The Ask:

Using the 401kFiduciaryOptimizer, our client has been targeting plan sponsors that are offering expensive plans lineups to their participants. By showing the sponsor better performing, more efficient lineups, he has won a lot of business. But many of his wins have come from clients that were with a particular provider. So he asked us how he could target sponsors that invest through that provider with high cost?

The Problem:

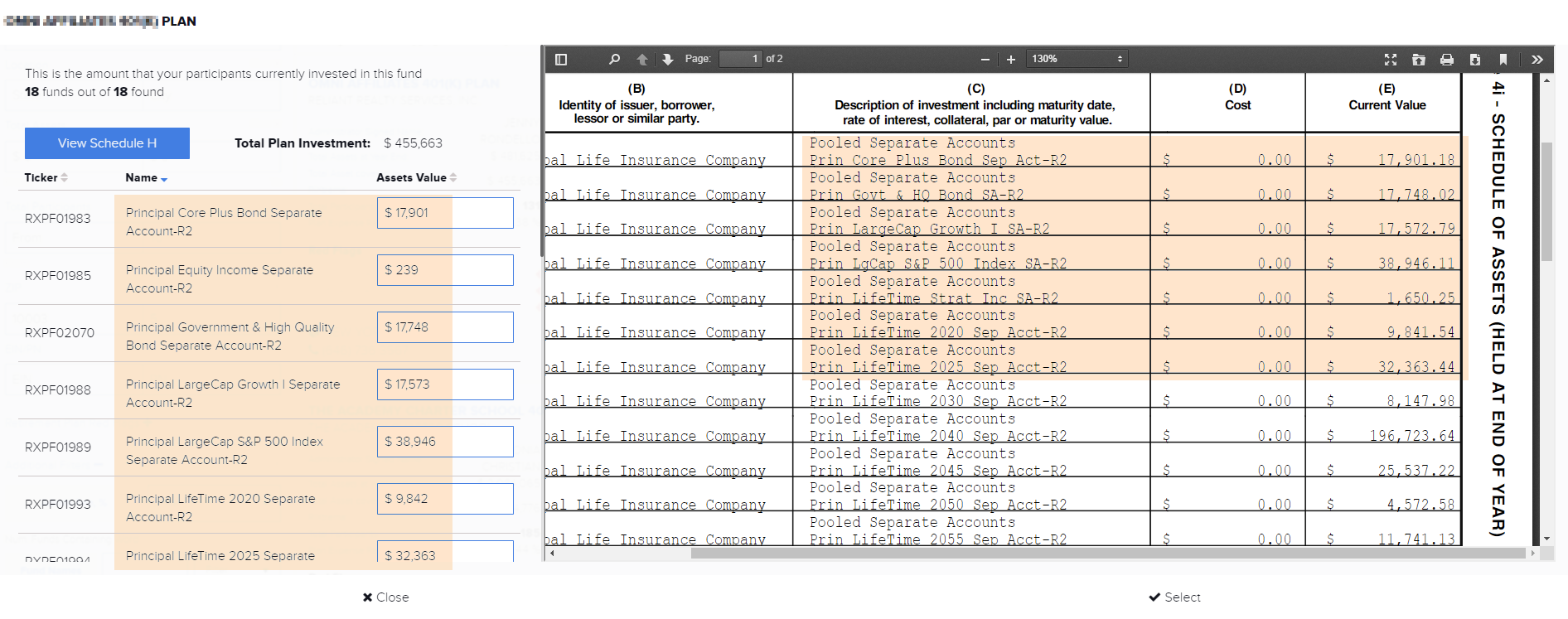

Clients have had to use various prospecting sources to examine plan lineups and provider lists. For those that have spent time examining the form 5500 filings, you know that this is no easy task. Our client needed a way to target expensive plans from a particular provider, and offer them a better solution.

The Solution:

Our client was already utilizing the 401kFiduciaryOptimizer’s powerful Plan Screener search tool that lets you easily examine the lineups of audited 401(k) retirement plans and offer better performing lower cost alternative investment options. The 401kFiduciaryOptimizer technology possesses sophisticated text recognition algorithms, which extracts a plan’s original fund menu with precise fund names, detailed down to the share class of the fund (in most cases, where the share class is defined for the fund).

