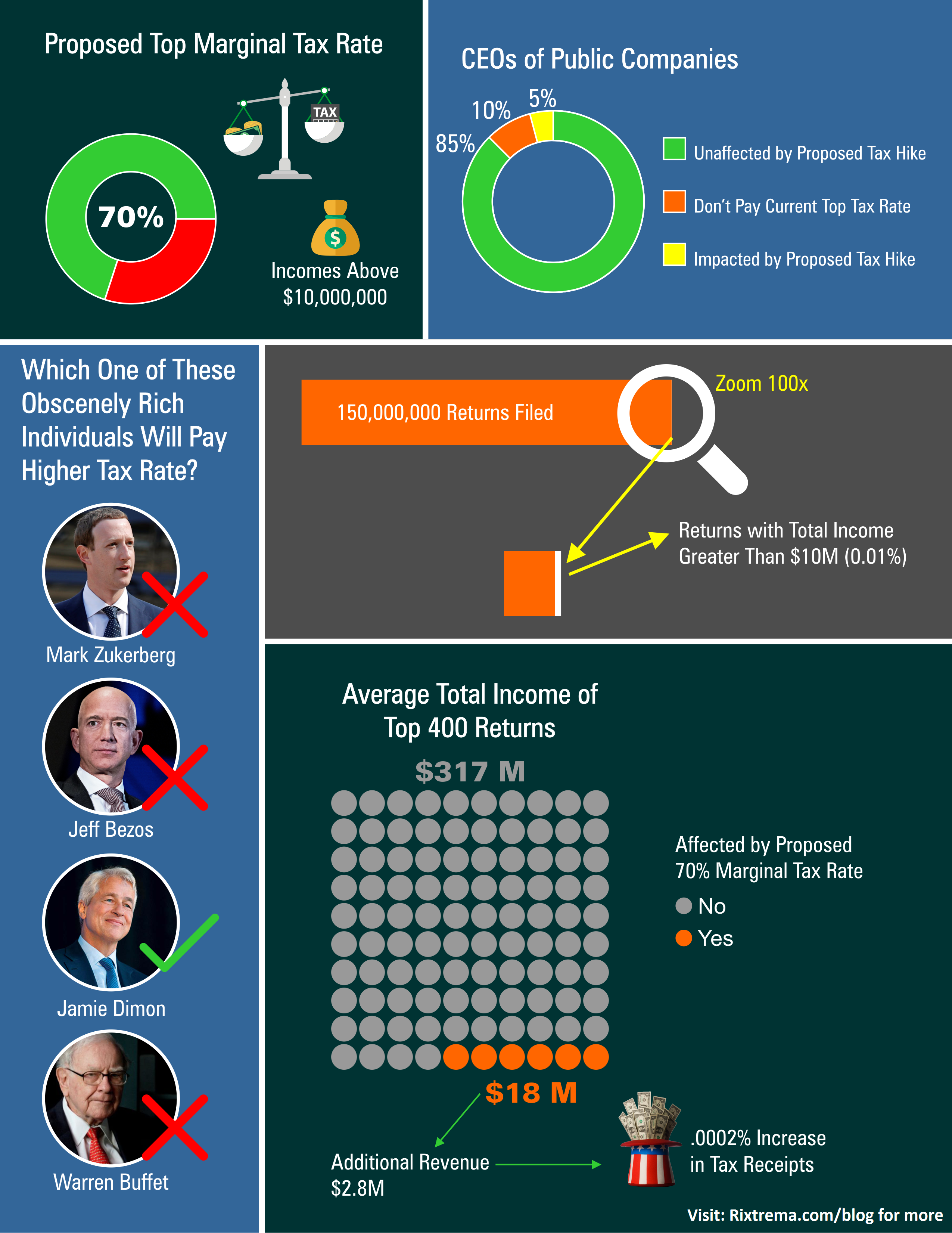

Tax the Rich: Let Them Stop Eating Cake

Taxing the rich is not a new idea by any means. But the call to take more money from them has become louder. People with some power to act have begun to unabashedly call for higher taxes on the rich. Much to the chagrin of many wealthy Americans and those in attendance at Davos for...Read More

Case Study: Here is How a Prudent Process Approach Prevails

Litigation against plan sponsors is nothing new. But in the aftermath of the financial crisis of 2007-2008, the number of excessive fee lawsuits that were brought by participants in 401(k) has increased. Tibble vs. Edison, decided in 2017, was one of the most famous cases in which the plaintiffs claimed that executives of the Edison International Inc.

Chuck’s Gambit: Spend Your Tax Windfall Like We Tell You To!

On Monday, senate minority leader Chuck Schumer and senator Bernie Sanders wrote a New York Times Opinion piece that, quite frankly, left me a bit puzzled. I understand why the piece, titled “Limit Corporate Buybacks”, was written, but it can’t be considered real policy. The opening paragraphs constitute a bit of anti-Randian fantasy: “From the...Read More

How Cryptocurrency Can Still Take Over The Internet: Part II

In a previous post I explained why most of the common criticisms of cryptocurrency (and Bitcoin specifically) are off the mark or are simply disingenuous. At this point, I would like to explain the real problem with cryptocurrency today and offer a fairly specific solution. Before I do, there is one more criticism that I...Read More

More Advisors Now See Opportunity Instead of Competition in Technology

Financial advisors are less intimidated by the risk of technological progress taking their jobs rather than they were a few years ago. Indeed, there are signs that advisors are becoming more comfortable with technology, especially as their clients become more tech-savvy and demand an enhanced experience in the digital age era. From the recent report...Read More

As a Fiduciary, How Well Do You Know Your Risk?

Recently FINRA has released its 2019 Risk Priorities and Examination Priorities Letter, where investment suitability remains its top priority. The main category in the suitability area continues to be deficient quantitative suitability determinations or related supervisory controls. However, it is still common that advisors ask their clients to trust their expertise when it comes down...Read More

Case Study: Finding Plans with the Highest Fees

Our client specializes in cutting out excess fees in retirement plans, so their ideal prospect is one that is paying too much for their current plan. They need to be able to easily identify plans that are paying a high cost for their size, so how can they identify how much is too much?

6 Things that Prospects and Clients Don’t Want to Hear from 401K Advisors

When it comes to communicating with your clients and prospects, it’s important to make sure you steer clear of certain things to make sure you start and maintain a good relationship. Below we’ve listed off a few topics and phrases that you should be careful of when talking to your clients, old or new. “I...Read More

How You can Answer the “What if” Question When it Comes to Your Client’s Portfolio

To an investor who’s trusted an advisor with their retirement savings, they aren’t just any ordinary person anymore. The fiduciary duty of an advisor to their client is one of the most serious responsibilities out there. Of course, it may seem obvious but, how many of advisors help their clients to understand the vulnerability of...Read More

Case Study: Winning 401K Business by Knowing Who Is Around You

Our client recently launched his RIA business in the suburbs of Chicago. He is determined to grow by prospecting as much as possible and using every opportunity to approach various plan sponsors. He had scheduled a meeting with a prospect and wanted to use that meeting as a pretext to get meetings with other prospects in the immediate area. He reached out to us for guidance on how to accomplish his plan