- Robinhood pioneered free brokerage

- Charles Schwab investors didn’t take the news well

- Free brokerage services will pull Millennials into investing

- How will Financial Advisors adjust to free brokerage services?

This week Fidelity joined Charles Schwab, TD Ameritrade, and E*Trade by providing commission-free trading to their investing customers. With so many established financial services companies adopting this practice, we must wonder what on earth we were paying for in the first place? It is just another example of how the financial services industry is moving to attend to the tastes and preferences of Millennials and Next-Gen clients.

Robinhood pioneered free brokerage

Backed by truckloads of venture capital, the Robinhood app helped to pioneer zero-commission stock trades and now has more than 6 million users, mostly Millennials, and more than a $7.6 billion valuation. As ignorant as I was, I flew, like many Millennials, to its free-trading platform when it became popular in 2015. While I didn’t understand the exact nature of investing, Robinhood allowed me to participate at a manageable scale. On a $100 trade, my bank was charging $7.95 per trading execution meaning I’d have to receive a 15% return just to break even – you don’t need a RIA to see that as a ridiculous expectation.

Charles Schwab investors didn’t take the news well

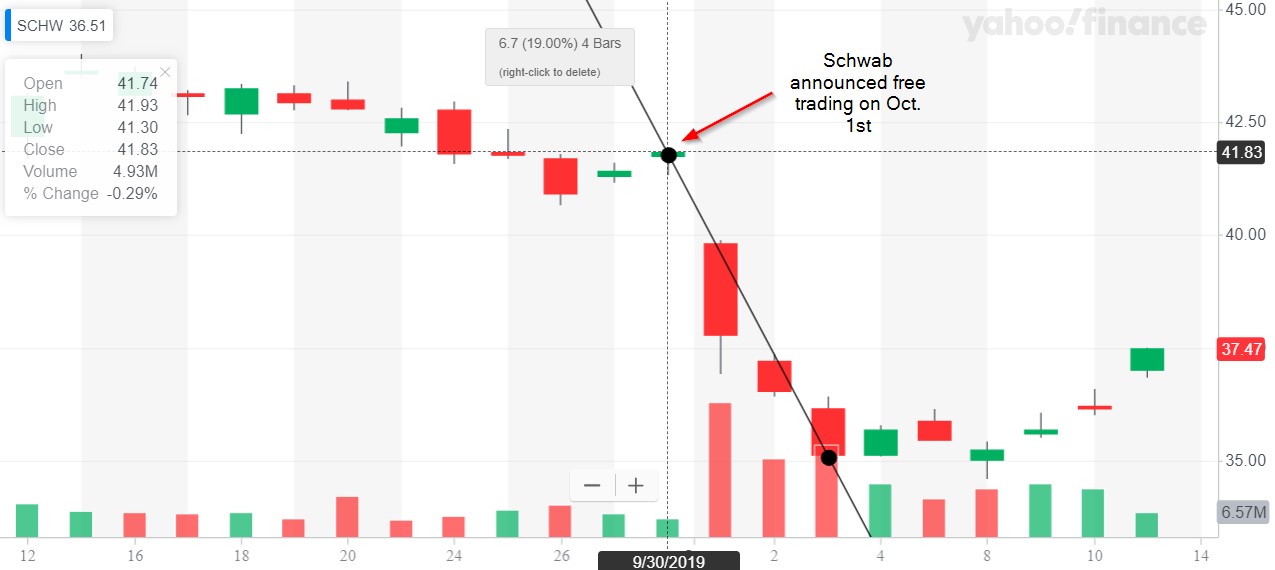

Investors may have been sideswiped by the news, as shares of Charels Schwab (SCHW) dropped 9.1% the day of the announcement (Figure 1). This dip will most likely be temporary considering many competitors are moving away from the same revenue stream. Brokerage services may be free, but I expect there to be premium services to help trading or institute strict minimum account standards to make profit from idle cash. Alternative revenue streams will certainly spring up now that free brokerage is the marketing standard.

Figure 1: Charles Schwab dropped 9.1% the day after it’s announcement

Free brokerage services will pull Millennials into investing

When I became interested in investing and saw Robinhood as a cheap way to experiment, so I sought advisement from the lowest cost financial advising partners I have encountered – my parents (lowest APR, too). With that advice, Robinhood was a great gateway to ETFs and a foray into IRAs and retirement planning. This is not uncommon for Millennials because we prefer to speak with people we trust in person about financial planning. We’ve written in the past about how financial advisors are missing Next-Gen clients and how they can take simple marketing actions to attract Millennials.

I am fortunate to have financially literate parents, but not every Millennial has the same privilege. Perhaps, free brokerage services will pull more people into the amateur investing space, and financial advisors can help them understand their financial situation and navigate markets suitable to their needs.

How will Financial Advisors adjust to free brokerage services?

As major banks and brokerage providers move to freemium models, Financial Advisors will have to adjust their business processes and services to meet the market changes. These free-brokerage financial institutions with a large brick and mortar footprint may begin to focus on building their financial planning services for a replacement revenue stream. By offering free trades, their revenue is more dependent on the robo costs which are low but not 0 in most cases. So, marketing to highlight the “advising” side of your business more than brokerage services may move clients who wish to execute trades themselves but do not have enough assets to use a traditional financial advisor.

Marketing to highlight the “advising” side of your business more than brokerage services may move clients who wish to execute trades themselves but do not have enough assets to use a traditional financial advisor.

You can read about market news and investment analysis alongside tutorials of our financial planning software platform at our blog. There you can also read about each product’s features, especially Larkspur Executive’s new marketing feature, Customized Trackable Marketing Letters, which can be deployed to streamline your marketing efforts. Feel free to contact our Client Success Team at clientsuccess@rixtrema.com to learn more about our products or articles.

Pingback : Reg-BI Is Along The Line Of Fiduciary Rule -