The Ask:

One of our adviser clients asked if he can compare an annuity to an alternative investment portfolio?

An annuity is an investment vehicle for retirement that has guaranteed income feature which makes it so attractive to investors looking to put together a financial strategy to retire comfortably. According to Jackson National Life study “The Language of Retirement 2017: Advisor and Consumer Attitudes Toward Income in Retirement.”, approximately 48% of investors either currently own (42%) or previously owned (6%) an annuity. By comparison, fewer investors own or used to own two very popular investment options: exchange-traded funds (ETFs) (31%) or target-date funds (TDFs) (21%). The chances of coming across one of the annuity products when dealing with retirement portfolios are very high.

The Problem:

Annuity products can be hard to analyze or compare. How can you look at an annuity along with other assets in the portfolio? It can be difficult to compare the annuity to other available annuities to evaluate strengths or weaknesses?

An annuity is one of the products which is hard to analyze because it comes in so many different colors. There are Immediate Annuities, Deferred Income Annuities, Fixed Annuities, Variable Annuities and others. Among these classes of annuity, there is a huge variety of features that must be evaluated, such as caps and floors in Fixed Annuity, subaccounts in Variable Annuity, etc. For a specialist, it is a demanding job to stay on the top of these but for an advisor who rarely deals with the annuity, it becomes a challenge. Comparing annuities can be challenging enough, but add to that the difficulty of evaluating an annuity alongside other portfolio investments and it is clear that annuities present a real challenge for advisors.

The Solution:

Annuity Optimizer analyzes and compares annuities and portfolios.

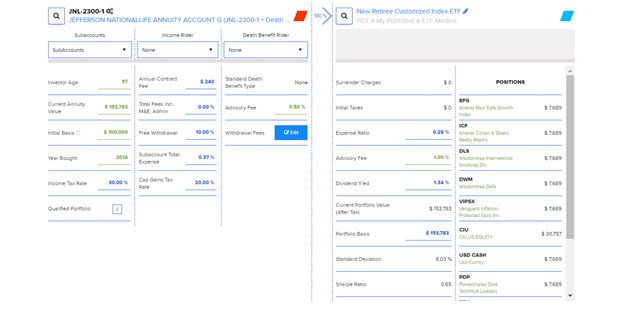

Larkspur-RiXtrema’s Annuity Optimizer is a great analytical tool, allows advisors to look at annuities in great detail. Whether comparing an annuity to others, or integrating it into a retirement portfolio and analyzing it in a holistic way, the AnnuityOptimizer can help. The advisor can search among more than 2,000 different variable annuities available in Rixtrema’s database or create an annuity from the scratch using fixed/fixed index annuity based templates. The example of an annuity rollover to a qualified IRA account is displayed on the screenshot below.

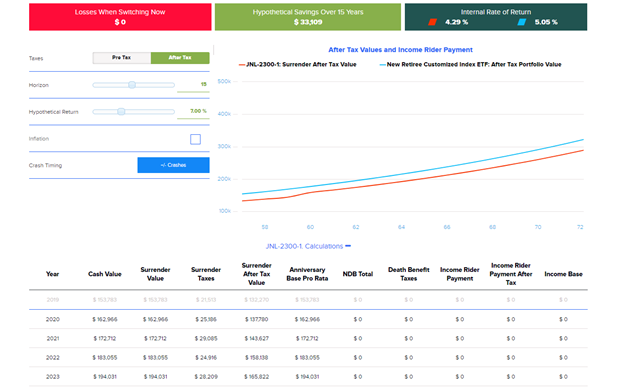

A 57 year old prospect wants to roll over his annuity into a qualified account. Currently, his subaccount expense ratio is 37 basis points and the advisory fee is 50 basis points. However, if the annuity is rolled over into the ETF portfolio with an expense ratio of 29 basis point and the advisory fee of 1%, the hypothetical savings over 15 years will be close to $33K because Internal Rate of Return on ETF portfolio is 5.05% versus 4.29% from the annuity. In addition, the infographics help to grasp the process with ease by visually seeing what is happening. The flexibility of the tool allows changing underlying parameters like horizon, hypothetical return to play out various options.