- ESG Commitment

- Keeping up with Traditional Investing

- Shifting from “E” to “S”

- Is it still ESG if it’s all Tech?

- Wait and See on ESG

- Don’t let headlines direct clients

The accurate measure of an investment is not just how well it performs relative to its benchmark. The COVID-19 shutdown is the first stress test for a large portion of the sustainable investing market because many investment vehicles did not exist before the 2007-08 financial recession. How are they fairing compared to traditional investments? What elements of ESG Investing can be misleading to investors?

Yon and I have written about ESG Investing before on this blog, but this is a COVID-19 update on the performance of sustainable investing strategies.

ESG Commitment

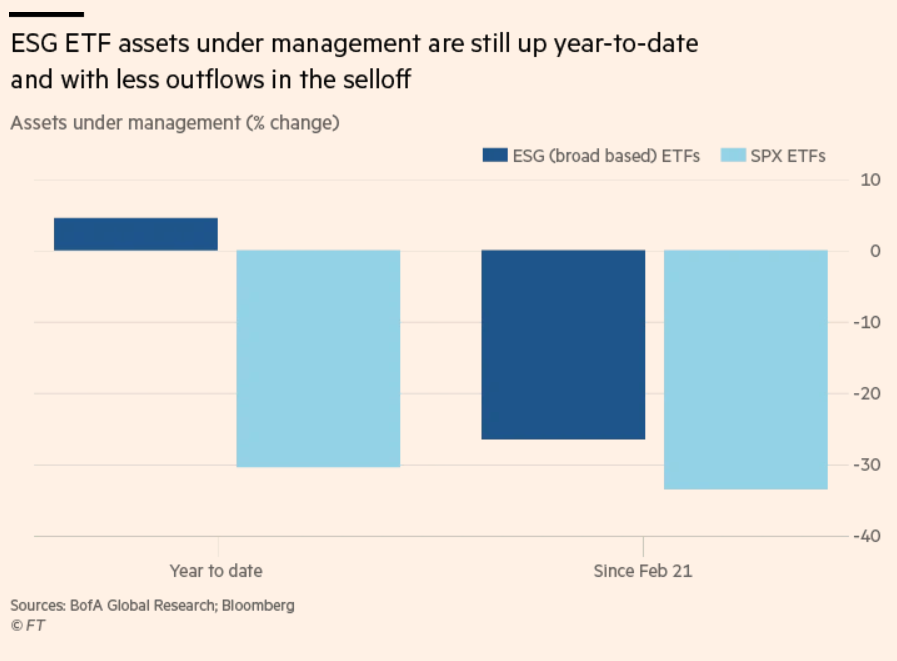

There may have been record-high ETF selling since the beginning of the pandemic crisis, but “ESG funds have experienced inflows for 10 straight weeks” (BofA) (Figure 1). BofA reported in March that ESG Investments attracted more than $70bn since last year.

The inflows during the crisis may show that investors were looking for an opportunity to enter the ESG market and know that there are long-term benefits to stock performance for firms that adopt sustainability considerations.

