- Sending a Risk Questionnaire

- First, Risk Tolerance

- Expanding the Picture with Risk Capacity

- So the Investor Completed the Questionnaire, Now What?

- Key Takeaways

At Larkspur-Rixtrema, we know how important it is for financial advisors to understand their client’s risk preferences, so they can utilize appropriate investment products for their client’s portfolios. Simply measuring risk tolerance based on a client’s psychological assessment of their willingness to take risks is not enough. Portfolio Crash Testing PRO (PCT Pro) presents a complementary metric to objectively measure risk preference: Risk Capacity. Now, PCT Pro offers both an objective risk capacity assessment and a psychological risk tolerance questionnaire that will streamline this risk assessment and help advisors use a holistic approach to creating appropriate investment portfolios and educating clients. Measuring a client’s risk capacity takes just a few minutes of the client’s time but illustrates a critical investment risk metric and their likelihood of achieving their retirement goals. Both tolerance and willingness can be assessed by sending a single risk questionnaire, making the process seamless to clients.

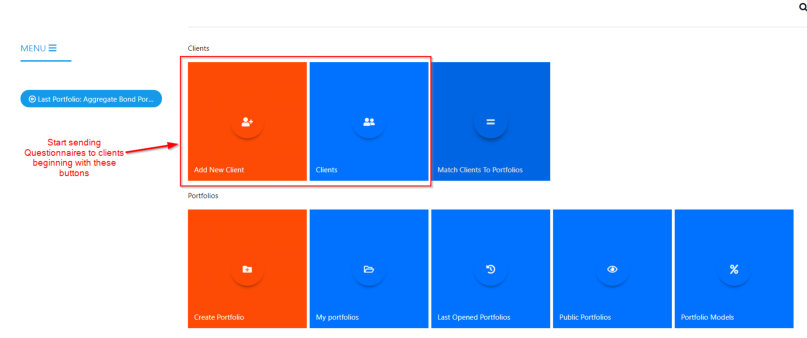

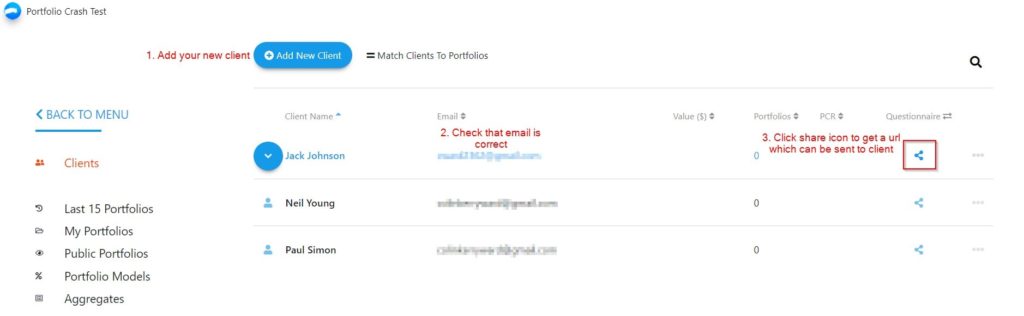

Sending a Risk Questionnaire

To send a risk questionnaire to a client, first open up your client list in PCT Pro (Figure 1). Either add a new client or just check to see that the email is correct in your client list before clicking on the share icon (Figure 2). This will display a URL that you can send to the client via email. After receiving the email, the investor client can complete the questionnaire at their convenience by answering the Risk Tolerance questions.

First, Risk Tolerance

With just 5 simple questions, the risk tolerance questionnaire will explore the client’s emotional investment judgement. This is the point when many advisors stop explaining the risk narrative, but the risk tolerance is only half the picture. Not to mention, that emotional responses can change based on what is happening in your client’s life and assessments taken months apart can often result in disparate results. Halfway through the questionnaire, a Risk Tolerance Score will be provided following a graphic illustration of the trade-off between risk and reward (Figure 3). The investor can click and drag the circles to understand this trade off and accept the appropriate measure.

Expanding the Picture with Risk Capacity

Neglecting the client’s Risk Capacity would leave the investor client without an understanding of if their risk tolerance is compatible with their retirement goals. The Risk Capacity connects how their present investment behavior and emotional judgement may be missing their retirement goals. It reminds the client that the financial advisor is building a personalized portfolio — and not just some packaged portfolio for their own benefit.

After completing the risk tolerance section, the client will complete an investment survey questionnaire to provide basic information about where they are on their journey to retirement (i.e. age, amount saved, time to retirement etc.). Based on this information, PCT Pro runs a Monte Carlo simulation of 1000 hypothetical market situations, and displays a summary page reviewing their responses (Figure 4).

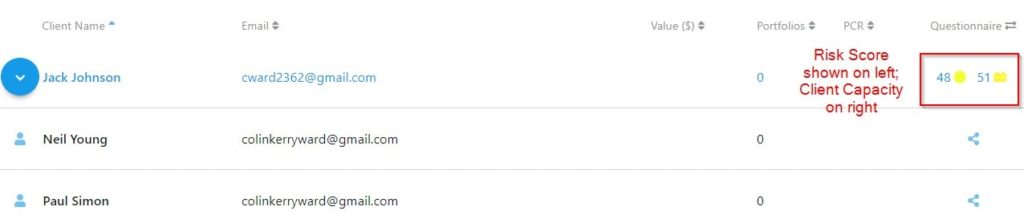

So the Investor Completed the Questionnaire, Now What?

When the client has completed the questionnaire, the Financial Advisor will see corresponding risk tolerance and risk capacity numbers next to the client’s name (Figure 5). This prepares them to discuss the meaning of these scores and take steps to build a portfolio that will balance the client’s emotional willingness (risk tolerance) and their ability to take risk (Risk Capacity).

Key Takeaways

- Measuring just Risk Tolerance does not give you the full sense of the investor client’s situation.

- Risk Capacity combines age, goals, and the amount already saved in their account to show how their investing practices differ from their risk aversion.

- If risk tolerance is much lower than their capacity, then the investor can take more risk than they may think. If risk tolerance is higher, than they may need to reframe their retirement goals or save more to ensure a safe retirement.

- Risk Capacity is crucial because it shows the investor client that the financial advisor is building a personalized portfolio addressing their unique retirement situation — not just selling a prepackaged portfolio for their own benefit.

- Portfolio Crash Test PRO provides a questionnaire that the investor can take at their convenience while the financial advisor remains a neutral fiduciary investment educator

In future articles, we will examine using the risk capacity measure for clients already in retirement and have begun to draw on their retirement portfolio.

If you have any questions about the questionnaire feature or would like to learn about any of our financial planning software, then please contact our Client Success Team at clientsuccess@rixtrema.com.

Pingback : PCT Pro Using RetireRisk To Plan Cashflow In Retirement -