State and Local Government Employees Approve of Auto-Enrollment

“Auto-enrollment revolution” in retirement plans is considered one of the most important innovations in investing and savings. It’s already recognized by many behavioral economists and experts, such as Richard Thaler, Shlomo Benartze, as an option that will lead to better overall outcomes , and a recent study shows that it’s getting through to the general...Read More

New Technology is Bound to Change the Landscape of the Retirement System

I agree with Ted Godbout in his argument that new technology is bound to change the landscape of the retirement system. It is very clear that following the new tech trend is the game to be in. The early adopters of it create a solid foundation for future growth. Big data, cloud computing, AI, machine...Read More

Mad Cats, Free Dollars & Monetary Policy Fat Cats

“To begin with,” said the Cat, “a dog’s not mad. You grant that?” “I suppose so,” said Alice “Well, then,” the Cat went on, “you see a dog growls when it’s angry, and wags its tail when it’s pleased. Now I growl when I’m pleased, and wag my tail when I’m angry. Therefore I’m mad.”-Lewis...Read More

Case Study: Compare an Annuity to an Alternative Investment Portfolio

The Ask: One of our adviser clients asked if he can compare an annuity to an alternative investment portfolio? An annuity is an investment vehicle for retirement that has guaranteed income feature which makes it so attractive to investors looking to put together a financial strategy to retire comfortably. According to Jackson National Life study...Read More

15 Weekly Stats for Financial Advisors: Week of March 18, 2019

Matt Meyer and Michael Robinson are founders of The BluePrint Insurance Services. Their mission is to be the premier insurance partner for RIAs and comprehensive financial advisors. The BluePrint provides an operational insurance platform that allows our partners to provide the highest level of insurance access and support. We feature this weekly update with permission:...Read More

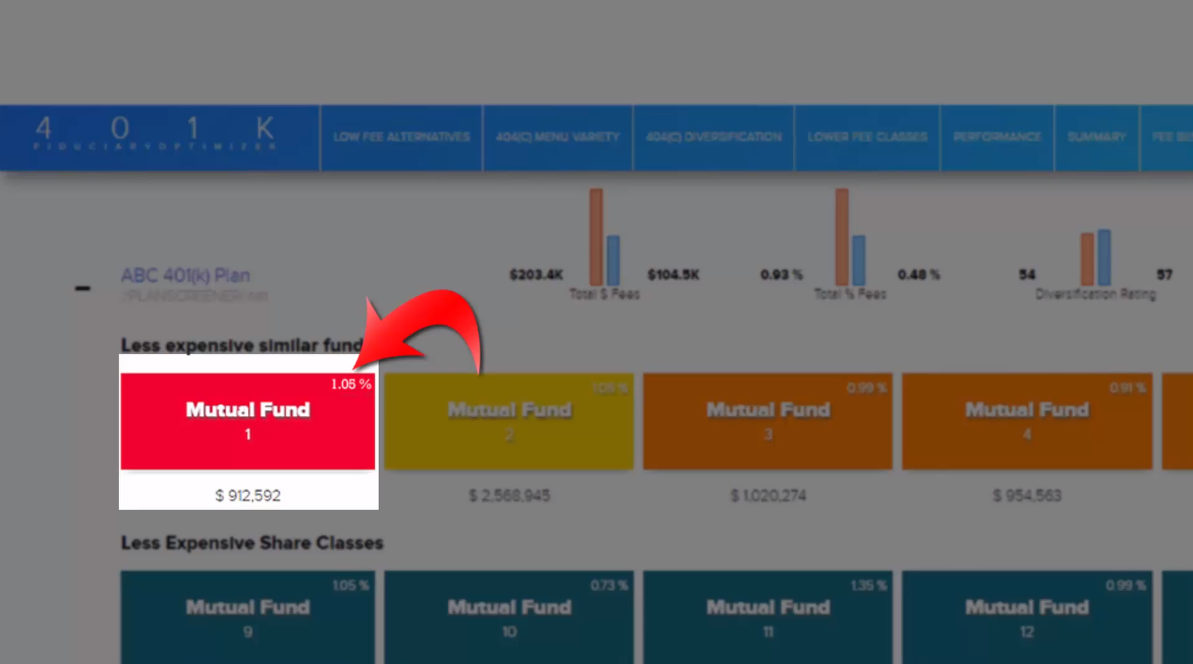

Video: Fulfill Your Fiduciary Duty of Continuous Plan Monitoring

As an ERISA fiduciary, you must continuously monitor your plans. This was affirmed in a major 401k lawsuit, Tibble vs Edison. When defendants in that case argued that they need 2-5 months to fix problems with the plan, judge told them they should’ve acted immediately. Clearly, expensive share class investments are not the only problem...Read More

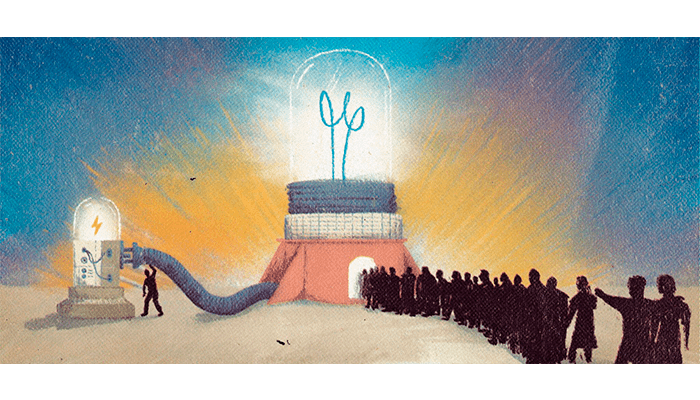

The Deep Internet: Why Bitcoin and Crypto Must Beat Centralized Platforms or Die

There is a great deal of content about cryptocurrency and blockchain, so why read this article? To put it simply, it will make sense of the future of cryptocurrency for you. Pretty ambitious.

What Does it Take to Become a Successful Digital Marketing Fiduciary?

The fiduciary standard is centered around serving the best interest of investors. In a recent post we have discussed how to explain fiduciary responsibility to a potential client or prospects. It is important to remember that actions and results will speak volumes in relation to simply “saying” you’re a fiduciary. This includes being able to...Read More

11 Client Acquisition Tips for Financial Advisors

Blog, blog, blog Be Original Having a Target Market Makes you Memorable! A Bit of Networking can go a Long Way Know Your Numbers Modernize Improvise Hold a Free Seminar or Event Arm Yourself with a Good CRM Build a Marketing Strategy Around Life Events Use an Unorthodox Approach with the Prospects of Wealth 2.0...Read More

Case Study: Diversifying 401(k) Plans as a Great Prospecting Opportunity

The Ask: Creating a great proposal that will increase interest from your prospects should be ideal not only in terms of cost-efficiency but also in terms of diversification. While cost-efficiency is based on the fund fees and performance, diversification means protection against market loss, which can potentially dramatically decrease your plan savings. The Problem: When...Read More