The Ask

It’s practically the norm for the fees on many 401(k) plans to be anything but straightforward. Indirect compensation and revenue sharing are some of the biggest culprits in this. So, when making any kind of proposal to a new prospect, it can be exceedingly difficult to paint a fair picture of the fees on the current plan. How can we make any kind of proposal when we don’t really understand both how and how much the current plan’s service providers are being paid? Clients using our tools want to be able to understand this and be sure to factor in revenue sharing and indirect compensation to any proposal.

The Problem

Our 401kFiduciaryOptimizer tool is designed to demonstrate how a plan sponsor can cut plan costs dramatically by moving their assets into lower-cost, highly similar funds. Because of this we often will compare mutual funds in a prospect’s current menu to a non-revenue sharing fund. Comparing a revenue sharing fund to a non-revenue sharing fund presents several problems because some of the cost on the original is of course going towards another required plan expense. So it is unfair to make this comparison without first factoring in these costs. Luckily this problem is not insurmountable and we’ve thought of a few ways to deal with it.

The Solution

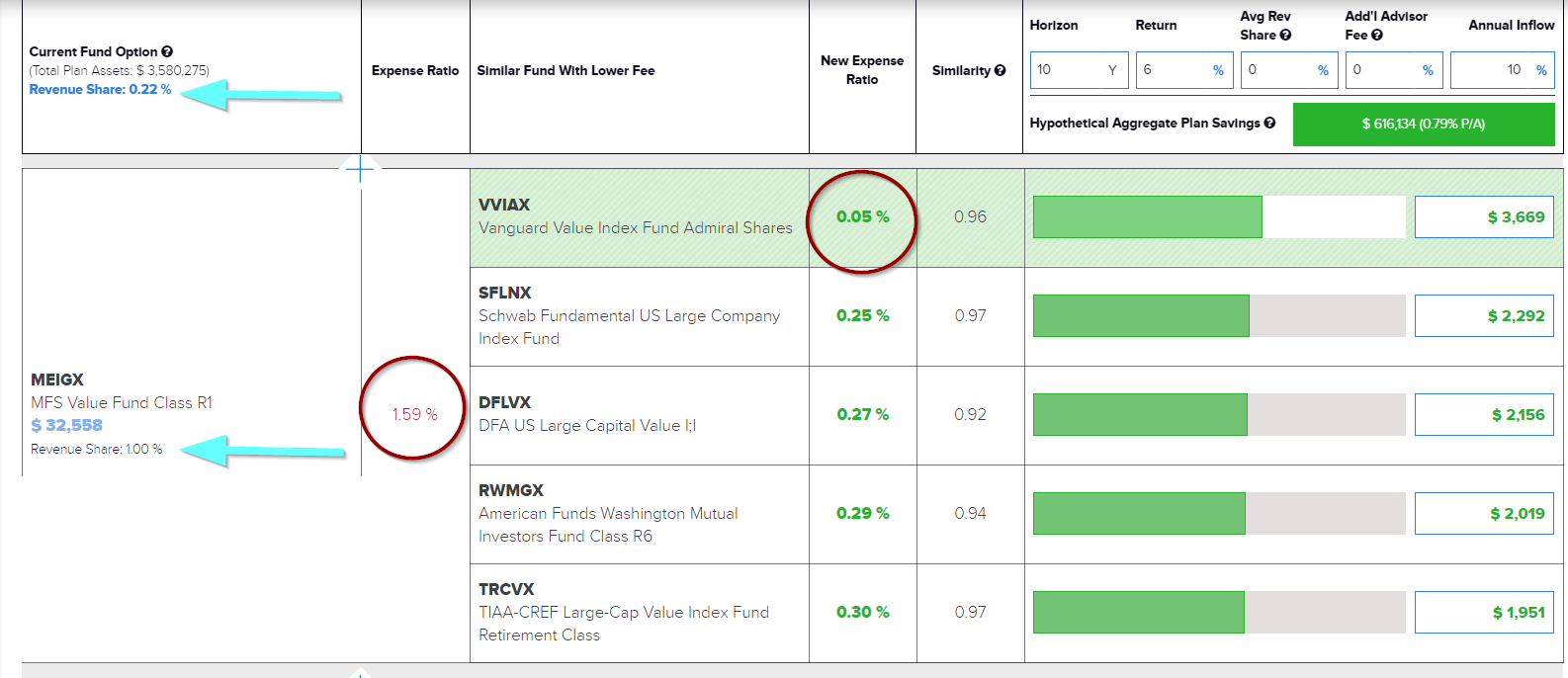

Using the 401kFiduciaryOptimizer, we have several ways to both understand and include revenue sharing on the prospect’s plan and factor it into our proposals. First and foremost, we assume that all 12b-1 fees in the plan’s funds are equal to revenue sharing and therefore being used to pay for a required plan expense like the record keeper or advisor. This method may not be 100% accurate 100% of the time in fully encompassing all of the revenue sharing on the fund’s expense, but it’s a great start. You can see below an example of how this works:

