The Main Weakness of Robo-Advisors and How You Can Capitalize

Wealthfront brought the Markowitz optimization algorithm to the masses and in many ways the company is a symbol of the democratization of risk management that’s now going on… Let’s use Wealthfront’s questionnaire as an example. I absolutely do not mean to pick on Wealthfront here; rather I am using them as an example as one...Read More

Why Risk Management Isn’t Like Silly Car Shopping

This article by RiXtrema President appeared on ThinkAdvisor.com I like to use car shopping as an analogy to the investing process. Let’s imagine what it would it be like to buy a car with a view only to targeting our tolerance for risk and forgetting why we are tolerating risk. Car Shopper: “I am considering...Read More

How ‘robo’ platforms for advisors should and should not be used

Michael Kitces, as is usual for him, asks some relevant and tough questions. You can read his recap of the T3 goings on HERE, but the key question that he raises is as follows: “Most advisors don’t have a high volume of prospective clientele coming to their websites, where their key problem is figuring out...Read More

RiXtrema President Investment News Interview: Tips For Dealing With Robo Disruption

Daniel Satchkov of Rixtrema believes advisers need to redefine their value to clients to compete with cheaper online advice offerings… Click Here To Watch Video

Federal Reserve Stress Scenarios Modeled In Riskostat

As you may know, the Federal Reserve recently released their stress scenarios: Base, Severe and Adverse. While the Fed may not explicitly regulate you, the role this organization plays in the financial markets cannot be underestimated. The specifics of their analysis are useful as the Fed has lots of up-to-date information at their disposal. But...Read More

What does Riskalyze ‘Risk Number’ really measure?

What does Riskalyze Risk Number really measure? Disclosure of calculation and methodology essential for meaningful discussion. Riskalyze has responded to our criticism of the math behind their interest rate stress test. Unfortunately, the response does not address a single point of substance and seems rather personal. Our systems serve some of the largest asset managers in...Read More

Crash Tests, Clairvoyants and Risk Managers

This blog entry is published in the Financial Advisor Magazine Expert Views Risk management is all about finding the suitable risk/return profile. Suitable, that is, to the holder of the portfolio. When your client has a suitable portfolio, he or she will not sell when the losses hit, because the possibility of those losses was...Read More

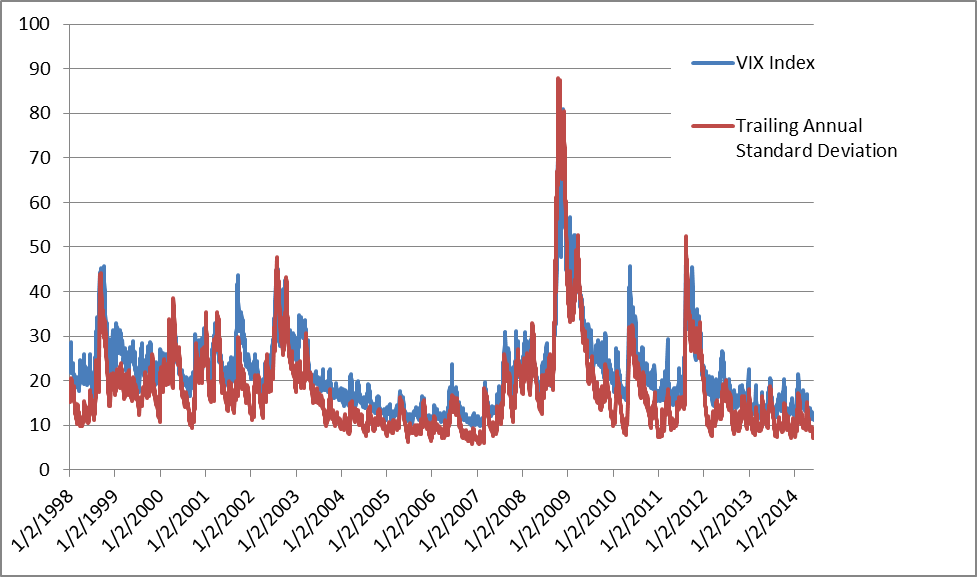

Black Swans Love a Low VIX

This RiXtrema blog entry is published in the Financial Advisor Magazine Expert Views As the VIX tumbles to lows not seen since before 2008, we must ponder the meaning of this complete disappearance of volatility. Are we really witnessing historically low levels of risk? Forward Looking Risk? VIX is supposed to be a measure of...Read More

What If Fed Tapers? How Does a Risk Manager Prepare?

In Part 2 the stress test of Fed tapering QE is discussed as a way to cover for shortcomings of risk models. Incorporating plausible macro scenarios is necessary to make risk models relevant again. RiXtrema researchers, a legendary risk manager Barry Schachter and RiXtrema President Daniel Satchkov participate.