2021 Fidelity State of Retirement Planning study says that the past couple of years have had a negative impact on the retirement plans of 80% of Americans. «Most Americans (69%) describe themselves as proactive or planners—and 64% either have a plan or have thought in detail about how to afford their desired lifestyle in retirement».

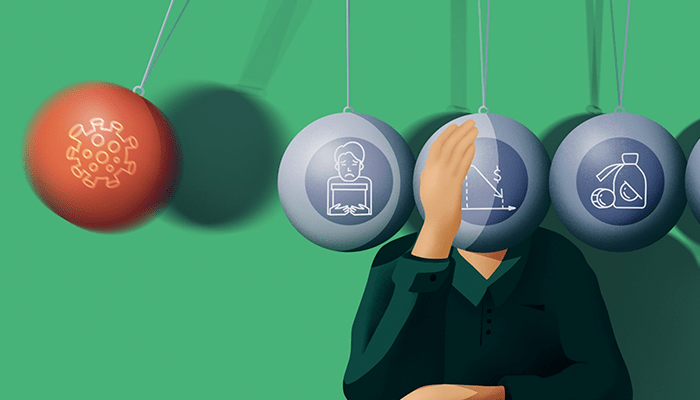

Those who lost their jobs and took retirement withdrawals had to delay their goals for two years or more. A survey by Goldman Sachs, through it’s program, 10000 Small Businesses shows that 42% of small businesses laid off employees or cut worker pay over the past year, leaving millions of Americans unemployed or underpaid.

However, the majority of people are still confident in their retirement plans. The reason for this is that seventy-nine percent re-evaluated their goals and improved their retirement preparedness.

Also, younger and older Americans have different factors that worry them. For example, not having enough money to retire the way they want worries those born between 1997 – 2012 (Gen Z) less than those born between 1965-1980 (Gen X).

Having a good financial mindset and a plan can go a long way in reducing stress, especially in times like these. Meeting a Financial advisor and setting financial goals first are some main steps people make in 35 and 39 percent respectively.

When it comes to planning, research shows that people who thoroughly plan out their retirement goals are more confident and relaxed about their ability to retire when and how they want.

A new report in The National Institute on Retirement Security finds that, over the past few decades, the U.S. retirement system changed.

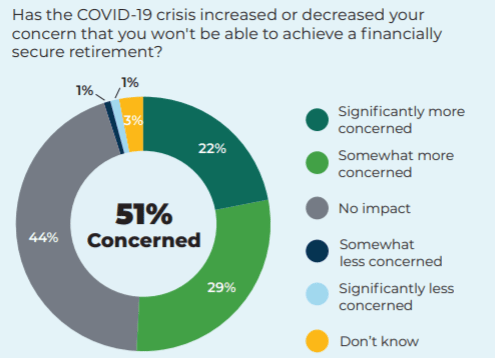

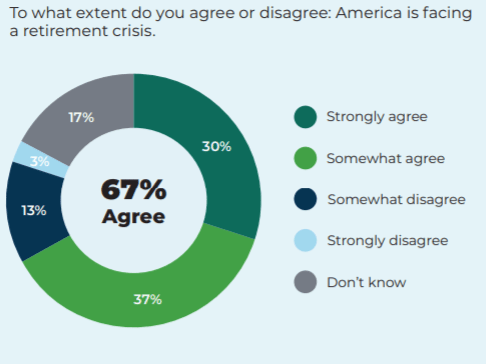

«Americans are deeply worried about retirement, the pandemic will impact retirement, and Americans see pensions and Social Security as important for rebuilding retirement readiness».

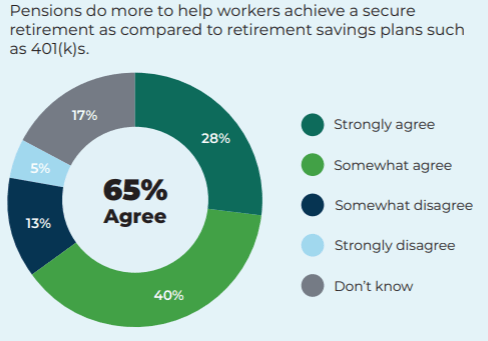

A concerning amount of people don’t have an employer-sponsored retirement plan. Workers with defined contribution individual accounts are less stable compared to those who have defined benefit accounts. The main factors that help us understand what Americans think about the shifting retirement landscape are:

– More than 50% of Americans say that they are now more concerned about achieving financial security when they retire. And sixty-seven percent plan to retire later.

– Sixty-seven percent say that a retirement crisis is a reality now.

– Sixty-five percent of people say that pensions can provide retirement security better than 401(k) accounts.

Although we are facing a retirement savings crisis. It is important to assess potential new risks that could arise from any proposed solutions to mitigate the crisis.

Our Portfolio Crash Testing PRO software can help you become a Trusted Risk Management Advisor. By analyzing the loss a portfolio may incur during the worst stress-testing scenarios, you can prepare and keep clients, even during a downturn.

Contact our Client Success Team at clientsuccess@rixtrema.com or visit our website to receive a call back to learn more about Portfolio Crash Testing PRO.