Latest quarterly report from Berkshire Hathaway contains a wealth of interesting data. The holding company incurred $25.4B of investment losses. Let’s break down the sources first, then see what it tells us about Warren Buffett’s current investing style and strategy. Broadly, there are two major sources for the shocking loss: a write down of Kraft Heinz assets and massive unrealized losses in the liquid investment portfolio.

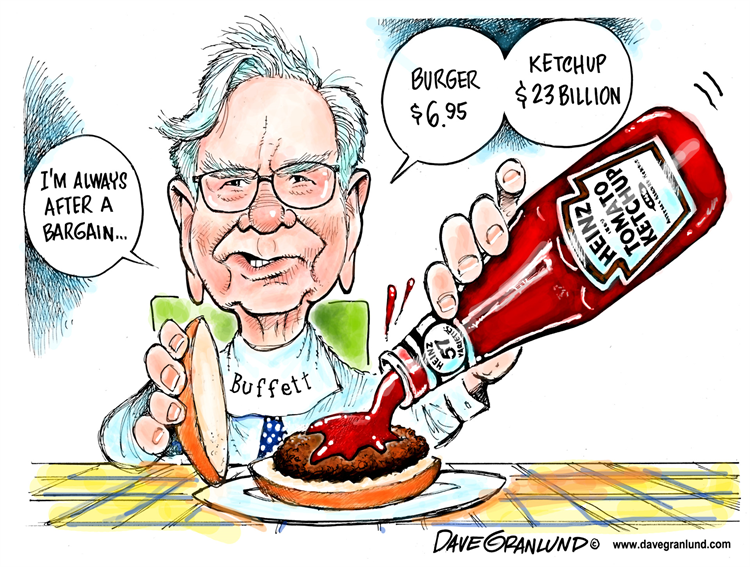

Kraft Heinz

Kraft Heinz had a slew of bad news lately culminating in a $15.4 B writedown on the value of its brands Kraft and Oscar Meyer. Kraft also posted $12.6 B loss and cut its dividend by 36%. On top of all that it announced that SEC is investigating its accounting practices. Stock fell over 30% immediately on the news.

There are couple of important points to take away here. First off, Buffett’s stellar investment reputation was built on a premise that he is a great value manager, who knows how to identify value and run a business. Kraft Heinz news shows that either those days are gone or that father time finally caught up to him. The reason problems at Kraft affected Berkshire’s accounting statements so much is because it wasn’t one of its typical investments. Berkshire bought a controlling stake in Kraft, so for accounting purposes it is treated very differently from other common stock investments.

You would think that buying a controlling stake in the company would prompt Buffett with his partner Charlie Munger (plus future replacements Ajit Jain and Greg Abel) to actually work some magic and help manage the company. Not so. Berkshire relied on a Brazilian PE firm 3G to run Kraft. 3G is ran by Jorge Paulo Lemann, whose playbook for running businesses seems right out of Oliver Stone’s Wall Street movies (sans any illegality, of course). The playbook is simple. 3G comes in, fires top management, cuts costs drastically. This strategy certainly had help from Federal Reserve’s cheap liquidity over the past decade to help finance such acquisitions, assuming you are large enough to avail yourself of that liquidity. Small and medium businesses had difficult time getting cheap financing even in 2012-2013, at the nadir of the cheap liquidity production. I can attest to that as a small business owner, who had to rely on bootstrapping. But I digress.

There is nothing wrong with cost cutting, as long as it doesn’t affect the long term innovation or morale of the company. Amusing examples of 3G cost management, such as removing free Kraft products for Kraft employees from office fridges probably didn’t help with the morale. As Kraft Heinz results show, this strategy of aggressive cost cutting is very limited. Once the effect of cost cutting dries up, Kraft had to innovate and be very nimble in the global competition for food markets. And it is this aspect that neither 3G nor Berkshire could master. As if to confirm that, in the letter to investors Buffett openly acknowledged that he continues: “to hope for an elephant-sized acquisition. Even at our ages of 88 and 95 – I’m the young one – that prospect is what causes my heart and Charlie’s to beat faster. (Just writing about the possibility of a huge purchase has caused my pulse rate to soar.)”

Warrent Buffett definitely has investment skills. Unfortunately for those who read his books and treat “Sage of Omaha” as a guru, those skills (such as elephant acquisitions) cannot be learned or applied without a $112B billion cash cushion to lean on.

