- Show your fees are reasonable

- How to plot historical trends

- Costs vary by participants and AUM

- Tunnelvision can disguise weaknesses

Interpreting data can be difficult, but here’s how Larkspur Executive makes it easy for you and your clients.

Accumulating and saving for retirement is a big goal, and, as a plan fiduciary, you are aware that it’s essential to keep employees informed about their retirement account.

Making sure your participants have access to all documents and notices is a principal part of your plan advisor duty. Access increases employee education and financial literacy and increases the participation rate for the plan sponsor. Being able to define and distribute plan information to plan efficiently, participants will enable you to make your services stand out at a competitive level.

We recently added a Participant Direct section to Larkspur Executive. It adds value by helping you extend your proposal to plan participants with individual risk assessment and optimization of their portfolios.

Show your fees are reasonable

Keeping participant fees in check is a primary focus of defined contribution plan sponsors. Benchmarking costs against what similar plans are paying can provide leverage when negotiating with service providers. Some plans can be charged a fee based on a percentage of plan assets for record-keeping and administration services. In contrast, others pay a flat rate per participant for these services if a plan has over $100 million in assets, for instance, as an asset-based fee of only a few basis points could end up being excessive.

Plan sponsors are required to understand all of the fees that are associated with the organization’s retirement plan. Because plan fee structures are often complicated and, sometimes, downright misleading, understanding plan expenses could be a tricky challenge.

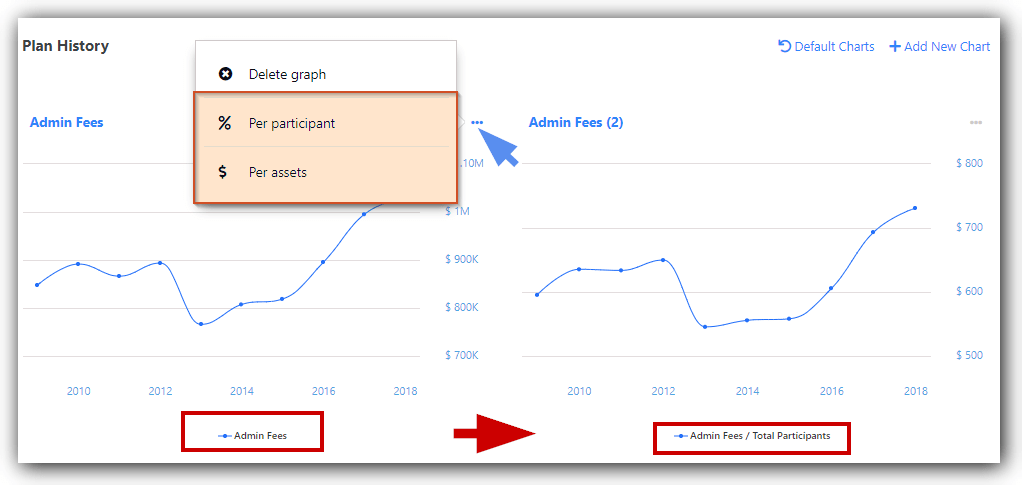

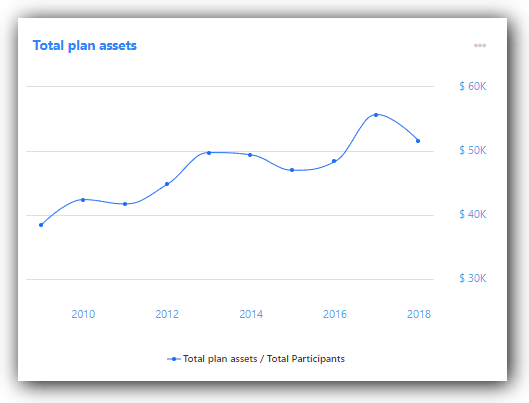

Larkspur Executive keeps track of all historical 5500 form filings of the company ever published on DOL, allowing the creation of analytical, historical charts of numerous plan parameters. It’s possible to break down parameters and plot historical charts highlighting the trend per plan assets or plan participants.

