In the United States, defined contribution (DC) plans are facing unprecedented problems.

According to Groom Law Group, the number of litigations under the Employee Retirement Income Security Act of 1974 (ERISA) reached a new high in 2020, with more than 200 new class action claims filed, and an increase of 80% in 2019. Despite the fact that activity in 2021 was slightly lower than in 2020, numerous lawsuits such as exorbitant fees, cybersecurity, and risky investments were still filed.

DC investment committees are now confronted with a new challenge to comprehend and adapt fresh regulatory guidelines and assess proposed rules. On April 14, 2021 the Department of Labor (DOL) issued cybersecurity guidelines, which underlined the importance of a fiduciary’s role. A fiduciary is responsible for keeping an eye on service providers and evaluating

the safety of participant information. Even though it’s not a new regulation, its impact can still be seen.

The sponsors realize that they must change their practices to fully prepare their participants for retirement in these challenging days. The cost of inactivity is postponed retirement which would have a significant financial impact as a result of workforce management issues. Unlike a Defined Payout (DB) plan with a predetermined benefit, DC plans require the person to determine the right contribution rate so that their retirement is fully covered when paired with investment profits. What are the actions to take in this challenging climate to put plan participants on a road to achieving a fully funded retirement income stream? Here’s a list of actions that can be taken to mitigate these risks:

Legal issues

Adjust plan governance

Regular fee benchmarking, operating in line with the plan agreement and investment policy statement, and continual monitoring of plan investment alternatives are examples of activities that may be taken to reduce legal risk.

Establishing clear investing principles and objectives for the plan is also a crucial first step in the process of enhancing governance. They are currently used by many major plans and are regarded as a core feature in global best-practice models, essential to enhanced governance.

Improve plan governance

The SECURE Act (Setting Every Community UP for Retirement Enhancement Act) passed in 2019 includes revisions aimed at expanding plan coverage for employees of smaller businesses by letting them join together in a single plan, known as a Pooled Employer Plan (PEP) or Multiple Employer Plan (MEP). MEPs and PEPs are great solutions for small businesses that can make use of collective power to get reduced costs and more extensive services. However, it’s important to remember that employers retain fiduciary responsibility for the careful selection and continuous control of MEP and PEP providers under these agreements.

Enforce cybersecurity

“ERISA-covered plans typically store millions of dollars or more in assets and preserve personal data about members, which can make them enticing targets for cyber-criminals,” according to the DOL’s cybersecurity guidelines, which were released on April 14, 2021. Thus, “Responsible plan fiduciaries must ensure that cybersecurity risks are properly mitigated.”

The DOL guidelines include the following actions in hiring service providers to help plan sponsors manage cyber risks:

– Inquire about the provider’s security processes and policies, as well as the security levels/standards it has met and audit findings, and compare them to those of other companies.

– Examine the provider’s records, which include data security events, litigation, and legal actions, and inquire about previous security breaches.

– Check to see whether the provider has any insurance plans that are relevant.

Participant outcomes

Understand the funding policies for DC plans.

To assess progress and identify which levers will have the greatest impact, it’s important to conduct retirement preparedness surveys at least every 3 years. Without establishing a baseline and conducting periodic assessments, it is impossible to correctly determine what adjustments are required in the future or to assess the impact of previous actions.

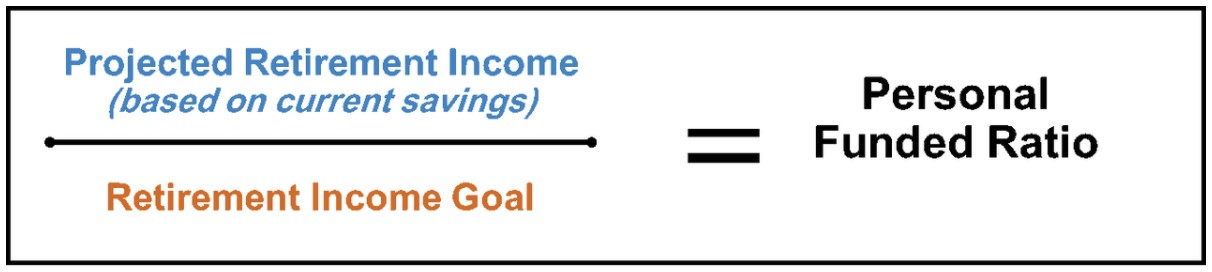

For example, Russell Investments invented the term “Personal Funded Ratio” to describe a proprietary technique for calculating “an individual DC participant’s personal retirement readiness based on the asset-liability funded ratio approach”.

Reconsider the menu design and portfolio organization.

Having a clear and well-designed core menu becomes very vital to boost the chance of a good retirement outcome. It is important to design a baseline investing structure for the core menu, which comprises an active and passive mirror. The goal is to make participant investment selections easier, retain economies of scale by investing plan assets in fewer alternatives, and meet the investment needs of the majority of participants.

Reconsider the Qualified Default Investment Alternative (QDIA)

The majority of DC plans in the United States have elected to employ TDFs as their plan’s QDIA. Target date funds create diverse portfolios with variable combinations of fixed-income assets. One of the reasons the series is typically the largest investment in terms of assets under management (AUM) and receives the greatest continuous contributions is due to its intuitive character.

While they allow members to avoid making investment decisions from the time they join until they retire, it’s critical that committees don’t neglect to evaluate their managers on a regular basis.

A hybrid strategy, in which members are first defaulted into a TDF but are then automatically shifted to the managed account as retirement approaches, starts to gain interest. The idea behind this strategy is that participants don’t require as much personalization early in their careers when they are less involved, but they will profit as they approach retirement.

For committees worried about managed account costs for a full-time staffer, this strategy might be a viable option.

Provide retirement income options to people who are nearing retirement.

DC plan sponsors and committees have traditionally focused on assisting members in accumulating assets during their working years, with minimal assistance offered in retirement.

The SECURE Act establishes a new fiduciary safe harbor for choosing an insurance company as a distribution alternative. The SECURE Act, in combination with increased product availability, appears to be a catalyst, with more committees showing interest in assessing retirement income options for their DC plans.

Well-managed implementation

Implementation is widely described as trading methods performed by a third party to avoid costs and unwanted risk exposures when a committee decides to make a manager change. If risk and expenses are not carefully controlled, each asset movement in a DC strategy might have major consequences. Transitioning assets from one investment manager to another or centralized investment implementation of multi-manager portfolios are examples of implementation in DC plans.

Efficient investment implementation lowers turnover and trading costs, keeping members fully active in the capital markets, and eliminates the blackout dates and performance holidays that are widespread in today’s DC plans.

Conclusion

Today’s DC committees have major obstacles in preparing their members for retirement, which are made much more difficult by a number of legal and regulatory considerations. However, if committees are to enhance participant outcomes, they must avoid being immobilized by fear of lawsuits. It is critical that committees assess the savings and investing techniques presented in this article.

Ensure your DC plan is well-balanced and regularly assessed,with Larkspur Executive. Schedule a Demo with us to see how to benchmark your plan or reach out to clientsuccess@rixtrema.com to set up a demo.