It shouldn’t be surprising that a plan which had over 200 options for participants to choose from in its plan menu is settling its lawsuit. More than 10 times the average plan! The issue of plan menu size can be part of a productive conversation with any plan sponsor.

(The original lawsuit against Invesco was primarily for stacking the plan with proprietary funds, although part of the complaint was about the size of the plan menu.)

Key Talking Points

The language used in the filing against Invesco provides valuable insight into how this type of discussion can be framed. Below are some of the key quotes.

To make matters worse, Defendants failed to even carefully select which Invesco Investment Options to include in the Plan and instead indiscriminately filled the Plan with a huge number of Invesco affiliated investment products

This second quote cleverly uses the Plan’s Summary Plan Description as the standard that the Plan is obligated to maintain. This quote highlights how a plan can be held to their original aims and promises that they had set out.

The SPD stresses that participants “will obtain the greatest value from the Plan if [they] understand the benefits available and the choices [they] can make under the Plan.

The third quote focuses on the Plan’s fiduciary obligation in regards to what is considered to be prudent.

Rather than evaluating and selecting the Plan’s Investment Options through a careful and prudent process serving the best interests of Plan participants, Defendants …. failed to limit the huge number of offerings to a manageable amount.

This last quote has a participant focus. Ultimately the Plan is about benefiting the participants and this quote gives a good example of how to frame it in this manner.

Offering such a large number of Investment Options in the Plan was imprudent since it vastly exceeded the number of options that were manageable by Plan participants…. the sheer number of Investment Options rendered it virtually impossible for the typical participant to adequately understand….

Can the menu be too small?

According to Morningstar’s Bigger is Better study, there are two main benefits of having a larger core menu. Firstly, they found that increasing the core investment size will increase the rate of participants who accept the default investment. Presumably this is due to the participants suffering from choice overload. Increasing the number of participants in the default investments is seen as a benefit for increasing the ease of enrolling workers.

Secondly, Morngstar found that the participants who used self-directed accounts had better risk-adjusted returns. On average, they found plans which offered 10 funds participants chose 4.4 funds. But for plans with 30 funds that rose to 8.6. Although it was unclear if the improved efficiency was due to a broader range of high-quality investments or just naive diversification.

A Diversified Plan Menu

A participant must be able to choose a diversified portfolio from the plan menu. Obviously, if the plan menu is too small, then that may not be possible. But if the plan menu is too big then there are the problems associated with the lawsuit above, and that the bigger menu the less variety participants choose and the additional admin and monitoring costs to maintain a larger menu. So, even without defining the perfect plan menu size, we can assume there is always room for improvement.

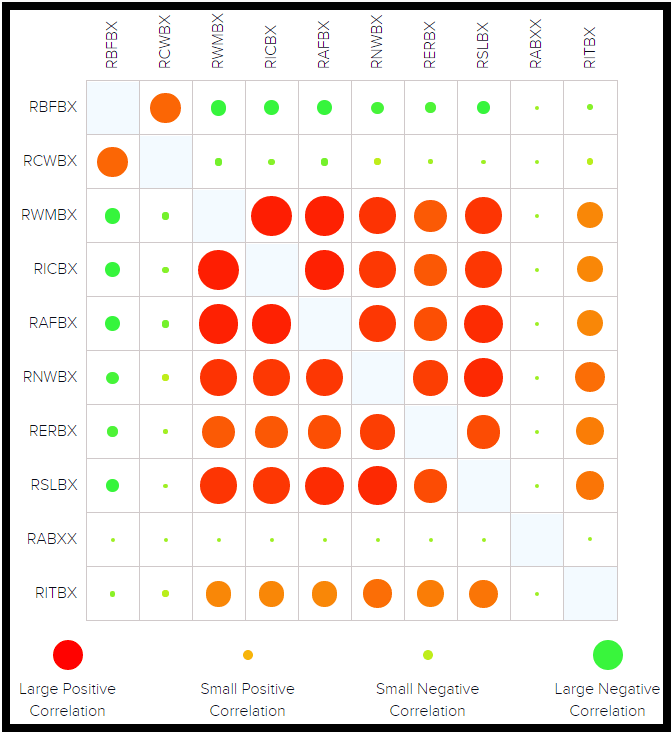

Below is a matrix which analyzes a plan menu’s diversification. It is comparing every fund in the plan menu to every other fund in the same plan menu. It shows how strong the correlation is between the funds. This type of analysis can be used to identify when two funds are highly correlated and then allow the plan menu to be trimmed by removing one of the two funds which are similar. This is one way to reduce the plan menu size without affecting the investment styles that a participant has access to.

Summary

Plan menu size can be a valuable dialogue to have with a plan sponsor. There are fiduciary risks and additional costs but improved efficiency for self-directed accounts and more participants choosing the default-investments if the plan size is too big. There are diversification risks if the plan size is too small. Prudently removing redundant funds that have an overlap with other funds is a win-win solution.