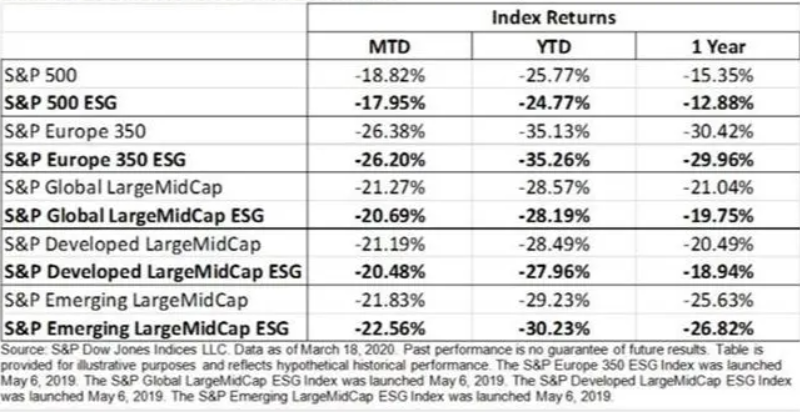

Keeping up with Traditional Investing

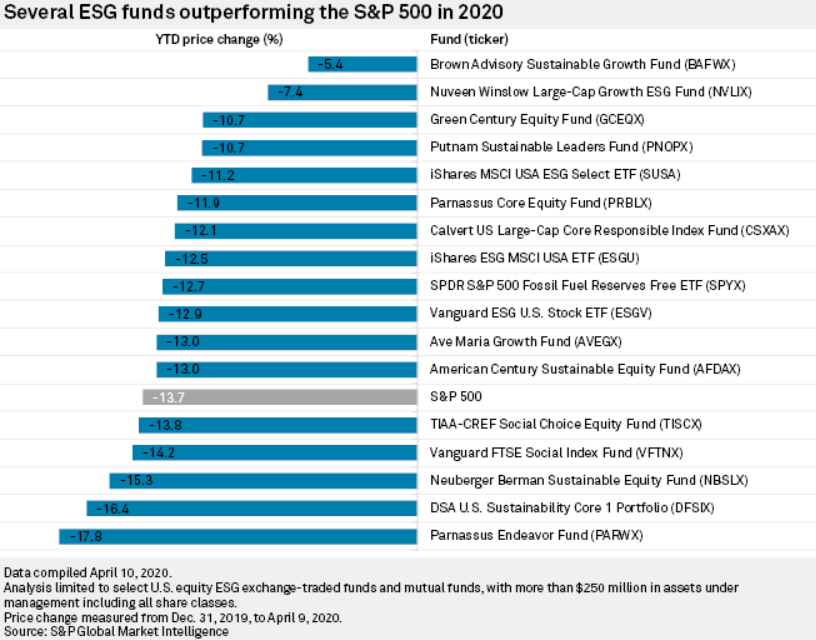

Let’s face it. Negative signs are the new normal for 2020 YTD returns (Figure 2). Most funds are in the red for this year, but most ESG Funds seem to be still breathing. Many conventional ETFs offer a corresponding ESG alternative to capture the interest of investors. As the table shows, ESG ETFs have not suffered quite as much as their traditional twins. More than half of ethical and sustainable funds “outperform the MSCI World Index.” Older, veteran ESG Funds have outperformed younger funds – showing the value of institutional knowledge and the potential greenwashing of funds to attract investors.

Shifting from “E” to “S”

The “Environmental” component to ESG Investing draws the most attention from traditional investors, but that is changing. As Yon and I learned from speaking with ESG Rating expert, Elgin Chou, investors can easily connect with the long-term value in sustainable energy or other environmentally-focused investments. Yet, as Bank of America recorded, many companies are looking for “Social” opportunities to help their communities – some even paying their workers when furloughed.

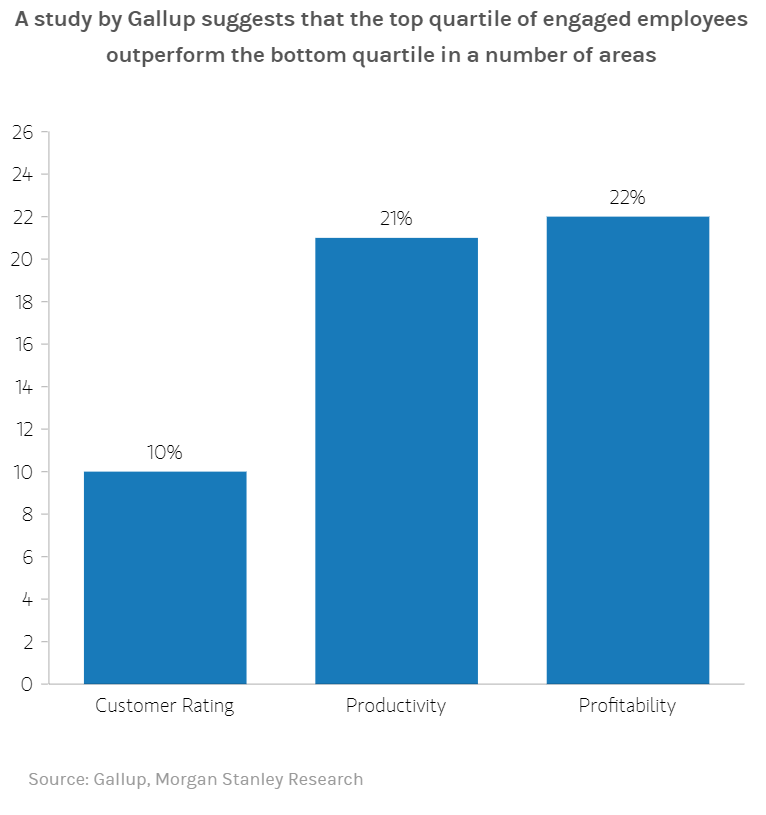

Morgan Stanley observed a similar refocus to “Social” considerations. Engaging with employees during times of significant vulnerability is more than idealistic – it can “improve outcomes in the near turn…and proactive actions by companies to support employees could be important drivers of employee loyalty and satisfaction over time”. 60% of customers are willing to pay more for products from companies with reputable brands and ethical values, and 71% of millennials said they would choose to work for a company that has demonstrated a strong commitment to its community.

