Amazon Inc. just passed Apple and Microsoft as the highest valued company in the world. Virtually nobody is surprised by this. But we all should be. After all, this is a company that was consistently losing money only a few years ago. In fact, its current Latest-Twelve-Months Price-to-Earnings ratio is somewhere around 95! Are investors crazy to make them the most valuable company in the world? Let’s find out (Hint: NO!).

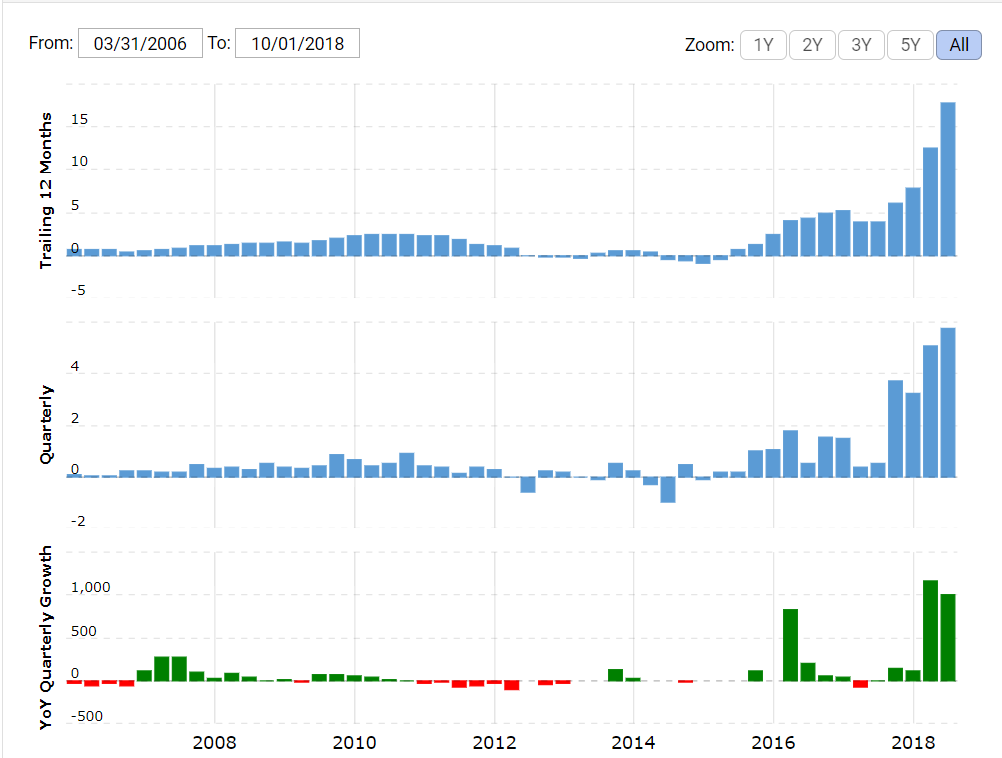

Consider the below chart of trailing 12-month Earnings-Per-Share. Look at the last two quarter bars on the right of the chart. Revenue doubled in the course of only a few months. Stuff of dreams! How can a huge established company ramp up their earnings the way Amazon did in 2018?

Exhibit – Amazon Earnings Per Share History

Source: Macrotrends.net

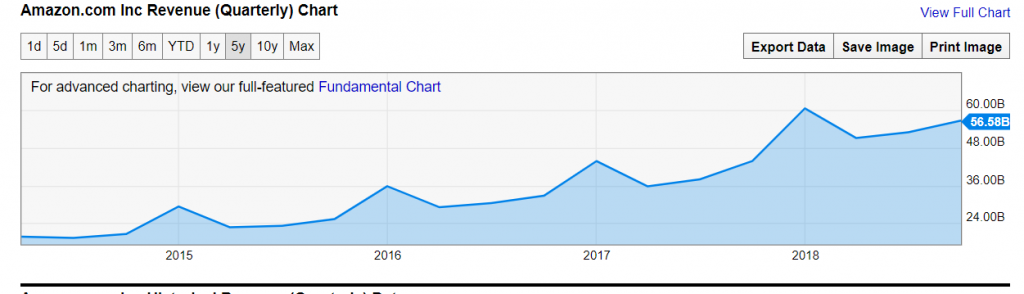

What happened? Did Amazon open up new markets? Created a new iPhone? Found philosopher’s stone? Looking at Amazon’s revenue chart below just shows steady growth, no explosion.

Source: Yahoo Finance

So, what gives?

