Technology so good you can taste it.

Beyond Meat has had a wild first month of public trading, rising over 500% from the IPO price before a few analysts urged caution to those expecting incredible financial results. But as soon as the analysts stopped downgrading the stock (to hold), the meteoric rise continued and the stock briefly eclipsed $200. While the IPO...Read More

Easy Steps for Retirement Plan Sponsors to Minimize Their Liability

In a recent article by JD Supra, we learned that being a plan sponsor is quite a difficult task, because besides setting up a plan, one needs to watch it constantly due to the liability exposure. Every plan sponsor should do their best to minimize their liability and courtesy of author, Ary Rosenbaum, here is...Read More

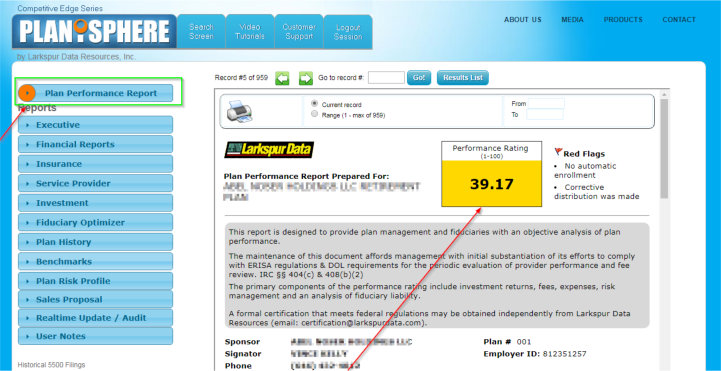

Prospecting Plans with the Lowest Ratings in Planisphere

The Ask: To win business, every financial advisor, should do their best to analyze nearby 401(k) plans. The key point here is benchmarking and choosing the right target plans. Our clients frequently ask us to help them find the best plans for prospecting, however, requires taking specific steps. The Problem: While you can find a...Read More

Smoothly Changing your TPA

A TPA (Third Party Administrator) can help manage all the logistics of general retirement plan and health services, so employers can concentrate on what they do best. Changing a TPA gives an opportune time for company executives to improve their vendor service road map and solicit extra worker compensation claims which were not addressed and...Read More

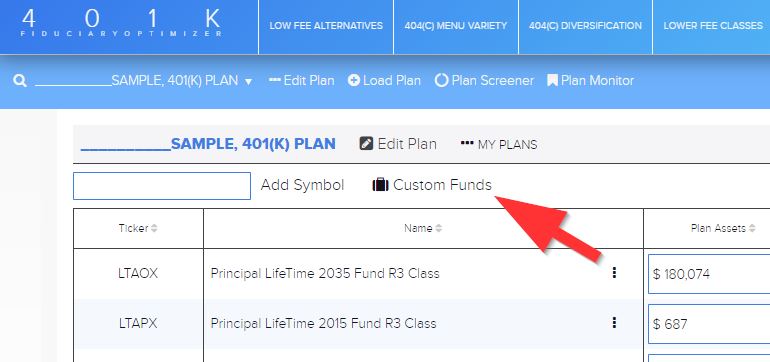

Managing non-standard securities in 401kFiduciaryOptimizer

The Ask: As you know, the 401kFiduciaryOptimizer, is quite a flexible tool where you can work with both audited and non-audited retirement plans. You can even run a full scale optimization even on a plan that doesn’t have any audited schedule of investments (Read up on how to do this on our separate case study...Read More

Week of June 24, 2019

1. THE HOME STRETCH – The S&P 500 has closed at its calendar year high in the second half of the year (i.e., during the 6 months of July-December) 74% of the time since 1950. In 17 of the last 30 years, the index’s calendar year high has occurred during the month of December. The...Read More

What kind of risks do you need to take when it comes to planning retirement income?

Recent research from the Deloitte Center for Financial Services focused on retirement preparedness, showing a number of practical barriers that were either preventing or discouraging people from saving for long-term needs. Such barriers often included conflicts of financial priorities, lack of trust to financial service providers, and poor understanding of the products serving the market....Read More

Senators Intend to Create a Federal Retirement Commission

As reported by the National Tax Deferred Savings Association, bipartisan legislation is creating a new federal commission that’s going to deal with studying and the recommendation of ways to improve Americans’ retirement security policies. The Federal Retirement Commission Act submitted on May 14 required the commission to review private retirement benefit programs (except for...Read More

Week of June 17, 2019

#6. – The 18-month recession that the United States experienced between December 2007 and June 2009 wiped out more than $7 trillion of real estate assets and stock portfolios. At the low point, the collective net worth of Americans fell to $50.4 trillion as of 3/31/09. 10 years later, the balance sheets of Americans have gained...Read More

What will new stipulations for CFPs mean for fiduciaries?

With all of the ongoing regulation by the SEC and DOL, it’s about time more parties join the ring. As reported recently by InvestmentNews, the CFP board will now be entering the fray. Now that we know that the SEC rule is not going to enforce a fiduciary standard onto brokers, the chief executive of...Read More