Case Study: Diversifying 401(k) Plans as a Great Prospecting Opportunity

The Ask:

Creating a great proposal that will increase interest from your prospects should be ideal not only in terms of cost-efficiency but also in terms of diversification. While cost-efficiency is based on the fund fees and performance, diversification means protection against market loss, which can potentially dramatically decrease your plan savings.

The Problem:

When you search for plans in your area, the main purpose of the Plan Screener page is potential plan savings. No doubt, that’s a good approach for prospecting, but behind the software you can find much more than that. For example, there is another key parameter called diversification, which is not visible on the first page.

Even if a plan report doesn’t show any significant savings, it doesn’t necessarily mean that the plan is well diversified, which gives you another great opportunity to prospect.

The Solution:

The 401kFiduciaryOptimizer algorithm rests on the measure called similarity, which is an average correlation of two factors:

- returns based correlation

- holdings based correlation

Consequently, you can check the whole plan menu, and see how well its funds are correlated between one another.

All you need to do is go to the 404(C) Diversification section by clicking on the corresponding tab on the top blue menu band:

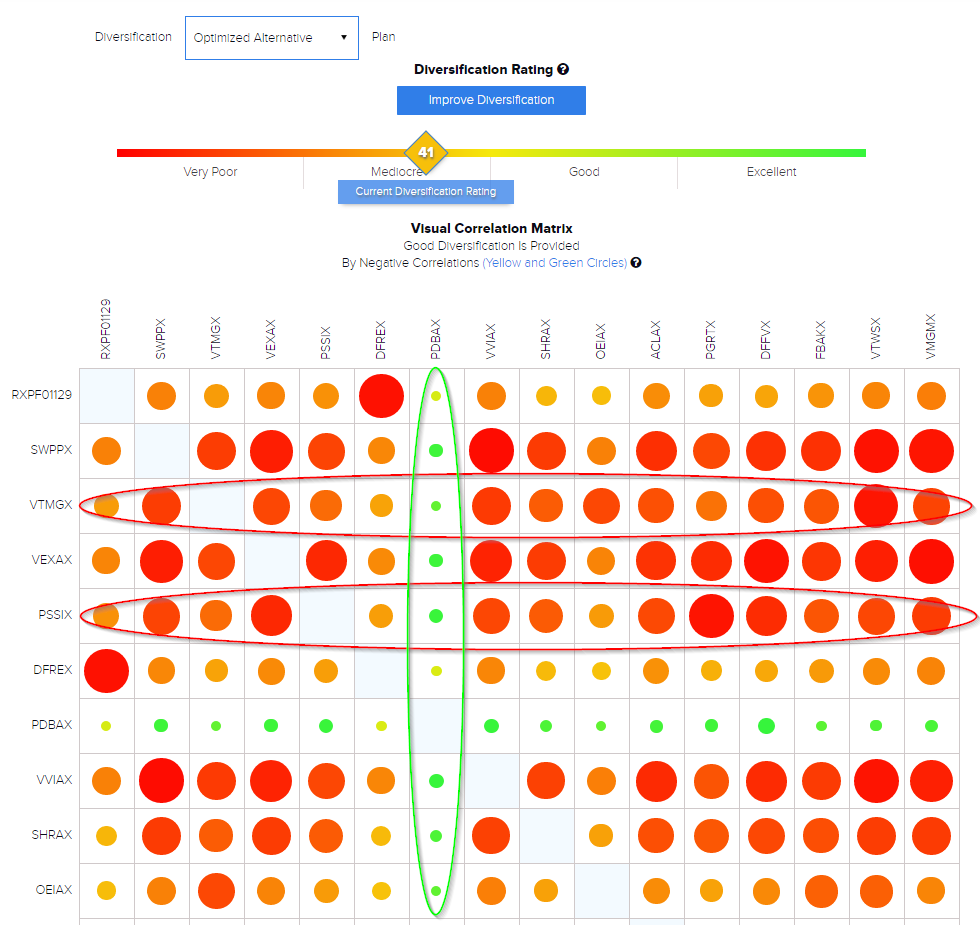

The diversification matrix below shows correlation between the funds. Red dots represent positive correlation and green dots show negative correlation, the bigger the dot is the higher the correlation between the funds:

For the current plan, diversification is mediocre (41 out of 100), which is not bad but you can easily improve it by clicking on the corresponding button:

On the next screen, you’ll be able to improve your current diversification rating by swapping current funds for negatively correlated ones. Each change will provide you significant rating improvement. For example, in this case we managed to increase diversification from 41 to 63 by simply changing two funds. You can also improve current plan rating by adding your own fund to optimization in the upper right corner.

After you save a new diversification rating, you’ll see a new matrix that will be included to the final report.

Therefore, if the plan savings will not be the case for your report, diversification improvement will definitely be the key point for this plan prospecting.

Pingback : How Advisors Can Connect With Different Types of Clients