15 Useful Weekly Stats for Financial Advisors: Week of November 26, 2018

Matt Meyer and Michael Robinson are founders of The BluePrint Insurance Services. Their mission is to be the premier insurance partner for RIAs and comprehensive financial advisors. The BluePrint provides an operational insurance platform that allows our partners to provide the highest level of insurance access and support. We feature weekly update with permission: Matt...Read More

Post DOL Fiduciary Rule Effect on Investors

The story of the Department of Labor fiduciary rule has been nothing else but a roller coaster ride. The ride which began in 2015 and initiated by President Obama’s administration, it peaked in June of 2017 after DOL fiduciary rule’s partial implementation, and finally, on June 21, 2018, the 5th Circuit Court of Appeals confirmed...Read More

10 Articles for the Financial Advisor Thanksgiving Weekend Reading List

Here are ten suggested articles for financial advisors to read this Thanksgiving weekend: 1. End-Of-Year Medicare Planning Opportunities During The Open Enrollment Period – The final weeks of the year are some of the busiest for financial advisors as they help their clients not only plan for the upcoming year but wrap up their planning for the...Read More

15 Weekly Stats: Week of November 19, 2018

Matt Meyer and Michael Robinson are founders of The BluePrint Insurance Services. Their mission is to be the premier insurance partner for RIAs and comprehensive financial advisors. The BluePrint provides an operational insurance platform that allows our partners to provide the highest level of insurance access and support. We feature weekly update with permission: Matt...Read More

Significant Number of 401k Participants Relying on Target Date Funds

Statistics show that average retirement plan balances have almost doubled over the past decade, and a large portion of it is now contained in target-date funds. According to Fidelity data, more than half of 401(k) plans hold 100% of their funds in target-date funds. Target-date funds are tailored to an age and retirement year of...Read More

What The Future of Multiple Employer Plans Looks Like

On October 22, 2018 the U.S. Department of Labor announced about the Notice of Proposed Rulemaking. The Proposal was a response of the DOL to the President’s Executive Order signed on August 31, 2018 and aimed at liberalization of the Multiple Employer Plan (MEP) rules. In the Executive Order the President asked the DOL to...Read More

5 Articles for the financial advisor weekend reading list: November 17-18, 2018

Here are five suggested articles for financial advisors to read this weekend: 1. Building The Five Pillars Of SEC Cybersecurity Requirements As A (Registered) Investment Adviser – Over the past few years, several high-profile data breaches have hit major US corporations, including Target, Home Depot, and Equifax, bringing into sharp focus the need for individuals and businesses...Read More

Recent Study Shows 401k Participants Aren’t Sure of Their Own Portfolio Allocations

In a recent article by PlanSponsor.com, they referenced a survey by Legg Mason that reports that many 401k participants are in the dark of their own portfolio allocations. According to the survey 22 percent of participants aren’t even sure of what their portfolio allocations are. Interestingly enough, 34 percent of Baby Boomers are included in...Read More

10 Social Media Marketing Mistakes Financial Advisors Make and How to Avoid Them

More and more financial advisors are turning to social media marketing every day. More than 81% of financial advisors use social media for business purposes. 79% have acquired new clients directly through social media, with an average gain of $4.6 million AUM annually through their social media marketing campaigns. Such success also comes with a need...Read More

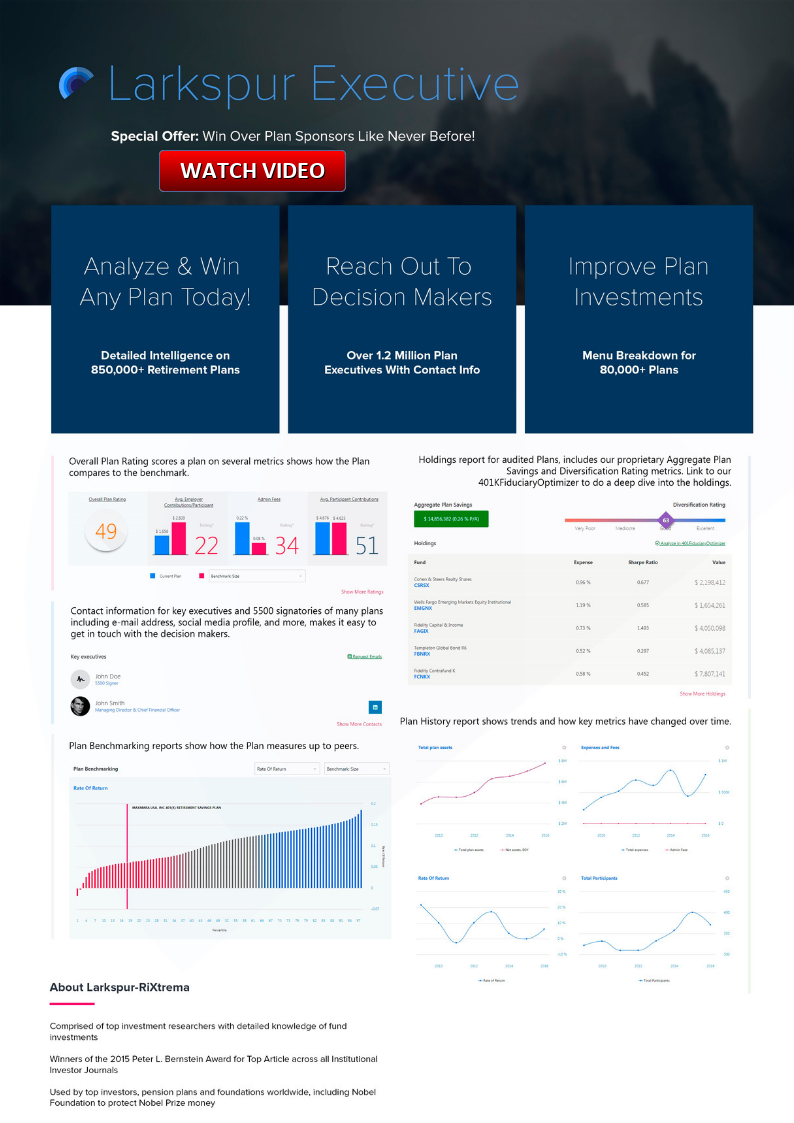

Larkspur Executive Infographic

Competition is getting ever tighter for financial advisors in the retirement plan space. With so much at stake, you cannot afford to use the same data and tools as everyone else. Your process is unique and you need unique tools to reflect that. Not only does Larkspur Executive have up-to-date information about 850K+ ERISA plans,...Read More