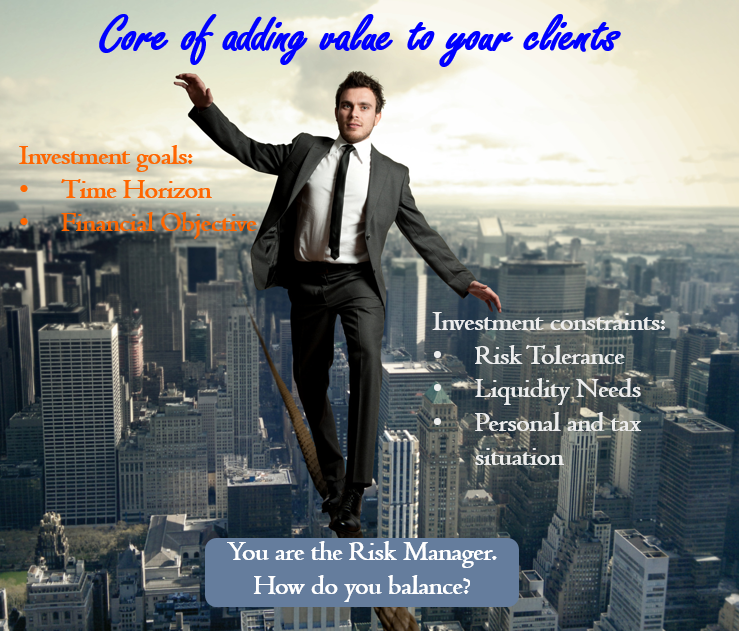

As advisors are adopting wealth management technology, they seem to be focused on the risk tolerance aspect of risk system implementation. But building a portfolio by subordinating everything else to the risk tolerance is detrimental. Portfolio creation in this case becomes similar to silly car shopping, when only car safety is considered when one chooses a car. It is critical for the advisor to discuss goals and risk tolerance together and identify the right portfolio that will match these two elements. Read our research with supporting examples about how to bring together client’s investment goals and risk tolerance: http://rixtrema.com/pdf/whitepaper1010.pdf