In my last article, I made a mistake that thousands of investors are making.

Now, A case of mistaken identity is shooting or zooming an unlikely stock to unreasonable highs. It’s a story of irrational exuberance or investor stupidity. Either way, it’s a reminder of the power of fear during unprecedented times.

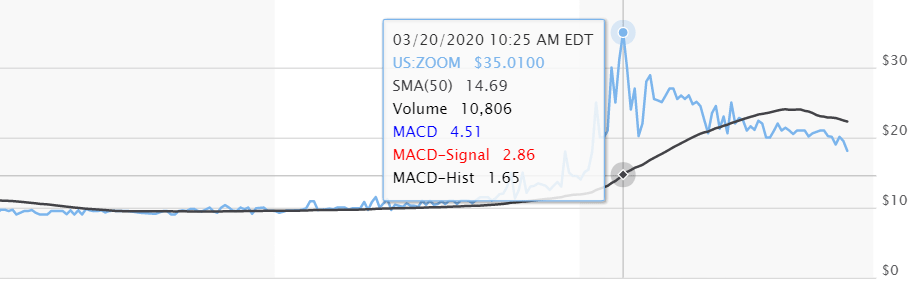

I referenced Zoom Video Communications, Inc. by the incorrect ticker: ZOOM instead of the correct one, ZM.

Well, the ticker, ZOOM, refers to Zoom Technologies Inc.

Who is Zoom Technologies Inc.?

Put simply, they’re nobody. My research suggests that they are a nearly defunct Chinese company that manufactures parts for mobile phones. I can’t find any financial statements beyond 2011, and it trades only on the riskiest pink sheets in the Over-the-Counter Market. They voluntarily delisted from the NYSE after failing to meet the Even after their stock price surged 20% on Monday, their market capitalization reached a pathetic $22.59 million before the stock reached.

My curiosity pulled me a bit deeper. There is little public information to support that this Zoom Technologies Inc. is anything and, at most, a holding company. The last pieces of information connect a Mr. Lei Gu as Chairman & CFO located at their Zoom Hong Kong location. You can contact their hysterically named email:

frankly.fu@zoom.com

Apropos, perhaps, for a company benefiting from American hysteria. The trail ends there, and it’s probably best to leave it before curiosity kills the cat. It speaks to the ludicrously complicated world of Chinese businesses and holding companies.

This isn’t the first time a mix-up has occurred. When the Video Conferencing service, Zoom, went public, Zoom Technologies increased 56,000%.

We may never know who benefited from this ridiculous mix-up, but somebody needs to check on Mr. Gu and tell him the good news.

Paranoia (and Mr. Gu): 1

Efficient Markets: 0

We need to laugh… as long as we’re 6 feet apart.

Markets are “efficient”, right?

I took Private finance from an economics professor who loved to reference the New York Stock Exchange as the closest to an efficient market, called “Strong-form efficiency.” Whereas emerging markets are considered “weak-form” mainly because of one reason: Information.

With sweat stains showing underneath his striped shirt, he’d wave his arms around at the ludicrous idea of trying to time the markets and participate in technical trading.

Information is the key to establishing a fair price. Weak-form markets only have past market information, whereas semi-strong form markets have more disclosed information. When data is not required to be shared, Asymmetric information creates significant disparities between the actual intrinsic value of a stock price and the market price.

Let’s all just take a deep breath

At times of crisis, an economist’s imaginative vision of a traditional stock investor becomes laughable. Even with more access to information, investors do not incorporate it into their decision-making.

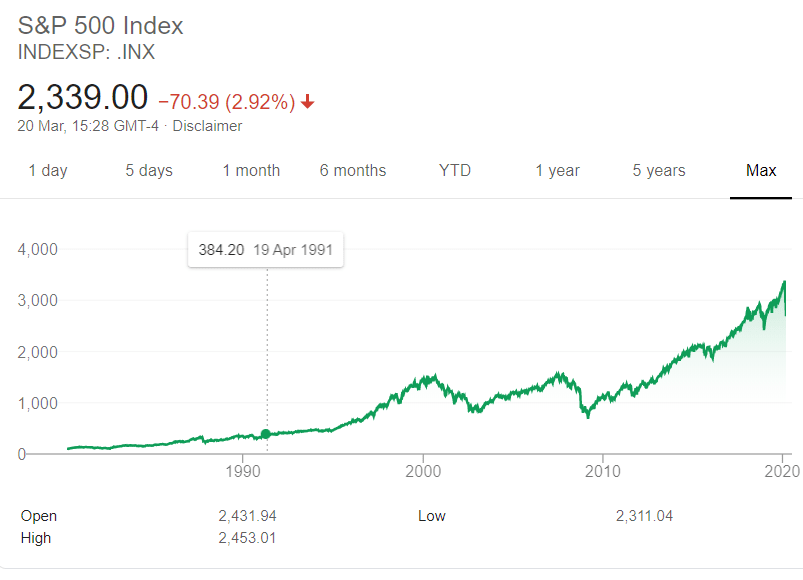

Don’t throw the baby out with the bathwater. Remember that we meet financial goals only in the long-term. As the figure below shows, even the recent downturn or 2007 financial crisis are merely small setbacks.

As Yon wrote earlier during the crisis, during times of confusion, it is better to not make any rash decisions. Form an action plan, execute, and adapt.