Follow These 4 Simple Steps to Win Over Prospects and Grow your Practice

Over the years we have developed an extensive database of 401K plan menus and the contact information for executives that work at the plan sponsor. By combining this information with our Portfolio Crash Testing (PCT) tool, you have a powerful prospecting platform that gives you the ability to tailor a unique pitch. Here’s how it works:

For most advisors, winning new business is one of their toughest jobs. With an estimated 250,000 advisors prospecting the same leads that you are, it can be difficult to stand out from the pack. So how can you start a conversation that helps you differentiate your value proposition from other advisors?

At Larkspur-Rixtrema we have thought a lot about this challenge and we have created a product called Prospects of Wealth 2.0 that we think can help, though our approach may be a bit unorthodox. We started by asking “What if we could develop a tool that enabled our clients to pitch a prospect with relevant information about assets the prospect likely holds?”. This would allow you to show portfolio risk and potential challenges the prospect may face in certain scenarios using assets that they are familiar with. You could immediately demonstrate your value proposition to a client in a more concrete way.

For about 1.2 million executives in the US, we can help do exactly that. Of course, we can’t get the portfolios these executives hold, but we can get close. At least close enough that the conversation is relevant and will hopefully compel the prospect to pay attention to your pitch.

Over the years we have developed an extensive database of 401K plan menus and the contact information for executives that work at the plan sponsor. By combining this information with our Portfolio Crash Testing (PCT) tool, you have a powerful prospecting platform that gives you the ability to tailor a unique pitch. Here’s how it works:

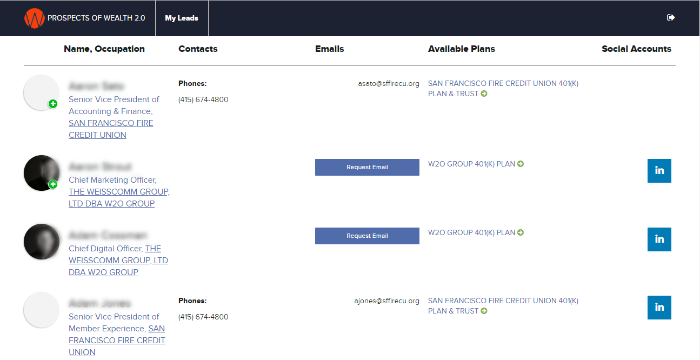

1. Find a prospect in your area using our search tool. Email address, social media accounts and phone numbers are provided when available, and e-mails can be requested (yes, we will find the e-mail address for you).

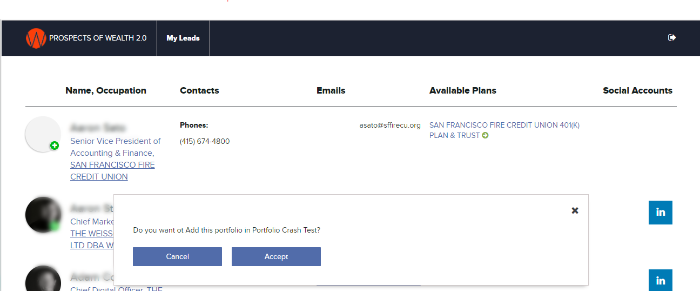

2. Click on the hyperlinked Plan (in the Available Plans column) to launch the Plan menu in PCT

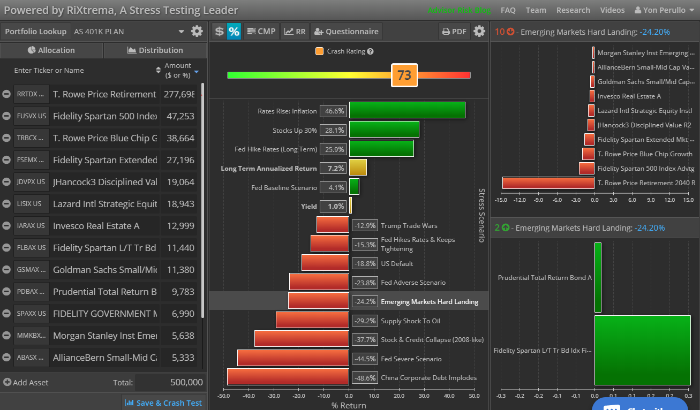

3. Examine the Plan using Portfolio Crash Testing’s robust scenario analysis, RetireRisk functionality, and portfolio comparison tools. Of course, the Plan menu does not contain the exact allocation of your prospect, but the funds are certainly familiar and are key holdings in the prospects retirement portfolio.

Prospects of Wealth 2.0 also contains the names of an additional 5 million wealthy individuals with wealth indicators (i.e. luxury yacht ownership), contact information, mailing address, etc. so that you never run out of leads. We have changed the way advisors use risk management and prospect.

These processes used to be artificially separated workflows that belong together. If you have a great prospect, assessing risk of the portfolio will help in bringing them onboard. Portfolio Crash Testing with Prospects of Wealth brings all of this together.

Become a trusted and successful advisor with Portfolio Crash Testing/Prospects of Wealth combo. Prospects of Wealth 2.0 is now officially released. You can request your demo at the link below and receive a combo of 5 million prospects with detailed data along with sophisticated risk management solution to win them over:

Pingback : How to Enhance Your 401(K) Plan Practice as a Retirement Plan Advisor

Pingback : Top 5 Larkspur-Rixtrema Blog Posts for June 2018

Pingback : Read about Prospects of Wealth 2.0 in The Latest In Financial Advisor #FinTech for June 2018

Pingback : Larkspur-RiXtrema Year in Review 2018: News, New Tools for Advisors and More…

Pingback : 11 Client Acquisition Tips for Financial Advisors