan menu. In this case I have opted to not replace anything, but to add in two new funds to our proposed menu, VLGSX and VUSTX (a government bond index and long-term treasury fund respectively). After adding only two new funds to the menu, we can already see the diversification rating has taken a huge leap from 35 to 56! Now we have moved from the “Mediocre” range to the “Good” range on our scale just like that.

Using the 401kFiduciaryOptimizer you can see how simple it is to make suggested improvements to a plan to not only save them money, but also to help them avoid potential fiduciary liabilities down the road with a poorly diversified menu.

6. Maximizing Plan Performance

Here we will look at the Summary report of a random plan and we’ll try to optimize it in terms of performance, and cost-efficiency. As you already know the 401kFiduciaryOptimizer algorithm automatically provides you with cheaper but highly similar funds, but have you ever thought about improving the performance of the alternative plan?

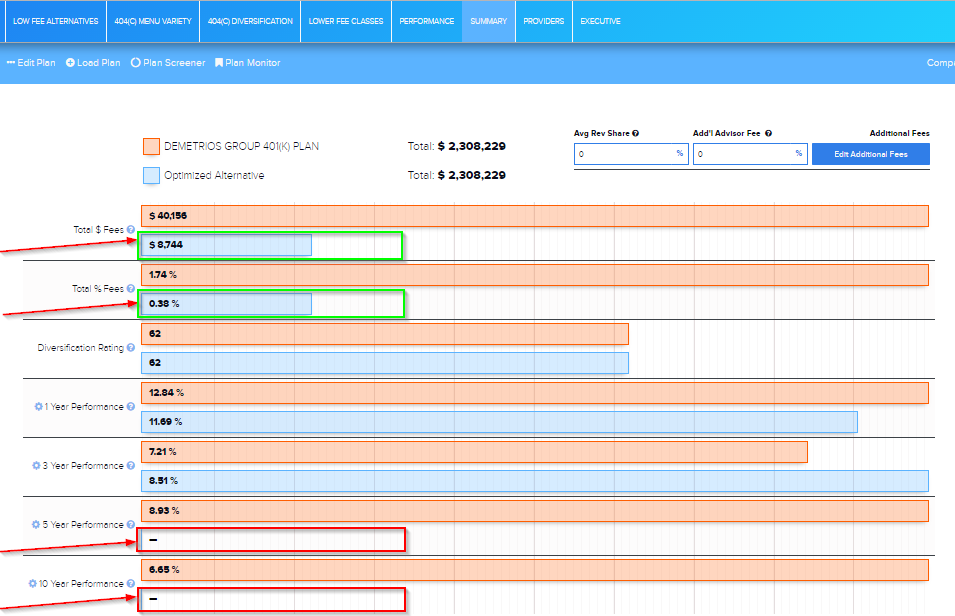

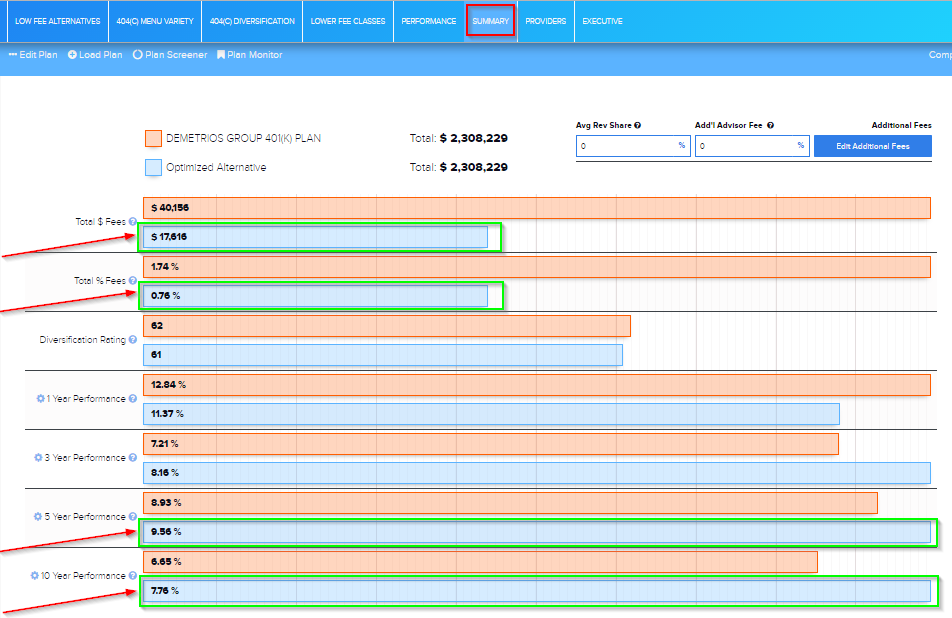

Let’s take a look at DEMETROS GROUP 401(K) PLAN Summary Report:

As you can see, the fees are significantly lower for the provided plan menu, but it still lacks a 5 and 10 year history.

