- The Ask: How can I monitor my plan lineup to ensure that the funds selected are the best share classes?

- The Problem: Fund companies change their lineup all the time.

- The Solution: 401k Fiduciary Optimizer.

The Ask: How can I monitor my plan lineup to ensure that the funds selected are the best share classes?

Litigation against plan sponsors is nothing new. But in the aftermath of the financial crisis of 2007-2008, the number of excessive fee lawsuits that were brought by participants in 401(k) has increased. Tibble vs. Edison, decided in 2017, was one of the most famous cases in which the plaintiffs claimed that executives of the Edison International Inc. 401(k) Plan breached their fiduciary duties by selecting more-expensive retail-priced share classes versus institutionally priced shares for identical investment options. Despite potential legal consequences, there are plans which have not done anything to remedy the situation.

The Problem: Fund companies change their lineup all the time.

It is necessary to have a screening process that would go through all the funds available to the plan sponsor based on either the provider platform they are using or an alternative platform. An alternative platform should be considered if it can benefit the plan sponsor and plan participants if they would switch to more cost-efficient alternatives available on that platform. The ability to quickly screen out the most cost-efficient funds from the all available options becomes the necessity of the prudent process. How the funds selected for the plan can be shown to be the best option available for the plan participants?

The Solution: 401k Fiduciary Optimizer.

The 401KFO is loaded with features that will help advisors identify the best share classes as well as scan through all available options loaded from a provider list to find highly similar funds, using quantitative algorithms, with the lowest expense ratio and better performance. This easy to use software optimizes the existing menu and shows the aggregate savings that can be generated by the low fee alternative funds.

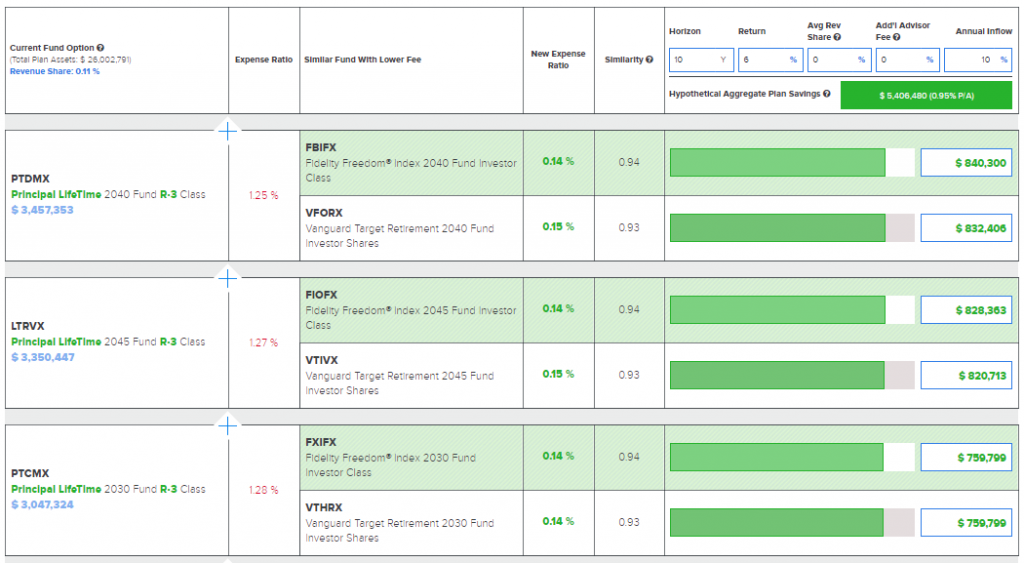

Moreover, lower fee fund selection is also based on finding funds with better historical performance. For example, for the plan with total assets of $26M (see the screenshot) the 401k Fiduciary Optimizer found low fee alternative funds that generate approximately $5.4M of saving over the next 10 years assuming that rate of return on the money saved is about 6% annually. This is a significant amount of money that can be returned into the plan if more cost-efficient funds would be picked.

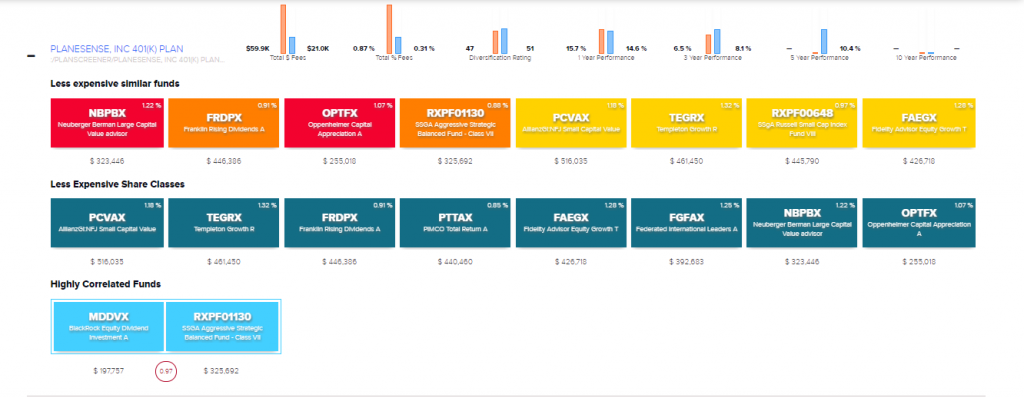

Plan Monitor, which is part of the 401k Fiduciary Optimizer, would provide the advisor with the dashboard to keep track of the health of their existing clients’ retirement plans by notifying them if any immediate action is necessary to avoid a fiduciary breach. It provides three areas to monitor which are Less Expensive Similar Funds, Less Expensive Share Classes and Highly Correlated Funds.

For example, knowing that less expensive share classes are available and being quickly able to discuss it with the plan sponsor makes a plan fiduciary prudent in his/her effort to act in the best interest of the client.

Pingback : Case Study: How to Find Retirement Plans with Specific Investment Names