- Our COVID-19 under-prediction

- An Arm Wrestle Competition between OPEC and Russia

- The Energy Crisis can linger longer than Coronavirus

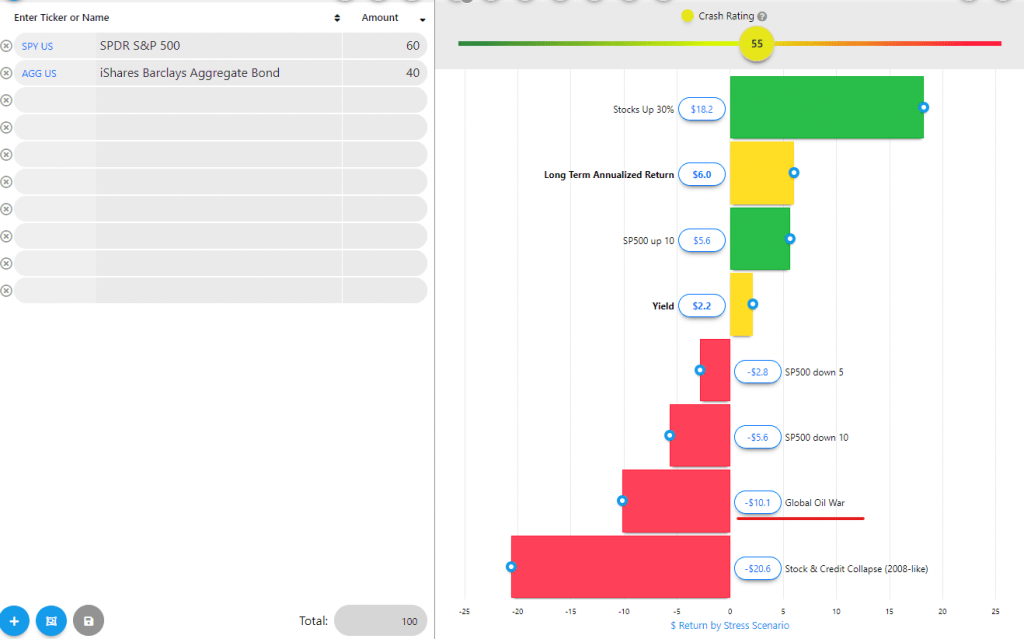

- Portfolio Crash Test Pro is the best tool for crises

COVID-19 is not the only story affecting financial markets, though its effect is a sheer massacre. The S&P 500 has dropped 30% in a matter of days, wiping out trillions of dollars of asset value along the way. The most significant point drop, 12.93%, occurred just a few days apart from the largest point gain, 9.36% (today is March 19, 2020). Another story, though, would be a concerning to markets even without COVID-19.

Our COVID-19 under-prediction

We started to cover the pandemic with our blog post “Pandemic Stress Test” on February 12, 2020. We predicted that the S&P 500 would drop only 20%, but the COVID-19 outcome shows that we underestimated the shock severity. However, we were entirely in the dark about what could happen in the energy market, and what happened on March 4, 2020, would reshape the global energy landscape for decades to come.

These historical high and low paint a vivid picture of the kind of volatility we are experiencing during this unprecedented time. We do not know if we hit bottom, but some expect that we did not. With the worldwide travel ban, countries on lockdown, cities on quarantine, and the row of industries out of business with millions of people lining up for unemployment insurance, we can undoubtedly say that there will more unpleasant surprises down the road.

An Arm Wrestle Competition between OPEC and Russia

On March 4, 2020, Saudi Arabia and Russia announced that they could not come to a consensus regarding the oil output production. It started as an argument by Prince Abdulaziz that cutting output by only 1.5 million barrels a day would be enough to bring balance to the energy markets. All the members of OPEC and oil alliance countries agreed with it except Russia.

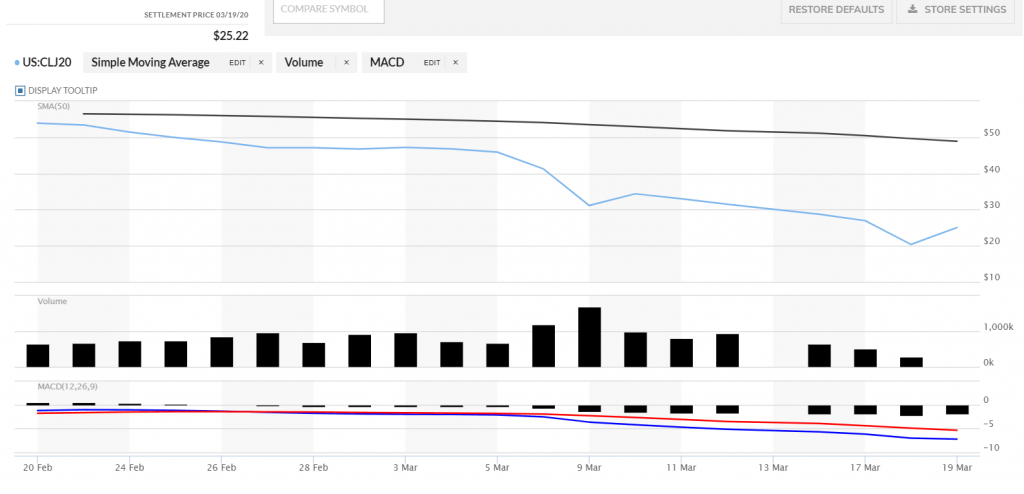

Russian energy minister Alexander Novak disagreed with it, stating that output cuts and higher prices would help the U.S. shale industry. After a failed negotiation, Novak walked out of the room and made a now-infamous commentary: “Beginning on April 1, every OPEC+ member country was free to pump at will.” That was the beginning of the epic oil price drop that started on March 5 at $45.90 per barrel and hit $20.37 on March 18 (see Figure 1), resulting in a 55% slide.

The Energy Crisis can linger longer than Coronavirus

We all hope that the COVID-19 outbreak will be collectively overcome soon. Every nation is working to develop a Coronavirus vaccine, and the first vaccine test was administered to a human. However, the realities of the energy market will stay with us for decades to come. As such, every advisor should be prepared to answer the calls from clients who would be asking how this new reality will be affecting their portfolios.

Low energy prices will definitely benefit the economy and speed up the recovery of markets. Still, also, it creates a vulnerability for the energy sector and all exposed portfolios. It will drag down major indexes like S&P 500 and Dow Jones with their approximate allocation to the energy sector to be 4.35%. Regardless of the energy sector relatively small weight in the major indexes, the overall market effect from the oil price shock can significantly result in portfolio losses. So, we created an extreme shock to the oil price, reflecting our current event with a 55% price slide from peak to trough in Portfolio Crash Test. You can see that it has a moderate effect on the simple 60/40 portfolio allocation with a 10.1% loss (Figure 2).

Portfolio Crash Test Pro is the best tool for crises

Portfolio Crash Test Pro allows the advisor to prove to their clients that they considered rigorous stress testing criteria when building a portfolio. The tool lets advisors analyze any portfolio and answer any client concerns by benchmarking portfolio behavior to extreme events. This powerful analytics tool, with essential metrics like Plan Fees, red flags, etc., can also be helpful for rollovers into a qualified plan in our RegBI Optimizer tool. By combining risk metrics with plan quality metrics, any adviser can create a thorough fiduciary process that keeps the practice focus on the best interest of the client.