- Risk Tolerance is just half the picture

- Now is the time to reflect

- A questionnaire without Risk Capacity is a blunt tool!

- Risk Capacity + Risk Tolerance = Risk Profile

How did your client investors react during the worst of the 2008 Financial Crisis? Did you stick to your investment plan or did you bend to the stressful situation? Predicting how investors will act during turbulent markets is the purpose of risk questionnaires but these methods are dated and unreliable. The Portfolio Crash Test Pro (PCT Pro) Risk Capacity measure is designed to improve upon the weaknesses of traditional risk questionnaires by giving financial advisors a picture of their investor client’s retirement situation and emotional response to risk.

Risk Tolerance is just half the picture

PCT Pro adds a metric to supplement the emotional risk tolerance profile: Risk Capacity. Risk Capacity takes into consideration the investor client’s present retirement situation and how it measures to their goals by recording age, present savings, yearly contributions, retirement age, and terminal value. It summarizes the amount of risk an investor client must take to reach their investment goals. Then it is most useful when balanced with risk tolerance and used to initiate a conversation with the client investor.

Now is the time to reflect

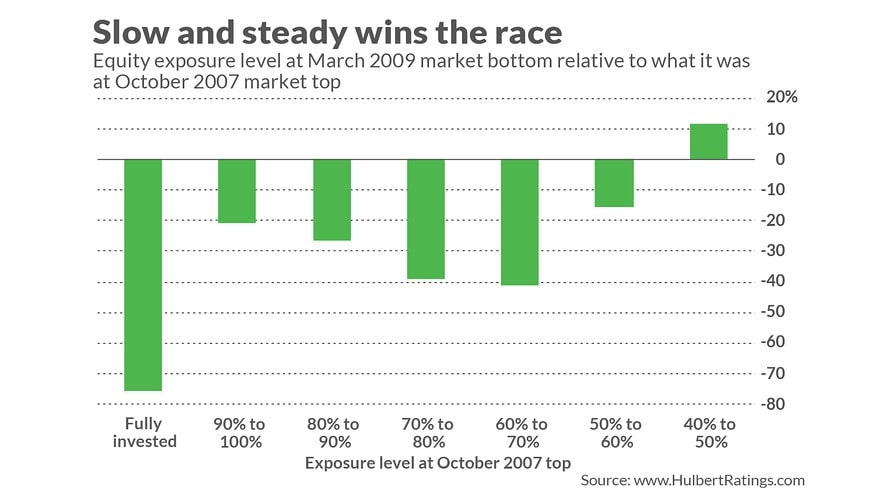

While investor market confidence remains high, trade tensions, corporate debt, and an inverted yield curve are inciting more bearish media discussions. (Read more about these conditions in our series: Global Recession Deja Vu?) So, reflecting upon past behavior is proactive and could position you in a better situation to capitalize on volatility. So, what do most people do when the market collapses? Well, Mark Hulbert, found that of all those fully invested at the top of the wave in October 2007, only 26.2% were still floating to buy at the March 2009 (Figure 1). Investors who took action without understanding their complete risk profile were holding their breath underwater during a once-in-a-generation buying opportunity.

A questionnaire without Risk Capacity is a blunt tool!

This fearful sell-off indicates that we underestimate how much emotions affect our decision making during stressful situations. Perhaps, because advisors and investors don’t use risk questionnaires wisely. The renowned retirement expert, Wade Pfau, found that 95% of financial professionals see risk questionnaires as ineffective and 82% of individual investors share that belief. The merits of the assessment itself are merely an afterthought. Risk tolerance questionnaires don’t capture how clients truly feel and, perhaps, even if they did, clients would want to shift into a more conservative strategy when the going gets tough.

I won’t berate my parents for gifting me A Catcher in the Rye instead of The Intelligent Investor. Yet, as I reflect on Buffett’s stock purchases during the deepest trough of the Great Recession, I can’t help but think that my financial situation would be more enriched if I had read about portfolio theory more than angsty, neurotic teenagers. Writing for the Times in October 2008, Warren Buffett wrote that his personal portfolio before the financial crisis was nearly all bonds. This allowed him to buy cheap equity by a simple rule: “Be fearful when others are greedy, and be greedy when others are fearful”. He capitalized on the economic recovery because his investment plan reflected his entire risk profile and he could act tactically – being a billionaire helps too.

Risk Capacity + Risk Tolerance = Risk Profile

Misunderstanding a client’s Risk Capacity, and not balancing it with Risk Tolerance, may place them in a position where they are unable to meet their investment goals. If too conservative, then they may miss out on the normal market expansion and if invested without regard for risk then they may not be in an advantageous position following a market decline. PCT Pro can also simulate timed market crashes so that clients can have a deeper understanding of the investment plan — especially how it will affect their retirement terminal value. Then clients may not panic as much when the bottom falls out because that instance was already accounted for in the planning model.

The PCT Pro Risk Questionnaire and Risk Capacity will help you initiate conversations that show you to be a fiduciary and foster long client relationships. If you have any questions about these features, or would like to learn about any of our financial planning software, then please contact our Client Success Team at clientsuccess@rixtrema.com. You can also read more about PCT Pro through our a blog.

Pingback : PCT Pro Using RetireRisk To Plan Cashflow In Retirement -

Pingback : Reg-BI Is Along The Line Of Fiduciary Rule -