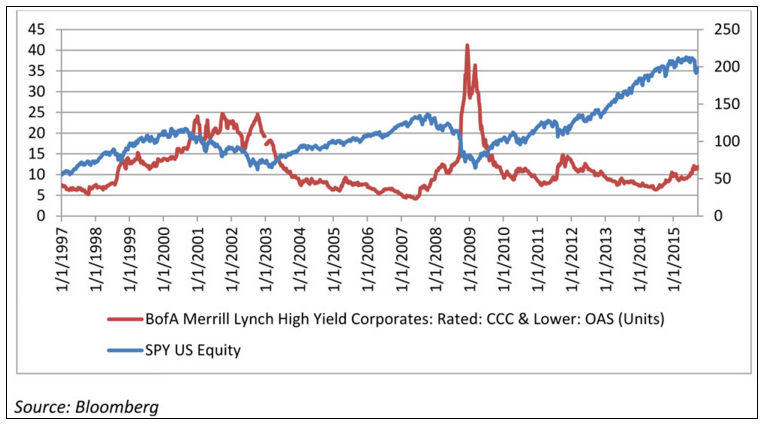

High Yield: Are ‘Fixed Income People’ Smarter Than ‘Equity People’?

Increases in junk credit spreads have historically been predictive of the stock market moves, especially after a prolonged period of very low spreads. And so today, the junk debt market is in serious trouble with contagion spreading. If your clients own high yield, make sure they understand that it is a very risky investment. Read about...Read More

How You Can Win Client’s Trust Where Others Lose It

How can an Advisor differentiate from competition in this volatile market? Study after study shows that the first thing that prospects and clients care about is capital preservation. Investors are worried about risk! Last quarter was the first time since 2008 that both stock and bond funds suffered outflows. It is a clear sign that...Read More

The Investor Revolt Continues In The Wrong Direction

The «investor revolt» continues. According to Investment Company Institute, US equity funds have outflows of $17.5 billion in August on top of the $28.58 billion in July. These are very serious numbers. Overall, investors have pulled $50.3 billion out of US equity mutual funds in the past quarter. What is also staggering is that they...Read More

Dolor Egestas Porta Venenatis

Sed posuere consectetur est at lobortis. Sed posuere consectetur est at lobortis. Cras justo odio, dapibus ac facilisis in, egestas eget quam. Aenean eu leo quam. Pellentesque ornare sem lacinia quam venenatis vestibulum. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem...Read More

Mollis Vestibulum Risus Parturient Porta

Sed posuere consectetur est at lobortis. Sed posuere consectetur est at lobortis. Cras justo odio, dapibus ac facilisis in, egestas eget quam. Aenean eu leo quam. Pellentesque ornare sem lacinia quam venenatis vestibulum. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem...Read More

Duis mollis est non commodo luctus

Sed posuere consectetur est at lobortis. Sed posuere consectetur est at lobortis. Cras justo odio, dapibus ac facilisis in, egestas eget quam. Aenean eu leo quam. Pellentesque ornare sem lacinia quam venenatis vestibulum. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem...Read More

Robos deny impact from volatility on their AUM growth, straining credibility

AUM growth of first-generation robo-advisors dramatically slowed in light of market volatility, yet statements by robo advisors deny this fact, straining credibility. Financial Planning magazine published the deep dive into this issue with our supporting analysis: http://www.financial-planning.com/blogs/why-i-am-not-convinced-about-volatility-and-robos-2694230-1.html

The Problem With Robo-Advisors’ Use of Mean Variance Optimization

Letting machines that are essentially error maximizers automatically build investment portfolios is not a great idea. In fact, it’s a terrible idea for your clients. However, the first generation of robo-advisors does precisely that! In our review of the shortcomings of robo-advisors, published by ThinkAdvisor magaine, we explain the key problem of the first generation...Read More

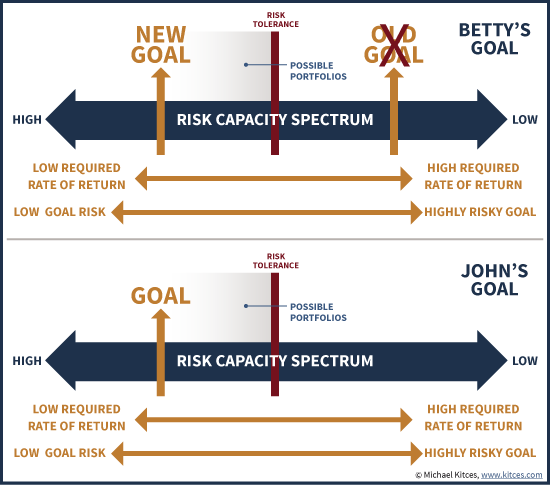

What To Focus On: First – Goals, And Only Then – Portfolio

When discussing investment plans with clients, it always makes perfect sense for an advisor to talk about ‘why’ before ‘how much’. The ‘why’ for the investor is always the goal. This is why they invest the money and certainly why they tolerate any risk in the first place. In this respect, there are excellent insights...Read More

Aenean eu leo quam pellentesque

Sed posuere consectetur est at lobortis. Sed posuere consectetur est at lobortis. Cras justo odio, dapibus ac facilisis in, egestas eget quam. Aenean eu leo quam. Pellentesque ornare sem lacinia quam venenatis vestibulum. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis mollis, est non commodo luctus, nisi erat porttitor ligula, eget lacinia odio sem...Read More