Is Your 401(k) Safe From a Banking System Collapse? And how can you protect it?

The failure of several banks and the ensuing market turmoil has put investors on edge in the past week. While regulators and the Biden administration have tried to quell the concerns of jittery American consumers, the ripple effects are continuing to rattle the economy and many questions remain.

War, Oil, and Your 401K: How to Manage Risk in Times of Market Uncertainty

The war in Ukraine has created uncertainty in the global oil market, which can lead to an increase in oil prices.

What does the war in Ukraine mean for the global market and your investments?

The crisis in Ukraine has been covered by the global media more closely than any other conflict that scorched the Earth in recent times or the ones that are ongoing currently parallelly in the middle east and elsewhere.

What Are MEPs And How Can They Help You?

According to investopedia, an MEP or Multiple employee plan is a retirement savings plan adopted by two or more employers that are unrelated for income tax purposes, as defined by the Internal Revenue Service (IRS) and the U.S. Department of Labour (DOL).

SECURE Act 2.0

The Secure Act 2.0 increases the required minimum distribution age to 73 starting in 2022, the age to 74 in 2029 and 75 in 2032. The original secure act expanded eligibility for long term, part time workers to contribute to their employers 401(k) plan.

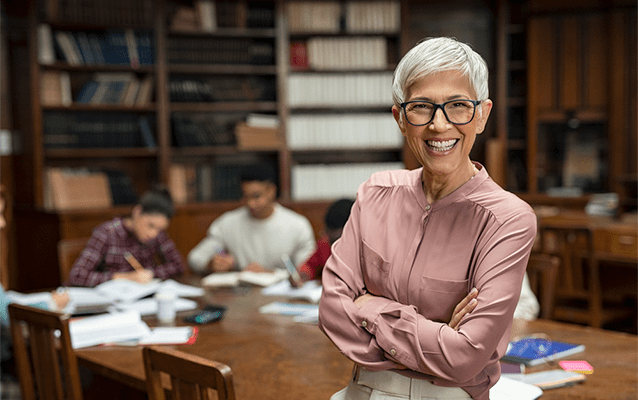

Higher Education Plan Sponsors See More Demand for Participant Investment Help

A recent study on higher education plans from Voya found 43% of plan sponsors say motivating employees to save adequately and invest wisely are the top challenges in helping their employees prepare for retirement.