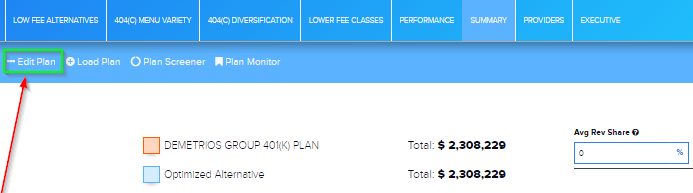

To fix that, let’s go to the Edit Plan section and customize our settings:

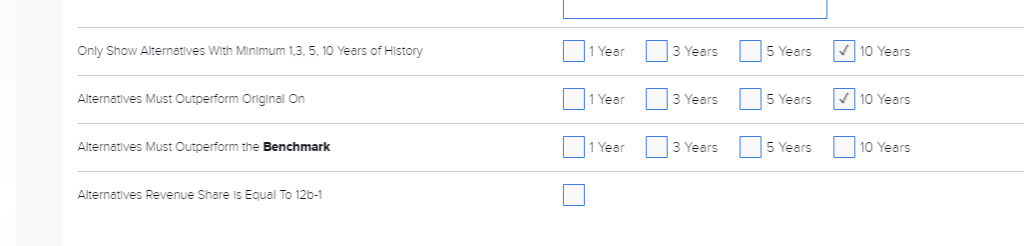

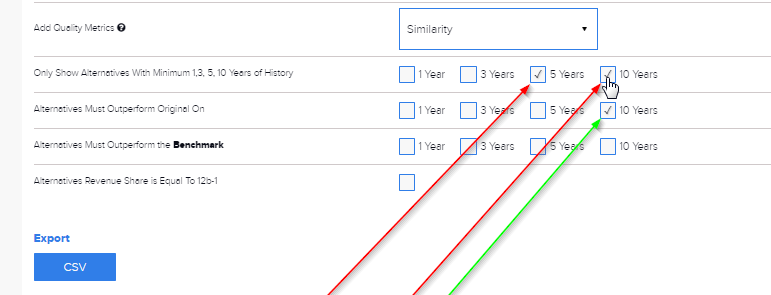

At the bottom of the page we will place a check in the following boxes:

- 5 and 10 years in the setting called Only Show Alternative with Minimum 1, 3, 5, 10 Years of History

- 10 years in the setting called Alternatives Must Outperform Original On

Now, let’s go back to the Summary report and…here you go!

Through a simple settings configuration in the Edit Plan section we now have the best balance between cost efficiency and performance! At this point nobody could argue against the fact that the initial plan needs to be optimized.

7. Crash Testing a 401(k) Plan

Here is how we can “crash test” a retirement plan menu using the Portfolio Crash Test tool. Users of our 401kFiduciaryOptimizer will already have access to over 85k retirement plans across the country and can optimize their assets for lower cost alternatives, but using the Portfolio Crash Test we can take it one step further.