How to plot historical trends

To do this, click on the three dots menu in the upper-right corner of the chart and choose Per participant or Per assets:

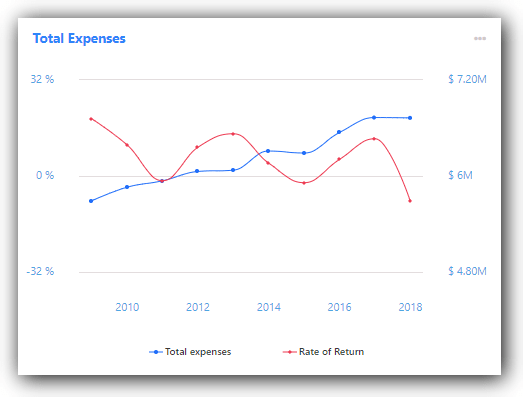

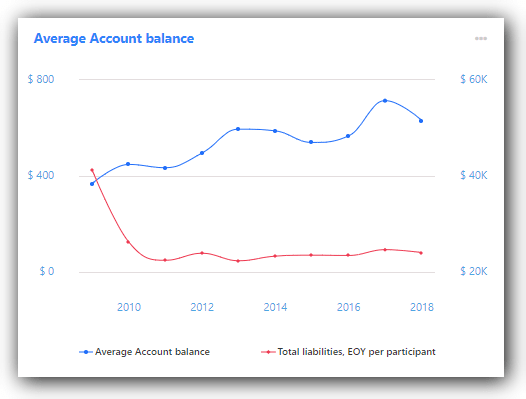

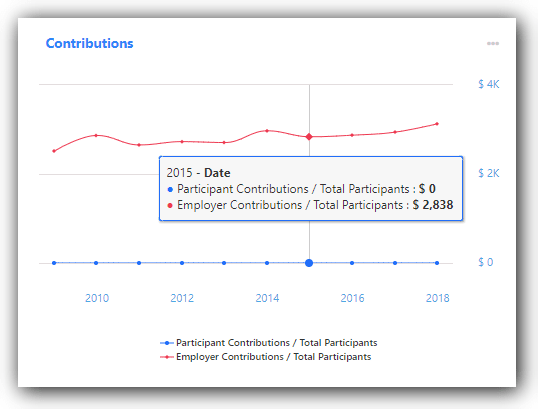

As you can see, several parameters can also be combined in a single chart for a better comparison view:

