According to a recent study “Automatic enrollment: The Power of the Default” by Jeffrey W. Clark and Jean A. Young from Vanguard, automatic enrollment not only triples the participation rate of new workers but also causes a significant proportion to raise their deferral rates over time. They discovered that the default decisions made by defined contribution (DC) plan sponsors under automatic enrollment have a strong effect on member saving and investing behavior. The research is based on nearly a million newly hired eligible workers hired in 2017-2019 in 520 plans.

Automatic enrollment

Automatic enrollment is a popular method these days. Qualified workers are automatically enrolled in a DC plan at a set deferral rate, with the choice to leave at any moment. Automatic enrollment is a critical technique for improving retirement benefits in defined contribution (DC) plans in the United States and throughout the world.

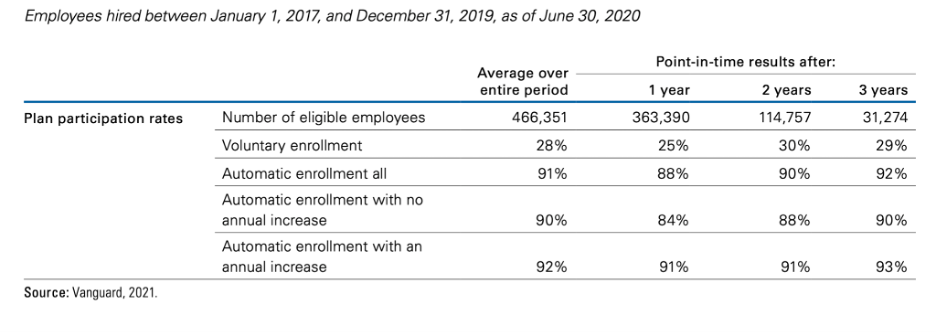

Automatic enrollment increases participation rates among new workers by three times . Vanguard researchers note that throughout research the participation rate for new recruits under automatic enrollment was 91 percent vs 28 percent under voluntary enrollment (Figure 1). After three years, 92 percent of individuals employed by automatic enrollment remained active, compared to 29 percent of participants hired through voluntary enrollment.

Participation rates in automatic enrollment programs remain extremely high, remaining constant at 92 percent during the first six months and after three years. On the contrary, there is a modest trend for plan participation percentages to grow over time with voluntary enrollment. After three years, the average voluntary enrollment participation rate is 29 percent, up from 21 percent at the start. Participation rates in automatic enrollment programs remain extremely high, holding constant at 92 percent during the first six months and after three years. However, it’s crucial to understand that only qualified employees who stay with the company are in these new recruit participation rates. Employee turnover rates among recruits are extremely high.

Automatic enrollment has the greatest impact on plan participation among young and low-income employees. Take into account that even individuals earning less than $15,000 had an 82 percent participation rate under automatic enrollment against a 4 percent participation rate under voluntary enrollment. Moreover, with automatic enrollment, 9 out of every 10 workers under the age of 25 were plan participants, compared to less than 2 out of 10 under voluntary enrollment.

We then look at how automatic enrollment affects plan contribution rates over time. In automatic enrollment plans without an increase option, the proportion of participants who continue to defer at the default deferral rate established by the employer decreases over time, falling from 50% after 12 months to 37% after three years. One-third of participants decided to overcome the employer’s default and increase deferral rates after three years, while another quarter chose to override the employer’s default, increase their deferral rate, and sign up for a deferral rate rise. After three years, more than nine out of ten eligible participants are still paying the default deferral rate or more.

