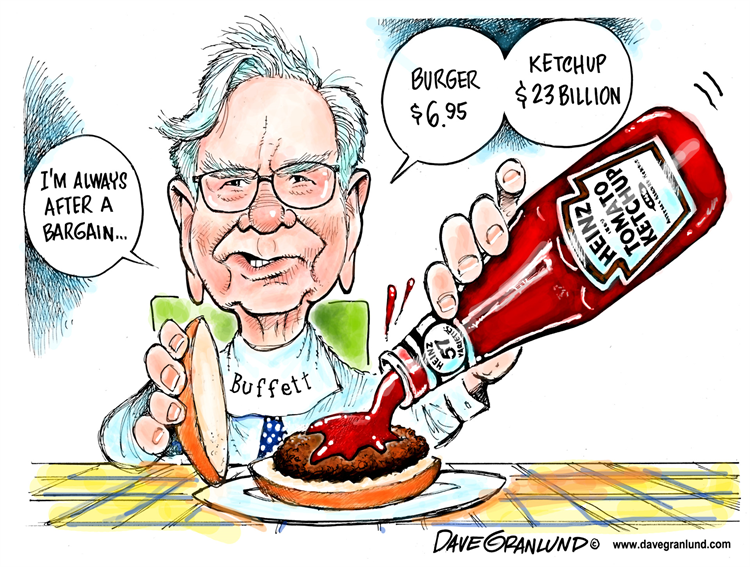

A Look Behind Berkshire’s stunning $25.4B loss or How Warren learned to love the MOMO

Latest quarterly report from Berkshire Hathaway contains a wealth of interesting data. The holding company incurred $25.4B of investment losses. Let’s break down the sources first, then see what it tells us about Warren Buffett’s current investing style and strategy. Broadly, there are two major sources for the shocking loss: a write down of Kraft...Read More

Asking the Right Questions When it Comes to Retirement Plan Cybersecurity

Today, Cybersecurity is one of the key interests and a highly debated topics in congress, specifically in regards to retirement plans, providers and plan sponsors (and participants). Congressional representatives have come up with 10 important questions, and are seeking answers about the protections in place. Since cyber attacks can put any plan data and retirement...Read More

Emergency – SOS!

On January 15th I wrote an article in which I described that the most likely outcome to fund the government was congress passing a bipartisan resolution while President Trump declares the situation at the southern border a national emergency. And on Friday, this largely played out (though I also predicted that all of this would...Read More

Case Study: How to Find Retirement Plans with Specific Investment Names

By showing the sponsor better performing, more efficient lineups, he has won a lot of business. But many of his wins have come from clients that were with a particular provider. So he asked us how he could target sponsors that invest through that provider with high cost?

15 Weekly Stats for Financial Advisors: Week of February 18, 2019

Matt Meyer and Michael Robinson are founders of The BluePrint Insurance Services. Their mission is to be the premier insurance partner for RIAs and comprehensive financial advisors. The BluePrint provides an operational insurance platform that allows our partners to provide the highest level of insurance access and support. We feature this weekly update with permission:...Read More

Telling Your Clients that Investing Early For Retirement Is Vital

The financial education on the importance of starting to save early for retirement cannot be overrated. Saving early for retirement is a must do for everyone and should be emphasized whenever possible. According to BlackRock’s 6thAnnual Global Investor Pulse Survey more than half of 27,000 respondents from 13 countries worry more about their current financial...Read More

Case Study: How to Prospect Executives with Risk Assessment Report

When you’re looking for individuals that could be potentially good for prospecting, you need to search for names and positions of key executives. The whole process can be tiresome and take a lot of time and effort. Moreover, you need to get some detailed and helpful information for a proposal, based on thorough analysis and a client centered approach.

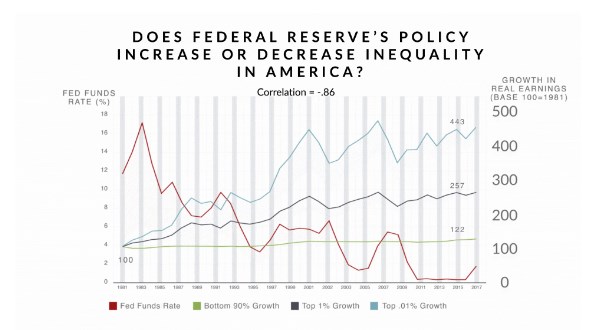

C’mon Baby, Tax the Rich: The Elephant In The Room

I would like to follow up my colleague’s top notch research note HERE on the consequences of dramatically increasing taxes on the wealthiest Americans. I will start out by saying that I believe this to be an unproductive idea, but my reasoning will be very very different from most comments on the topic. And you...Read More

Why is QDIA Important?

I agree with the author of “Are Qualified Default Investment Alternatives (QDIAs) Good, Bad or Lazy “Choices”?” that QDIA should be an important component of any retirement plan. Besides the fact, it protects the fiduciary of the plan as well as provides an invaluable option for participants. There are millions of people who need financial...Read More

Case Study: What is Wealth Crash Test and How it can Help You

Our client can reach out directly to thousands of HNWI leads using our POW 2.0 tool. They can even create a risk diagnostic report on the lead’s 401(k) plan using our Portfolio Crash Tester.