15 Weekly Stats for Financial Advisors: Week of March 11, 2019

Matt Meyer and Michael Robinson are founders of The BluePrint Insurance Services. Their mission is to be the premier insurance partner for RIAs and comprehensive financial advisors. The BluePrint provides an operational insurance platform that allows our partners to provide the highest level of insurance access and support. We feature this weekly update with permission:...Read More

How Vanguard is Staying Competitive with Robo Advisors

The financial industry like other sectors of the economy keeps evolving and new trends surface every 5-7 years. The latest new big trend that emerged over the past few years has been robo-advisory. It is a new class of financial advisors like Wealthfront Inc. and Betterment LLC that provide financial advice or investment management online...Read More

Case Study: What will Happen to my Client’s Portfolio if the Chinese Credit Market were to Explode?

The Ask: It is a fiduciary duty of each advisor to protect investments of a client. How can it be done effectively before a disaster strikes? It is customary to think about portfolio protection strategies when dealing with events close to home, such as a looming economic recession and market correction. You know the portfolio,...Read More

They are Watching You: The Evolution of AI in Public Spaces

Cameras are everywhere. They are always watching you. We know this. In the US, it seems every outburst is caught on video and shared via social media. Cell phone and CCTV cameras will catch almost every move made in public. This is not just a US phenomenon, nor is it only unknowing civilians that are...Read More

Main Reasons for 401(k) Advisors to Collaborate with Benefits Brokers

Benefits brokers’ responsibilities are very similar to those of retirement plan advisors; they are responsible for supervising any issues related to medical and insurance benefits, and, among other things, can conduct enrollment meetings. Although many retirement consulting companies provide benefits brokerage services, along with their primary services, advisors can always collaborate with outside brokers for...Read More

5 Ways to Explain Fiduciary Duty to Your Prospects and Clients

There’s a lot of talk out there on what it means to be a fiduciary and how it is beneficial to the clients to understand the difference between who is and who isn’t. But how can you actually explain this to a potential prospect of even your current clients? We’ve thought up of a few...Read More

Case Study: Growing Your 401k Business with the Right Prospecting Strategy

Every advisor is constantly thinking about ways to grow their business. There are many options available to achieve this goal. However, there is no cookie-cutter formula on how to make prospecting a successful endeavor.

New Fiduciary Rule Introduced in Maryland

Lawmakers in Maryland have recently introduced a new bill (Senate Bill 786) called the Financial Consumer Protection Act of 2019. Within the bill is a provision which would require broker-dealers, investment advisors and insurance agents to act in the best interest of their clients. This is similar to the Nevada bill that was recently introduced...Read More

Case Study: Create the Ultimate Optimization Report for a Plan Sponsor

In order to create a winning proposal for a prospect, you need to make sure it includes all the best investment options. On the one hand, they should be optimized in terms of fees and performance, which might interest a plan sponsor, and finally they should correspond your provider platform requirements.

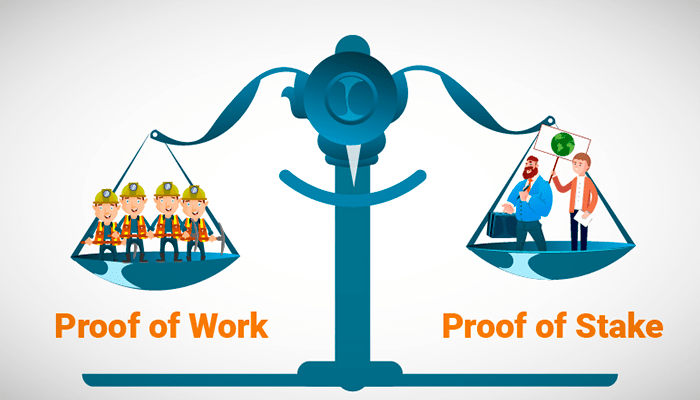

Proof-of-Work vs Proof-of-Stake: Theory & Practice Part 1

Blockhain is obviously a chain of linked blocks with transaction data in them, so that each block references all previous blocks before it and the chain is unbroken.