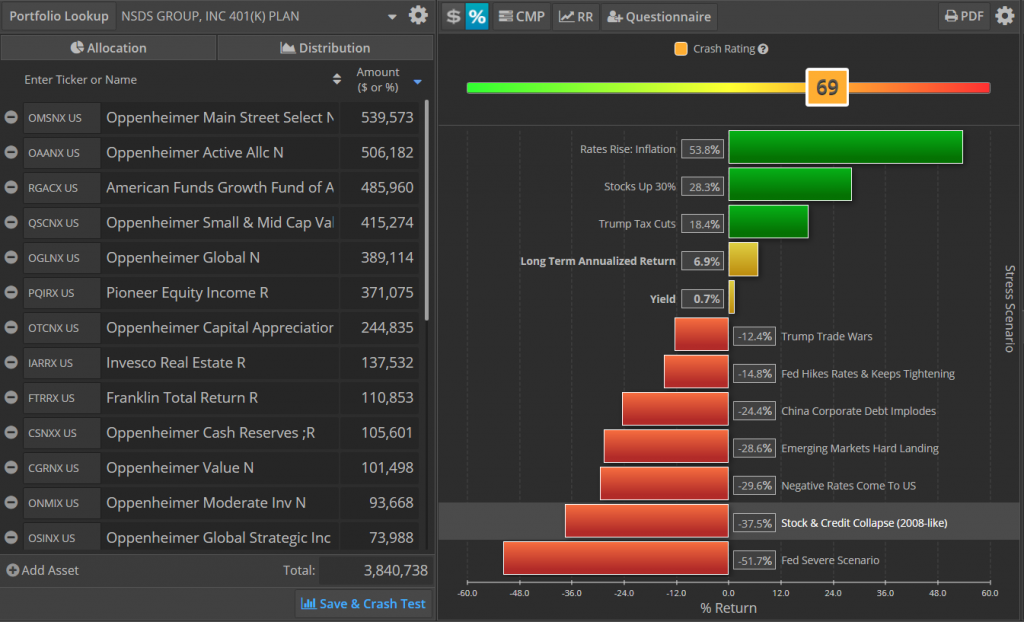

Using the Portfolio Crash Test, we are going to stress-test the funds and current allocations of a plan. For our example we are looking at NSDS GROUP, INC 401(K) PLAN.

In this plan, we can see it’s been rated as a 69 Crash Rating (What you need to know about the Crash Rating in Portfolio Crash Testing). For reference, the S&P 500 Index has a Crash Rating of 72. So the current riskiness of this plan is very close to the stock market in general. So right away, we can see that participants of this plan may not be taking advantage of some of the safer options available to them in their portfolio.

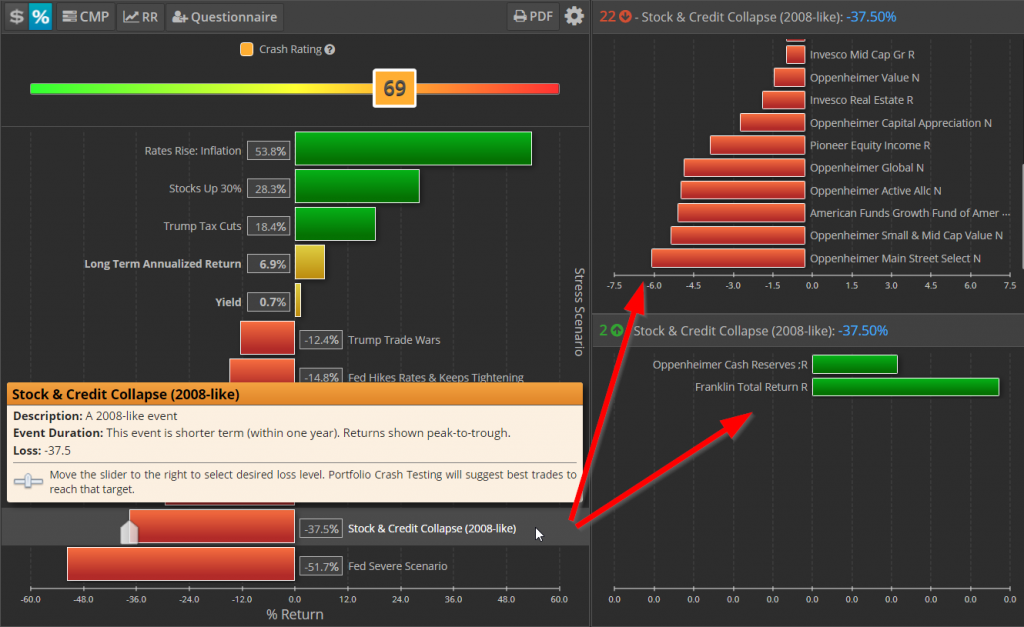

Looking at our “Stock & Credit Collapse (2008-like)” scenario, we can see that this plan stands to lose 37.5% of their assets if another 2008-like market correction occurred. Going further, the Portfolio Crash Test also shows us specifically which funds in this plan are contributing to this loss.

On the right side of the screen, we can see there are several funds causing a large amount of loss on this plan in a 2008-like scenario, the two largest contributors being the Oppenheimer Main Street Fund and Oppenheimer Small & Mid Cap Value fund. Below that, we can also see that there are two positive contributors in this scenario as well (Oppenheimer Cash Reserves & Franklin Total Return). This tells us that plan participants may be potentially over-exposed to some of the riskier equity funds in their plan, and if this is more loss than they can tolerate, they may want to start investing more into some safer funds.

Using the Portfolio Crash Test to manage a retirement plan’s risk a great way to keep plan sponsors and participants educated on how to manage their fund selection in their 401k so they can be sure to take advantage of the safer options available to them in them if needed.

Be sure to sign up for our newsletter to receive relevant case studies and other important research and insight from the Larkspur-Rixtrema Team.