Is it still ESG if it’s all Tech?

As Forbes pointed out, it is misleading to cherry-pick one ESG fund and herald the whole sustainable investing movement as more resilient than traditional forms. Even though many ESG ETFs are not declining as much as the S&P 500, they don’t necessarily have the same goals as the traditional index – the S&P has a much broader investment selection criteria. The Nuveen Winslow Large-Cap Growth ESG Fund (NVLIX), fell only 7.4% relative to the 13.7% fall in the S&P 500 index from December 31, 2019, to April 9, 2020 (Figure 4).

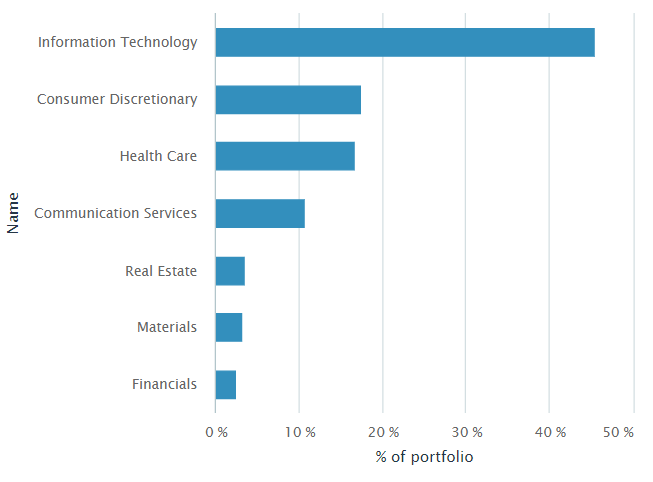

A closer lock into Nuveen’s diversification shows the classic problem with many ESG Funds – Tech and healthcare overexposure (Figure 5). Sometimes ESG Funds need to be more like “ESGT” to show the “T” for Technology. Information Technology is undoubtedly more resilient to the pandemic – solvent and able to work from home – but does not always embody the necessary criteria to be considered an ESG investment.

Some of the top holdings in Nuveen’s portfolio, Facebook and Amazon, may have a low environmental footprint, but their ESG ratings may not correctly reflect their controversy. Facebook has been battling privacy issues for years, and Amazon is infamously anti-union and seemingly indifferent to their workers’ suffering and deaths, from COVID-19. Regardless of the merit in these allegations, they have legitimate adverse effects on their brand image and long-term consumer loyalty. (Albeit what is the need for consumer loyalty when a firm is effectively a monopoly?)

Wait and See on ESG

Like most other things in this economic and viral crisis, the many unknowns force us to wait and see how ESG investments fair compared to their traditional alternatives. The case for sustainable investing alternatives strengthens only as their value propositions become realized. But, the naysayers have a more durable case if Technology and healthcare continue to be the drivers of growth and resilience for ESG Funds. The pandemic and looming recession will test companies with ESG expectations and ethical investment strategies. One grim unit of measurement may be the most important to watch: survivability.

Don’t let headlines direct clients

One thing is becoming clear during this crisis: fear is a crappy guide. As I wrote before, fear clouds our judgment, and RIAs need to intercept information that can interfere with their clients’ decisions. An advisor who informs their clients about risk narratives builds trust and shows that their training allows them to be a calm steward of assets during a hailstorm of bad news.

That’s why I and the rest of the RiXtrema team research and write these articles – to help calmly prepare for a client who is listening too much to the media without considering their long-term investment goals. One of RiXtrema’s premier financial risk software, Portfolio Crash Test Pro, helps RIAs show their clients that they have considered a multitude of potential risk narratives in building their client’s portfolios. You can read all about the software’s presentation capabilities on our blog or click the banner below to see a quick 10-min demonstration of its full power and range of options.