How You can Answer the “What if” Question When it Comes to Your Client’s Portfolio

To an investor who’s trusted an advisor with their retirement savings, they aren’t just any ordinary person anymore. The fiduciary duty of an advisor to their client is one of...Read More

Sleepwalking with the 2019 Global Risk Report

The Global Risks Report 2019, published by the World Economic Forum, was released on January 15, 2019. It is the perfect report to read on a dreary winter afternoon and...Read More

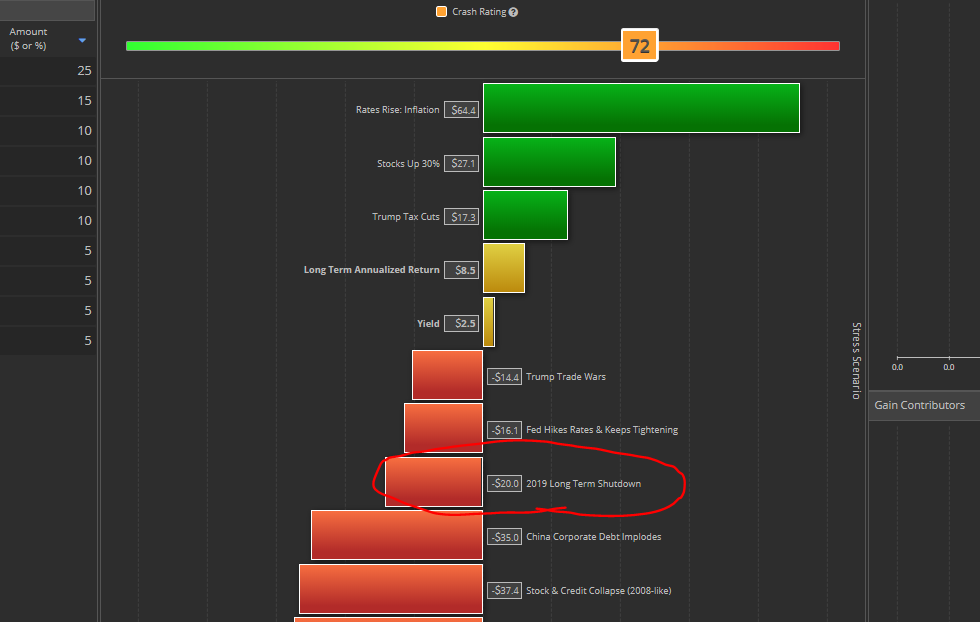

New Portfolio Crash Test Scenario: 2019 Long Term Government Shutdown

A scenario where there is a long-lasting shutdown, where the President does not declare a state of emergency, and the two sides don’t give in would have the biggest impact...Read More

iPhone Loathing in China Or Why 43% Of All Statistics Are Worthless

Statistics is the art of never having to say you’re wrong. A statistician is a person who draws a mathematically precise line from an unwarranted assumption to a foregone...Read More

Ways to help 401k participants understand the risk of their portfolios

One of the most obvious ways to look at the risk of portfolio is by checking its standard deviation. Standard deviation is a statistical measurement that sheds light on historical...Read More

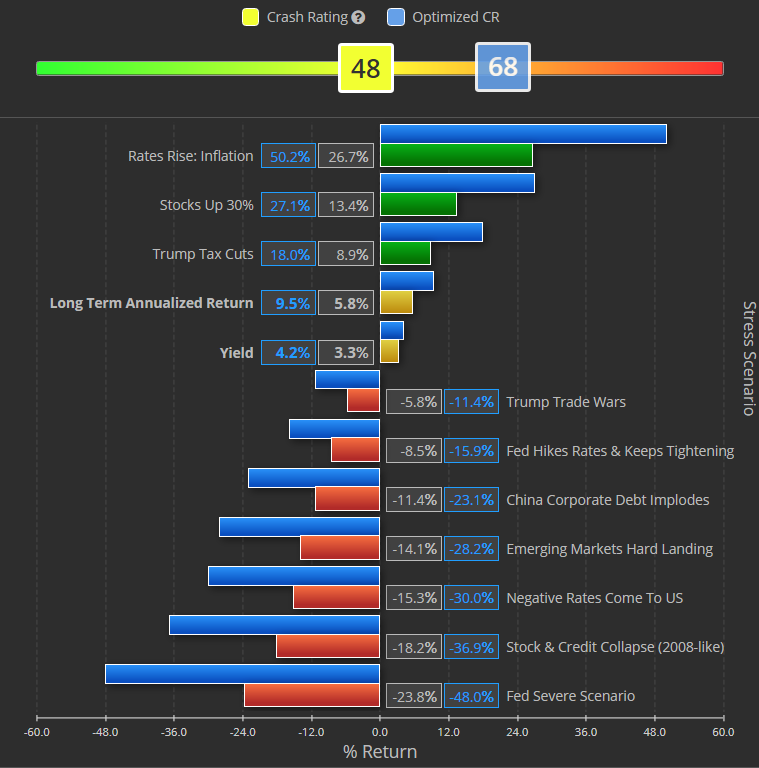

What you need to know about the Crash Rating in Portfolio Crash Testing

Crash Rating is a number used to measure the risk of a portfolio. It is a representation of the loss a portfolio may incur during our worst stress-testing scenarios. Here are...Read More