How Amazon of 2018 is Facebook of 2015 & What Happens Next?

Amazon Inc. just passed Apple and Microsoft as the highest valued company in the world. Virtually nobody is surprised by this. But we all should be. After all, this is a company that was consistently losing money only a few years ago. In fact, its current Latest-Twelve-Months Price-to-Earnings ratio is somewhere around 95! Are investors...Read More

15 Weekly Stats for Financial Advisors: Week of January 21, 2019

Matt Meyer and Michael Robinson are founders of The BluePrint Insurance Services. Their mission is to be the premier insurance partner for RIAs and comprehensive financial advisors. The BluePrint provides an operational insurance platform that allows our partners to provide the highest level of insurance access and support. We feature this weekly update with permission:...Read More

Video: A value investor in the world of zero interest rates and high frequency trading

We have done this deep research and created this amazing piece of intellectual deep thinking. Now we know what active value managers felt for the past 9 years! This is a must see!

Hard Brexit vs Cool Brexit: How Will Each Impact Your Clients’ Portfolios?

The news that Prime Minister Teresa May’s Brexit deal was rejected by Parliament was not particularly surprising to anyone, including PM May. But ‘rejected’ doesn’t begin to put the loss in context – the result was the largest parliamentary loss in more than 100 years. This is an incredible outcome given the time and resources...Read More

Case Study: Selecting and Monitoring Target Date Funds

Target Date Funds or TDFs, became a big part of the retirement process. At this point, TDFs represent around 20% of all 401(k) plan assets and approximately 50% of all new 401(k) contributions are directed into TDFs. There are different reasons why TDFs are so popular among the retirement professionals and participants, and why it...Read More

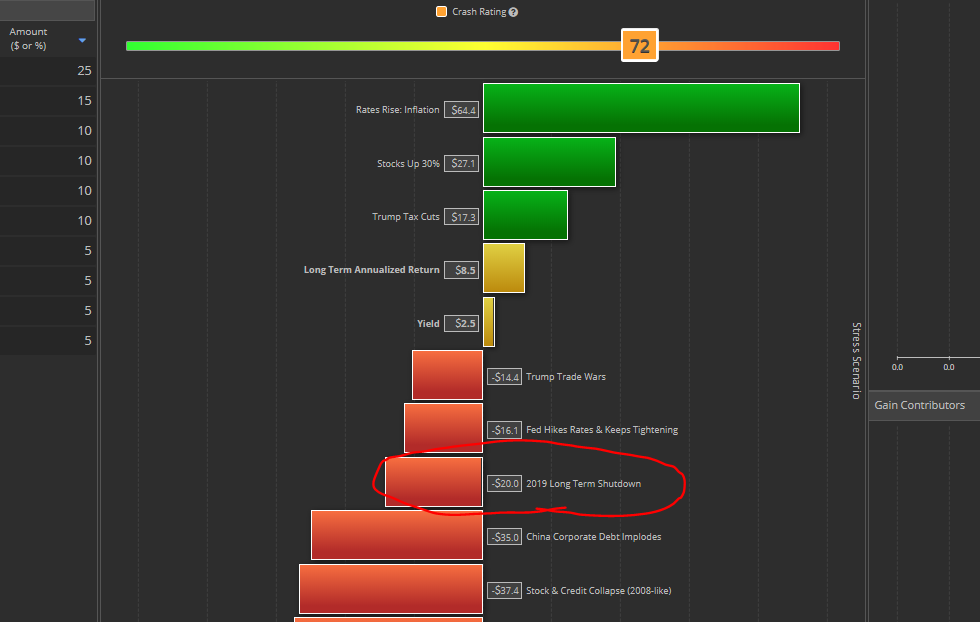

New Portfolio Crash Test Scenario: 2019 Long Term Government Shutdown

A scenario where there is a long-lasting shutdown, where the President does not declare a state of emergency, and the two sides don’t give in would have the biggest impact on your client’s portfolios. Economic effects of shorter shutdowns are generally minor and made up for once Federal workers (and contractors) receive back-pay. But a...Read More

How can Plan Advisors Grow their 401(k) Practice in 2019?

With a new year, we have new challenges and ways to grow businesses. Changing political trends, regulations, and new technology could make navigating the 401(k) space challenging. However, that doesn’t mean there won’t be ways to succeed. Here are a few things we came up with that might just help you get ahead in 2019....Read More

3 Scenarios in the Trump Government Shutdown: How will it Impact Markets?

Trump vs. The Democrats: A Fight for the Ages! Americans love a good fight as evidenced by the popularity of the Kardashians, Real Housewives of Wherever, the Bachelor(ette), the UFC and many other forms of entertainment. The government shutdown pitting Trump vs. the Democrats is not one of those fights, and I don’t think America...Read More

Cryptocurrency: Fiduciary Asset or Verrückt?

Cryptocurrency: Fiduciary Asset or Verrückt[1] My colleague Daniel Satchkov has put forth a couple of compelling pieces (Why Bitcoin Drop Was Good and Why Cryptocurrency Just Might Become a Fiduciary Asset and 2019 Will Be The Year That Crypto Decouples From Equity Markets) on why the rout in Bitcoin and cryptocurrency should be seen as...Read More

To Brexit or Not to Brexit

As anyone following Brexit knows, it is a mess. With the March 29, 2019 deadline for the United Kingdom to leave the European Union fast approaching, there is a real chance that no deal will be struck. British Prime Minister Teresa May is looking for a way to secure the votes needed in the House...Read More