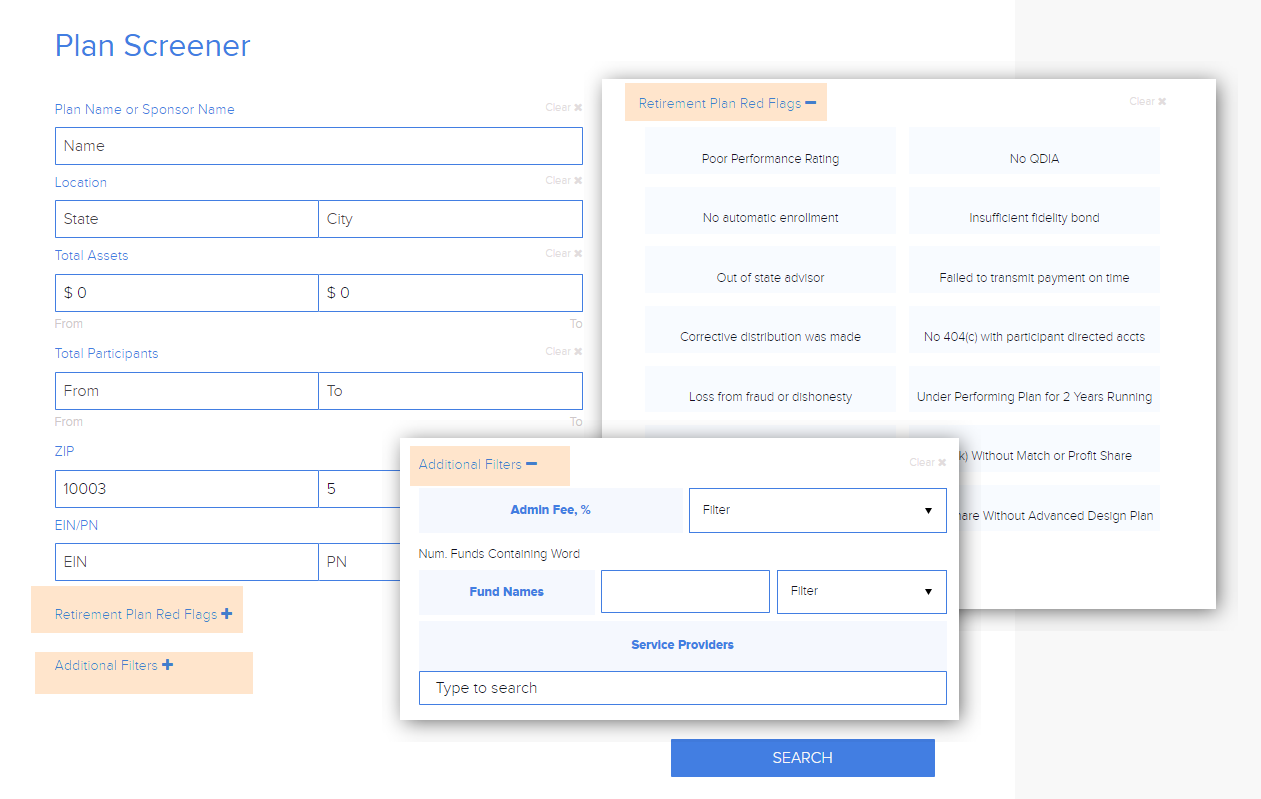

Plan Screener is an extremely powerful and easy to use plan location tool within 401kFiduciaryOptimizer. Among the usual Search fields, like Plan/Sponsor Name, EIN/PN number, Location or ZIP code, Total Assets or participants count. We have also added sections to search for retirement plans indicating specific Retirement Plan Red Flags and Additional Filters. If you, like our client, are targeting plans offered by a certain provider, it is this Additional Filters window that you will want to utilize.

Simply type the name of the provider here and you will be looking at all plans offered by that provider. Knowing that a plan is running on an inefficient investment platform and that you have already won business from that provider will allow you to further strengthen your proposal with better strategies to achieve the plan’s investment objectives.

The challenges that today’s plan sponsors face when selecting default investments on behalf of their participants are formidable. While they clearly want to do what is best for their employees, they must also consider their fiduciary obligations and provide a quality low-cost retirement plan. Choosing better plan investment providers is one of the more important fiduciary duties for you as an advisor to a 401(k). This is where 401kFiduciaryOptimizer comes to the rescue. Stand out from the crowd with the ground-solid retirement plan prospecting tool to stay ahead of the competition.

Also be sure to read how 401kFiduciaryOptimizer helps you stay prudent in the process of upholding your fiduciary duty in our recent case study.