According to CoinMarketCap, as of early August, crypto-assets were worth more than $1.66 trillion, 80 alt coins worth at least $1 billion. Many tech and finance experts say the underlying blockchain technology has the potential to drive innovation in finance and beyond, although many of the claims remain controversial. Nobody knows for sure what kind of digital transformation crypto will bring, or if it will ever make inroads into everyday society. Despite the fact the finance sector is slowly warming to crypto as an asset, you probably won’t find Bitcoin (or other crypto coins, like Ethereum) in most portfolios. The first and the current No.1 cryptocurrency – Bitcoin – has been around for just over 10 years. As it is such a young asset class, Bitcoin is both far less predictable and much more volatile if compared to traditional ways of investment. It is very concerning to see just how easily cryptocurrencies can be susceptible to the influence of celebrity Twitter accounts. The biggest offender is Tesla CEO Elon Musk who has rallied markets, in both directions, by just tweeting.

The recent Colonial Pipeline hack highlighted the pitfalls of crypto, and how Bitcoin ransom attacks could undermine the entire industry. It has the effect of souring public opinion against cryptocurrencies, and cements the perception that Bitcoin is only used for crime. So far the Biden administration shares this skeptical view of crypto, announcing new US Crypto regulations. Ultimately, we will only know just how mainstream and viable crypto can become when governments come up with a more extensive regulatory response.

See also: A little Bitcoin in your 401(k)? The DOL Isn’t So Sure

For the average person, focused on retirement planning and financial stability, investing in cryptocurrency is daunting. This is why registered investment advisors are needed to gain mainstream acceptance. Registering means they have a legal duty to act in a client’s best interests and clarifies the task of advising on crypto matters.

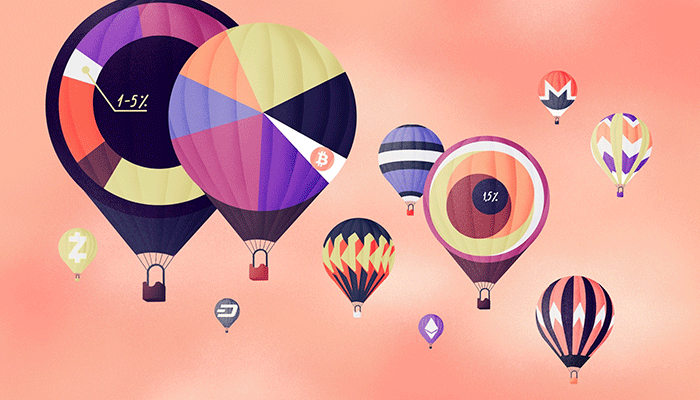

For Advisors, a general rule of thumb is that investors should consider crypto as a high-risk asset, which shouldn’t exceed more than 5% of a portfolio, even as low as 1-2% for beginners. The value of Bitcoin and other alt coins (that are in most part follow Bitcoin market patterns) can fluctuate wildly by day and even the hour, thus it requires nerves of steel and a certain degree of composure to remain comfortable with the volatility and uncertainty that comes with crypto.

However risky crypto is, going long is the name of the game. Anyone who’s made serious gains, invested early and held on in both a bear and bull market. Patience is key.

Here is another plus point when considering crypto. Bitcoin, and other cryptocurrencies are digital assets, and a valid asset class in a portfolio unto themselves, not correlated with traditional investments of stocks and bonds. So, perhaps a good option for those interested in diversification. More traditional investments paired with blockchain tech could be an alternative for tech-literate investors to get involved with cryptocurrencies. For example, ETFs or mutual funds from companies working in the blockchain space.

Despite consistent market volatility, potential future regulation and cybersecurity concerns, many crypto holders remain bullish. They believe it is the currency of the future.

RiXtrema has developed the CoinOptimizer tool to evaluate the riskiness of digital assets. It can help you analyze and compare digital tokens based on various sophisticated indicators. The CoinOptimizer can be handy for financial professionals on their path to profitable cryptocurrency investment. Please contact us at clientsuccess@rixtrema.com or dial (212) 513-7070 or (800) 282-4567 to request your personal online demo of the CoinOptimizer or other software from RiXtrema’s toolbox for growing your advisory and retirement plan business.