Investment Losses

But Kraft loss accounted only for about 10% of total Berkshire’s loss. What else went wrong? Well, the same thing that went wrong for just about any momentum investor who rode the wave of exuberant buying in the past few years. Momentum in the equity markets slowed. It didn’t reverse, just slowed. And that was enough to make the tide recede. And as Warren Buffett himself opined many moons ago, it became very clear who is swimming without the bathing suit. Consider the biggest holdings by Berkshire at the time of the loss:

- American Express

- Apple

- Bank of America

- Wells Fargo

- The Coca Cola

Does that look like a value portfolio to you? Or is this simply riding the unprecedented wave of cheap liquidity created by the Federal Reserve and tech bubble 2.0? As if anticipating these questions, Warren Buffett in the investor letter denied that measures of value are even relevant. That is certainly a departure from the past. For years, he was preaching the importance of book value of businesses, but in his latest newsletter he emphasized that the market value is now more relevant than the book value!!!

This time is different, indeed. Of course, with Berkshire’s book value down dramatically, it is not so shocking to hear that, but still… To be fair, Buffett’s strategy has long since shifted away from Graham style pure value investing. His portfolio was simply became too large for lots of pure value plays. Over the years Buffett shifted closer to the undervalued growth model advocated by Phil Fisher in Common Stocks and Uncommon Profits. But to suggest that book value is now irrelevant is something shocking for someone who build a reputation (whether deserved or not) as the voice of reason in times of excess.

The shift on the importance of book value reminds me of Apple recently stopping the reporting of sales numbers for iPhones, because it deemed them no longer ‘important’ after touting that very metric for years (check out our blog entry iPhone Loathing in China or Why 43% of All Statistics Are Worthless). Apple’s own Price-to-Book value stood close to a cool 10 before the latest price decline that hit Berkshire Hathaway so hard. The reason why these stock investment losses hit Berkshire’s financial statements in such a big way is due to the new GAAP rule that requires Berkshire to mark their holdings to market. Who could possibly object to that reasonable transparency requirement for an investment company?

But Warren Buffett wrote that both he and Charlie do not find this MTM rule to be sensible. Buffett wrote that mark-to-market ”…is not really representative of what is going on in the business at all” It is quite amusing to read this, because Buffett for year has railed against non-GAAP deceptive accounting practices.

It is also worth noting that 2017 Berkshire’s income of $32.5 B almost entirely came from Trump’s tax cuts that ended up benefiting corporations. According to Buffett himself approximately $29B of that 2017 gain was due to tax cuts. Without corporate tax cuts Berkshire would have been flat for 2017 and now essentially flat for 2018.

Summary

Warren Buffett undoubtedly made great many quality investment decisions over the years. However, for many years now he has been practicing a very specific investment strategy. Namely, investing in companies that disproportionately benefit from taxpayer bailouts and cheap credit. In addition, some of his biggest investments such as Wells Fargo engaged in massive fraud, experiencing no oversight from the Sage of Omaha. My hope is that value investing can make a comeback somehow to bring normal capital formation to the world economy.

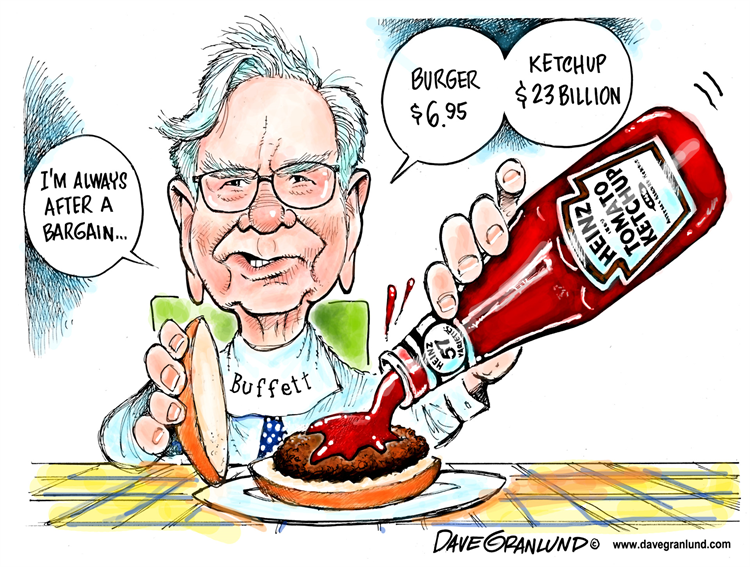

Finally, we leave you with this cautionary tale of a value investor living in a momentum world: