THE PROBLEM: Volatility is a threat to portfolio gains

Investors feel comfortable when markets behave rationally and their portfolios trend upward with expected fluctuations along the way. However, the investment landscape changes dramatically as the economy starts to sputter and market volatility creates chaos and instability. Investment experience reminds us that most investors are not ready for turbulent times and as a result the portfolio losses are huge. For example, during 2008 there was almost $8 trillion of losses in household stock market wealth. Navigating financial markets during such an uncertain time requires skills, knowledge, and experience.

Most household investors depend on their advisors for professional advice. This advice should include not only strategies that cover traditional assets like stocks, preferred stocks, bonds, mutual funds, exchange-traded funds but other assets like options, non-traded private equity funds, etc. The ability to analyze such assets and make recommendations to include them in a portfolio can make a big difference when presenting investment results to clients.

THE SOLUTION: Use analytical tools to tame the volatility of portfolio returns

Larkspur–RiXtrema’s Portfolio Crash Test (PCT) gives advisors a unique stress testing tool with which they can differentiate themselves. Knowing what could go wrong with the portfolio before it actually happens and creating various hedging strategies will ensure that the necessary steps are taken to prevent a disaster. PCT allows advisors to manage portfolio risk effectively by looking at the portfolio performance in different extreme events — scenarios created by RiXtrema research team or custom scenarios created by advisors themselves.

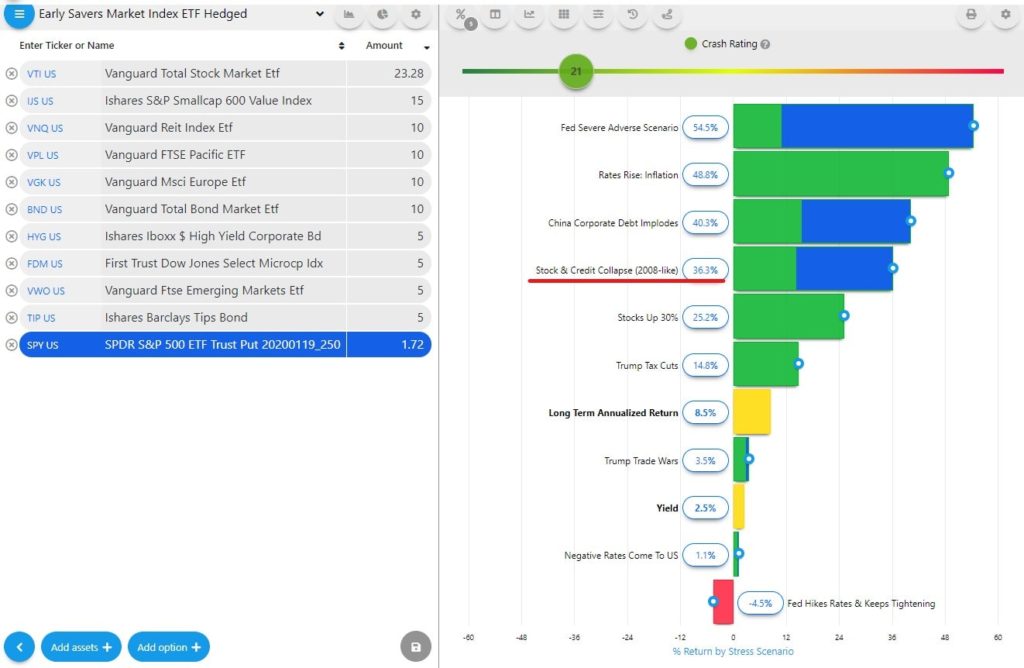

Options are one of the most effective risk hedging assets. In the Portfolio Crash Test dashboard, you can add options to a portfolio on-the-fly to see their hedging effect on the portfolio performance. In Figure 1, you can see the portfolio “Early Savers Market Index ETF Unhedged” has a Crash Rating of 69 and in the Stock & Credit Collapse (2008-like) scenario a probable loss of 38.5%. This is a typical result for a portfolio with an 80/20 allocation.

By using the Portfolio Crash Test feature “Add Option”, we can add any option to the portfolio to hedge the risk. In this case, we will use the put option of SPDR S&P 500 ETF Trust expiring on January 19, 2020 at $250. Adding only 1.72% of a put option to a portfolio reduces the Portfolio Crash Test to 21 and reverses the loss of the Stock & Credit Collapse scenario (2008-like) to a gain of 35.6%. Considering that an out of the money put option is cheap, using it as a hedging instrument can be good advice.

This is just one example of how you can use Portfolio Crash Test Pro’s dynamic interface to display portfolio possibilities to clients. It can also assess Risk Tolerance and Risk Capacity with a questionnaire, simulate thousands of risk scenarios, and help your clients examine different retirement withdrawal plans. If you would like to learn more about any of these features or our other financial planning software, then please contact the Client Success Team at clientsuccess@rixtrema.com. You can also read more about PCT Pro through our blog, InvestingCounterpoint.com.

Please join our webinar “Volatility is Rising, Do You Have the Right Portfolio Risk System?” which will be hosted together with Albridge.