Here we’re comparing the fund MFS Value Fund R1 to the Vanguard Value Index Admiral. The difference in expense is 1.59% to a mere 0.05% on the Vanguard fund. This is certainly a huge difference, but we can also see that the MFS fund has a revenue share of 1.00%. So this means with our core assumptions this 1.00% is likely paying for some other plan services and we have accordingly subtracted it for our comparison. This means we are effectively only using 0.59% on the MFS fund for our comparison, which is definitely a much fairer comparison. We can also see in the top left of the image that our 12b-1 assumption has accounted for 0.22% in total revenue sharing across all of the plan’s funds. While I mentioned this figure may not be 100% accurate, we have a few ways of checking it.

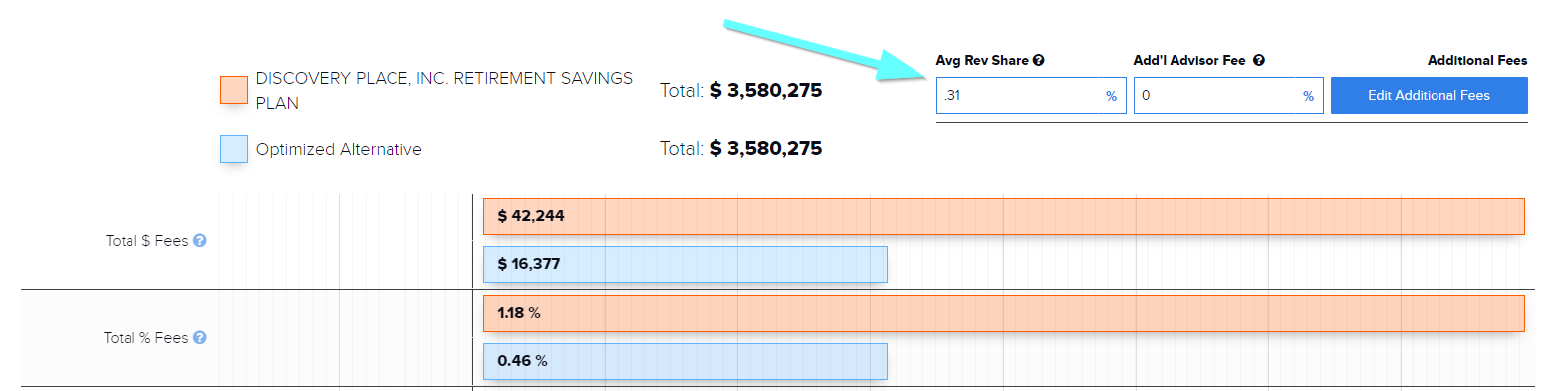

The above screenshot was taken from our “Providers” tab. In this section we can see a breakdown of how the plan is currently paying its service providers. In this section we can clearly see that they are paying $16,312 or 0.31% in indirect compensation to Kestra Investment Services. Now if you remember, our previous 12b-1 assumption captured 0.22% of revenue sharing expense, so actually pretty close to the actual amount of 0.31% as reported by the plan.

Now when we want to compare overall total costs of the plan versus what they could be saving with our lower fee alternatives, we want to include this exact figure in all of our number crunching. In the above image, we are seeing the 401kFiduciaryOptimizer’s summary report of total fees between the original lineup versus our proposed lineup. You can see in the top by the blue arrow that I have inputted the 0.31% into our “Revenue Sharing” box. This will automatically account for the revenue sharing that is going toward the service provider being payed indirectly. Now the total fees of our proposed versus the original are taking this into account and equalizing our comparison. Even after accounting for 0.31% of revenue sharing, our lower fee alternative menu still provides over 50% in savings!

With all of the different ways that some service providers have their fees hidden in 401(k) plans, the 401kFiduciaryOptimizer has plenty of methods in its toolbelt to deal with this. Just because the hidden fees are hard to find, doesn’t mean that we can’t shine some light on them.