The Ask

Our client is able to review and analyze virtually every defined contribution plan in the country using the Larkspur Executive. They specialize in acting as a fiduciary to the plan and helping plan sponsors to avoid fiduciary liability themselves. When hunting for new prospects they need a variety of specialized indicators can tell them if a plan may be at fiduciary risk so they can market their services to these prospects.

The Problem

The problem that our client faces is that it can be very hard to make a proper analysis of a plan’s current state and the liability that a plan sponsor may face. Understanding the intricacies of a 401(k) plan without even first sitting down with the plan sponsor to review everything can be quite difficult to do. Even trying to figure out the information that we do have from their form 5500 filings can be a difficult time. Deciphering the various codes and features indicated on a form 5500 is an absolutely massive task. So how can an advisor quickly identify prospects based on their fiduciary risk without sinking hours and hours of time into it?

The Solution

Retirement plan experts from Larkspur Data & RiXtrema have put in tons of research to uncover what we believe are some important plan flaws and Top Fiduciary Risk Factors to keep an eye on when looking for new prospects. We identify some of our Top Fiduciary Risk Factors from different codes that are indicated the form 5500. For now, let’s focus on just two different Fiduciary Risks that could definitely mean a plan sponsor is in need of direction on avoiding liability: “No QDIA” and “No 404(c) with participant directed accounts.”

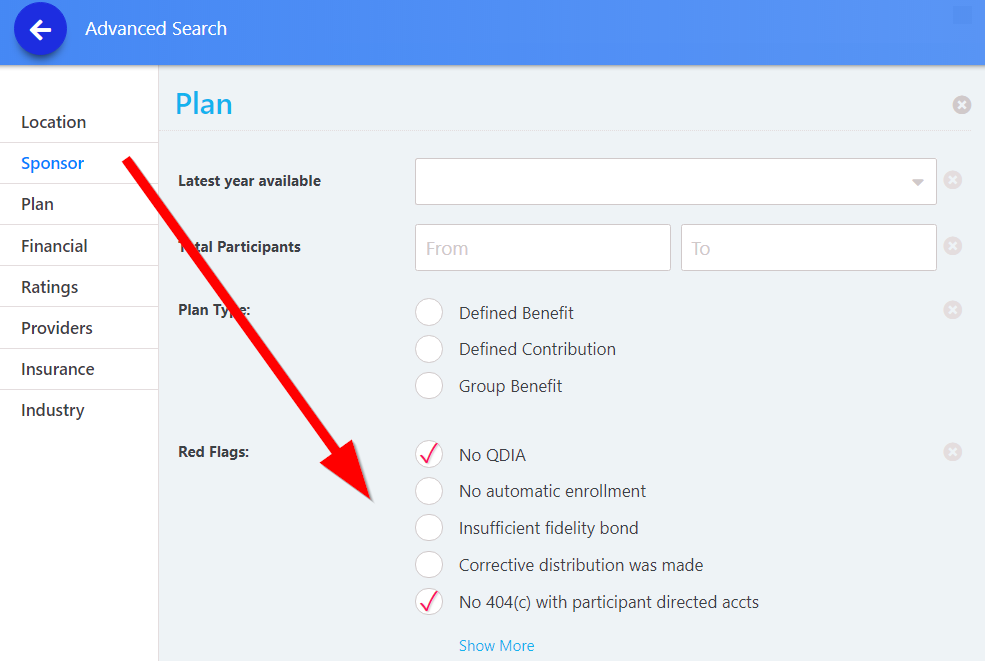

Using the Larkspur Executive “Advanced” search you can find all of our red flags visible under the “Plan” section.

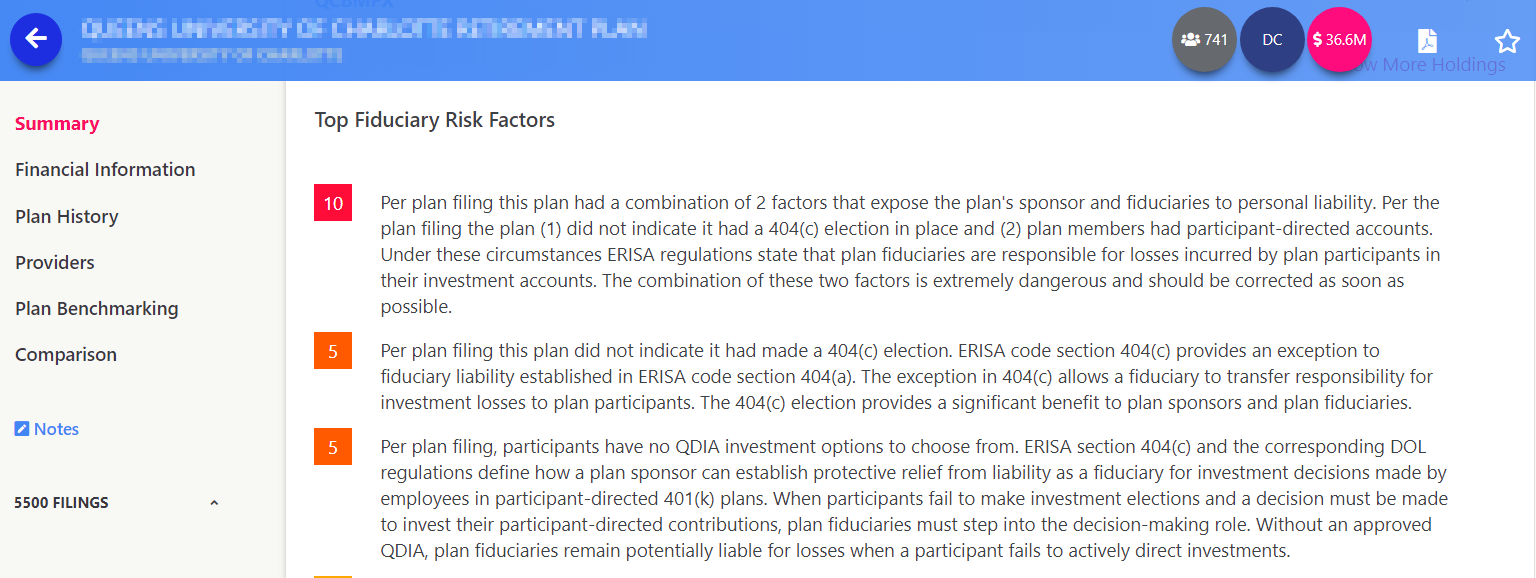

After pulling up a plan, you can find the Top Fiduciary Risk Factors at the bottom of the “Summary” report. We also rank these factors on a scale of 1-10, with 10 being the most severe. On this page we can see that this plan has two of our more severe risk factors, including not indicating it had a 404(c) election while also have participant directed accounts, and also missing a QDIA.

The 404(c) election provides an important shield to plan sponsors when it comes to protecting them from participant losses in their investment accounts. According to ERISA regulation, the plan sponsor is held liable for losses from participants if they don’t have this 404(c) election in place. Additionally, a QDIA provides participants with a default investment alternative when they do not make a decision on investments themselves. A QDIA, is another important feature of a 401(k) plan to protect both participants and plan sponsors alike.

Using the Larkspur Executive, our client can easily track down plans that have various fiduciary liabilities so they can hone in on new prospects. Many of these plan sponsors may not even be aware of their fiduciary responsibility to the plan and the liability they may face under these circumstances. Being able to come in straight away to educate these sponsors on some huge liabilities they may have and provide them with insight on how you can help them can be just the door opener you need to win new business.