StressTestAI Turns Fear Into Strategy

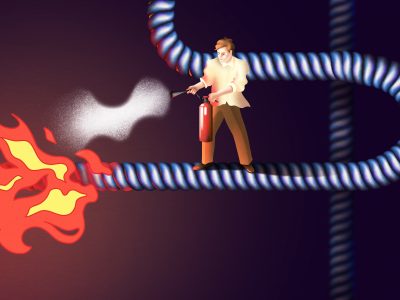

Tired of stress testing taking days or weeks? Relying on outdated "confidence level clouds" that vanish when real storms hit? The future of portfolio risk analysis arrived today with RiXtrema's groundbreaking StressTestAI

AI Boom vs. Gold & Silver: Stress Test Results

Will the AI investment boom cause gold and silver to soar or crash? We revisit our 2022 thesis on precious metals and run AI-powered stress tests.

The Hidden Flaws in Your Risk Model (And How to Fix Them)

Tired of stress testing taking days or weeks? Relying on outdated "confidence level clouds" that vanish when real storms hit? The future of portfolio risk analysis arrived today with RiXtrema's groundbreaking StressTestAI

See the Future of Risk Management: RiXtrema’s StressTestAI in Action

When volatility spiked in our example, a portfolio's risk metric jumped from 2.5% to 5% overnight - forcing advisors into difficult explanations. At RiXtrema, we believe risk management must evolve beyond these reactive approaches.

When Markets Crash: Simulate Crises, Not Predictions. StressTestAI

When volatility spiked in our example, a portfolio's risk metric jumped from 2.5% to 5% overnight - forcing advisors into difficult explanations. At RiXtrema, we believe risk management must evolve beyond these reactive approaches.

RiXtrema’s StressTestAI Reveals the Critical Flaws

Every investment portfolio carries risks - but the key is ensuring those risks are properly assessed and managed.