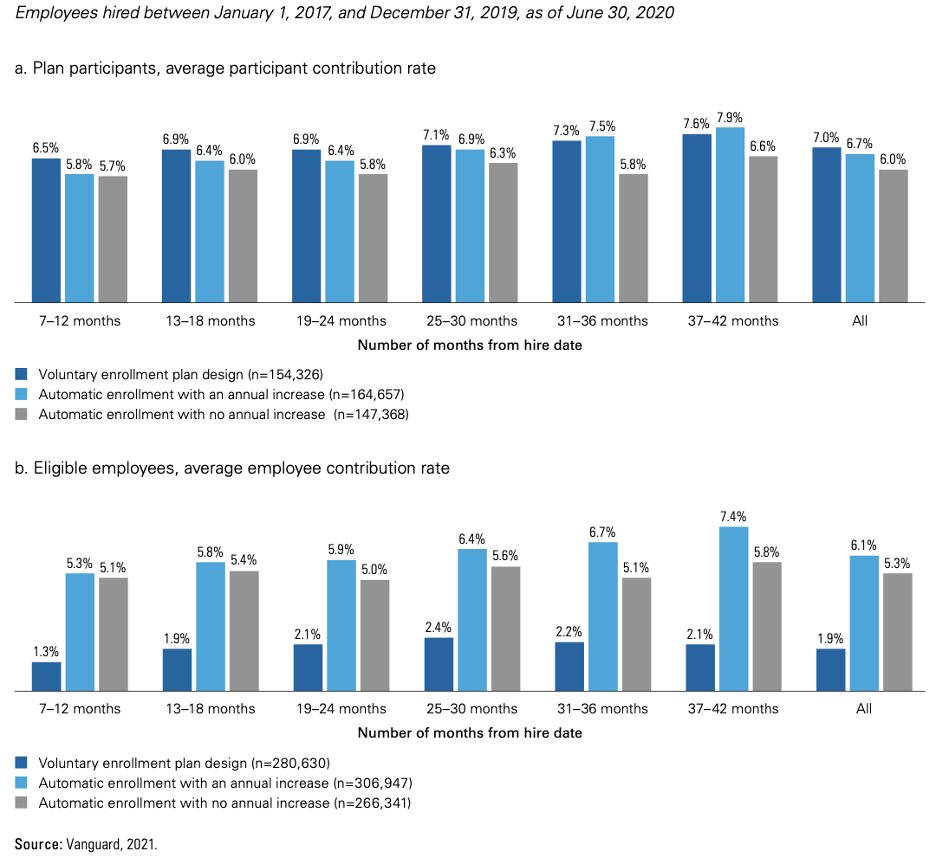

Contribution rates usually climb over time among members who voluntarily participate and those who are automatically enrolled with an automatic increase (Figure 2). Most noteworthy, among all eligible employees, automatic enrollment combined with an automatic increase feature typically results in larger employee contributions over time. In recent years, Vanguard researchers observed a trend among plan fiduciaries to raise the default deferral rate from the usual 3 percent starting point—long thought to be a rate low enough to dissuade opt-outs, if not genuinely enough to guarantee retirement income sufficiency.

Figure 2. Employee average contribution rates over time.

Vanguard researchers also examine the impact of automatic enrollment on investment behavior. Participants in automatic enrollment plans are approximately 30% more likely to remain in the default investment choice selected by the employer on average during our whole research period — “86 percent of participants in automated enrollment remain 100 percent invested in the default option versus 66 percent of participants under voluntary enrollment who happen to have chosen to invest their entire account in the design”.

However, the researchers also found the effects to be sticky over time. After three years, about 8 in 10 participants are still directing all of their contributions to the default investment option, while another 17% are using the default investment in combination with other plan investment options.

Follow us in Linkedin

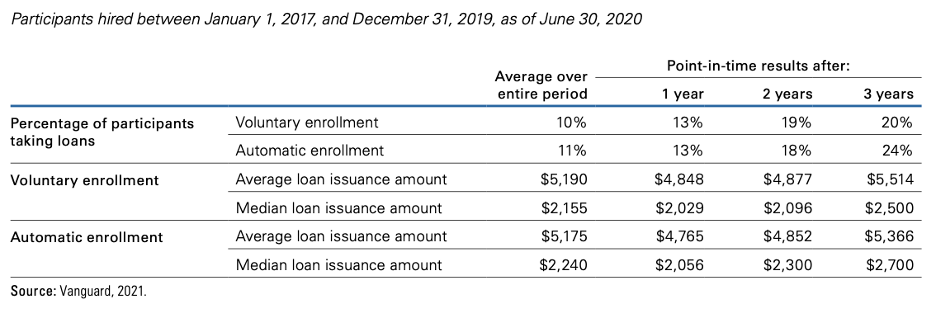

Finally, the Vanguard researchers examine the frequency of loans that participants take from their plan accounts. Is automatic enrollment retirement savings offset by greater debt levels for participants automatically enrolled in the plan? Over time the researchers discovered that auto-enrolled participants are somewhat more likely to have a loan outstanding than voluntarily enrolled participants (Figure 3). For example, after three years, “24% of auto-enrolled participants have loans versus 20% of voluntarily enrolled participants”.

Figure 3. Loans

Automatic enrolment has emerged as a critical method for increasing 401(k) and other DC retirement plan participation and employee savings rates. According to the research, the default effect has the greatest influence on participation rates, with 9 out of 10 automatically enrolled new recruits staying in their employer plan after three years. The default influence on portfolio selection is not as substantial, with 8 out of 10 participants contributing entirely to the default option after three years and another 17% contributing to the default and other plan investment alternatives. The default effect for an automatic increasing feature is also slightly weaker. After three years, almost two-thirds of eligible members are still on auto-escalation, though a substantial minority increased contribution rates while discontinuing the auto-increase function.

As a result, automatic enrollment raises the minimum, or “floor,” contribution rate in a DC plan by replacing zero-contributors with members who save at least 4%. Automatic enrollment paired with greater starting deferral rates, an automatic increase option, and a total automatic increase maximum of at least 10% can help sponsors enhance retirement outcomes.

Another significant way to enhance results is to broaden the automatic enrollment strategy to include all eligible nonparticipants rather than just new employees. Plan sponsors should think about harnessing the power of inertia by implementing different sorts of sweeps, including re-enrollment, under-saver, and automatic increase sweeps. Stronger default designs, all else being equal, will help enhance retirement results due to the influence of inertia. When structuring their DC retirement plans, sponsors should try to take advantage of this behavioral bias.

It is vital to consider the importance of automatic enrollment as one of the main red flags in retirement plans. Larkspur Executive allows you to easily find such plans with its advanced search option. Tailored emails that the software provides can then help you approach the plan holders who are not aware of the absence of automatic enrollment in their plan. Schedule a Demo with us to see how you can find the plans with no automatic enrollment or reach out to clientsuccess@rixtrema.com to set up a demo.