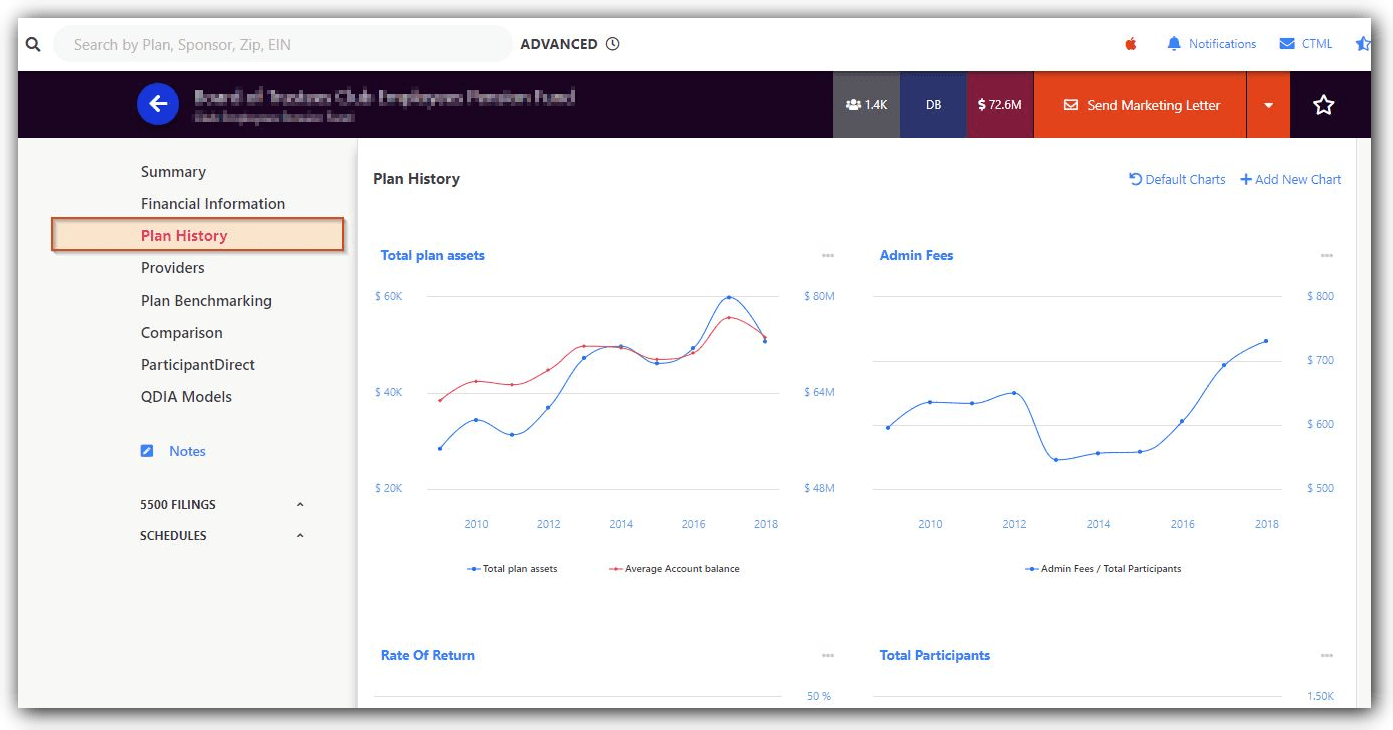

All historical charts in Larkspur Executive are listed when you click on the Plan History in the left-hand-side panel in the plan report view.

Costs vary by participants and AUM

Plan sponsors should benchmark their plan against those with similar characteristics, given that costs vary based on the number of participants and total assets, decreasing on a per-participant basis for more extensive plans. Fees much higher than the average for a similarly sized plan should be properly substantiated.

Tunnelvision can disguise weaknesses

But plan sponsors should not concentrate solely on benchmarking fees and ignore other metrics. Prudent plan sponsors cover all of their bases by benchmarking other measures of a plan’s success. Plan sponsors that are not already doing so should consider benchmarking:

- Overall plan asset growth. This is one of the most critical measures of a plan’s success. Even with the low-cost fee structure, the plan should be growing sufficiently to provide sufficient retirement income.

- Average account balance. The average account balance can serve as an overall measure of how plan participants are accumulating assets for retirement. It can have a significant impact on fees as, in general, plans with higher average account balances are more price-attractive for plan administration firms (record keepers).

- Participant and employer contributions. A low average employer contribution per participant may put sponsors at risk of violating the IRS’ discrepancy ratio between highly compensated employees (HCE) and non-HCEs. We have covered this topic in greater detail in the dedicated case study HERE.

This data analysis is one aspect of the fiduciary standard plan sponsors are expected to meet to fulfill their plan management responsibilities.

We are committed to providing you with information that can help you make the most of your proposal to retirement plan decision-makers.

And as always, the ClientSuccess team is always here to help you interpret Larkspur Executive retirement plan reports and prepare for plan sponsor meetings.

Don’t forget to ask your ClientSuccess Specialists for assistance at clientsuccess@rixtrema.com or calling us directly at 800-282-4567 ext.102.