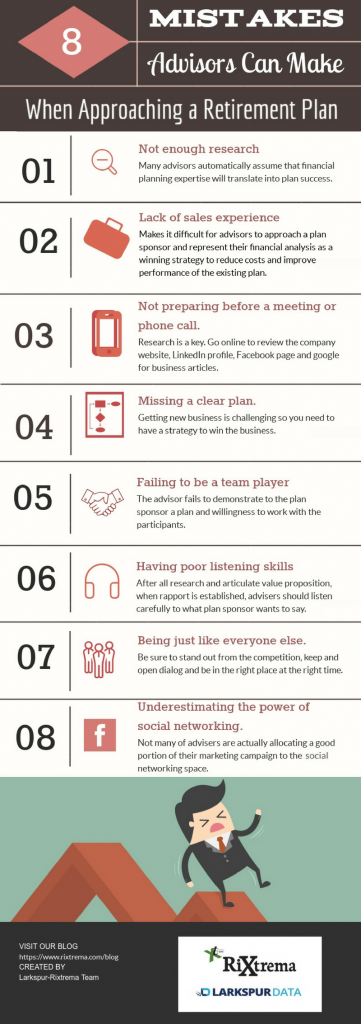

1. Not enough research. Many advisors automatically assume that financial planning expertise will translate into plan success. You need to actually learn the space and study governance best practices plus lingo to have any chance.

2. Lack of sales experience makes it difficult for some advisors to approach a plan sponsor and represent their financial analysis as a winning strategy to reduce costs and improve performance of the existing plan. Making the message (sales pitch, email, direct mail) powerful and eye-catching is as much important as the accuracy of the data in the report itself.

3. Not preparing before a meeting or phone call. Find out how to avoid this mistake with our Must Have Checklist for Retirement Plan Advisors

4. Missing a clear plan. Getting new business is challenging so you need to have a strategy to win the business. Many other advisors would also love to win the plan you are pitching, so be able to clearly articulate your value proposition and why the sponsor should choose you to advise on the plan.

5. Failing to be a team player. The advisor fails to demonstrate to the plan sponsor a plan and willingness to work with the participants. Participant Education is an important aspect that Plan Sponsors want from advisors.

6. Having poor listening skills. After all research and articulate value proposition, when rapport is established, advisers should listen carefully to what plan sponsor wants to say. Knowing needs and wants of the plan sponsor from the source would help the adviser to come back next time with the better value proposition that would show how remedy problems/issues the plan sponsor could be facing.

7. Being just like everyone else. Be sure to stand out from the competition, keep and open dialog and be in the right place at the right time. Read more about it here: How to distinguish yourself from the competition

8. Underestimating the power of social networking. Not many of advisers are actually allocating a good portion of their marketing campaign to the social networking space. Having a LinkedIn connection to the Plan Sponsor, or monitoring and tweet on the Twitter of executive person in a prospect firm could be a good starting point to building your bridge of close relationship. Monitoring their public social network data may give advisers that extra information about the right moment for a call or an introducing message at appropriate time. The usefulness of social media networking should not be overlooked.

Think we left something out? Please comment below and share your professional perspective…

Pingback : 15 Traits No Financial Advisor Should be Without

Pingback : The One Thing You Must Do As a Plan Advisor