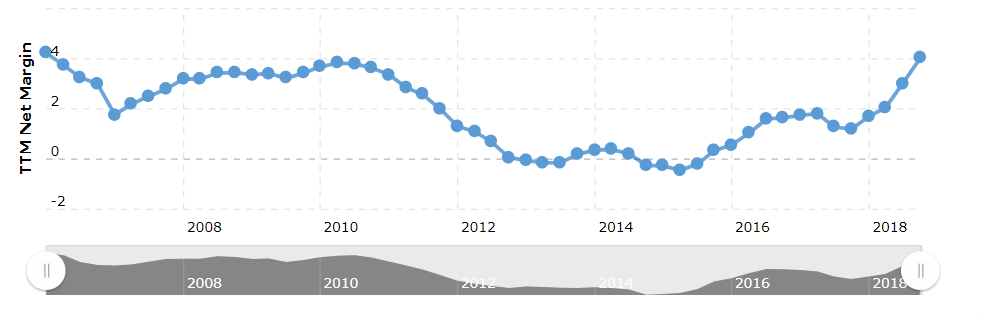

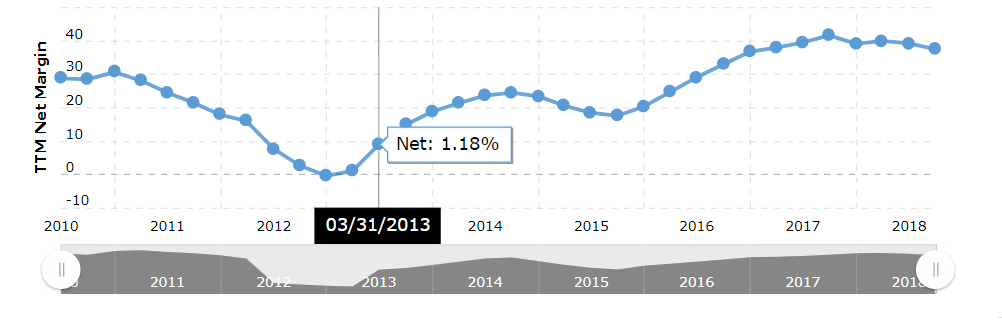

No, it wasn’t Alexa that brought in all those sales. It was the … profit margins. Look at the Net Profit Margin chart below. North American margins increased from 1.9% four quarters ago to 5.7%. Overall margin (the rightmost point on the chart) has surpassed 4%, despite negative margins in Europe (loss margin in Europe is still -3%).

Exhibit – Amazon Trailing-Twelve-Month Net Margin

So, how can we explain such an explosion in net margins for a large established business?

Evolution of Amazon

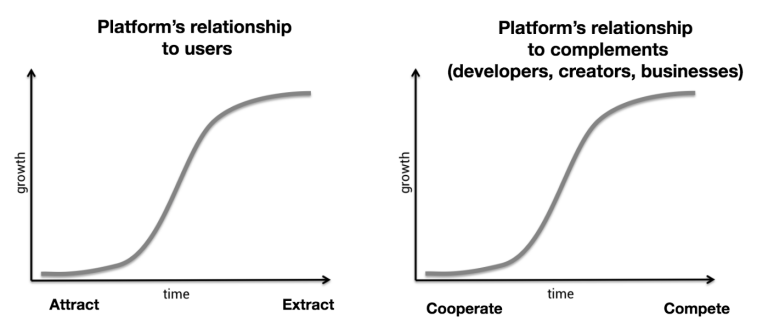

Well, much of it is explained by the life cycle of platform’s relationship with its ecosystem. I posted that chart in one of my recent posts (that one was about Facebook).

Source: https://medium.com/s/story/why-decentralization-matters-5e3f79f7638e

As you can see, a platform starts by being extremely cooperative and offering some great service for free or at a deep discount. In the middle of the graph, customers and suppliers are starting to pay more and eventually they are paying much much more in many different ways, while the platform rides high.

Amazon is done offering its amazing service at a loss to itself. Most of the competition is irreparably damaged, the scale gained is tremendous. Time to turn the screws. So, Amazon is somewhere just to the right of center in those graphs above. Gradually, they are clawing back the capital they’ve spent.

There is an important wrinkle in the Amazon story. Note that the profit margin was actually positive before starting to decline in late-2010. What happened around time? Well, financial markets finally got over the tremendous crash of 2008 and were really off to the races. Gains started in 2009, but the sense of riskiness didn’t really subside until mid-2010. Once the markets settled down and liquidity started flowing, Jeff Bezos used the opportunity provided by the Federal Reserve’s zero interest rate policy to increase Amazon’s market share. In fact, Amazon’s market share of e-commerce basically doubled since 2010 and is now approaching 50%! Running losses is not a problem when all financial assets are lifted by free capital.

However, as we now see in Amazon’s profit margins, the ‘philantropy’ story is over. And it is very timely for Amazon, just as the rates are beginning to rise and free capital is no longer available.

Corporate Welfare

Amazingly, Amazon is actually a recipient of corporate welfare. In 2017 the company reported $5.6 billion in profit, paid zero taxes and actually got a refund of $137 million. What?? Yes, that is how the tax code is written now. Amazon takes tax credits for various R&D projects and also can write off stock compensation to executives as a cost! I am guessing that R&D probably includes much of the technical machinery to gather big data about its customers to make even more money. And there you have it. Can you get paid by the federal government to create technology that actually uses customer’s data to sell them more stuff they don’t need? If not, you are not as smart as Amazon. In 2018 Amazon made out even better. And let’s not forget the $6.2 billion in tax incentives it is set to receive starting in 2019 for a decision to base its headquarters in New York and Virginia (conveniently located to major centers of financial and political power in the United States). So, it is not just about increasing margins. Having built a quasi-monopolistic position on back of virtually free credit courtesy of Federal Reserve, Amazon is now not only increasing margins, but monetizing its dominant position in many other ways in both private and public sector.

Is Amazon of 2018 the Facebook of 2015?

In my previous post, I outlined how Facebook used the same strategy to win over the market and then monetize personal data of something like 15% of world’s population. So given the similarities (and disregarding the differences for the moment), why is Amazon up so much and Facebook down nearly 50% from its highs?

We can find the answer when we look at Facebook’s profit margins for the corresponding period in the chart below. Notice that Facebook started reducing their margins to win market share on the back of Fed’s free money policy around 2010; same as Amazon. However, Facebook started extracting value from the platform much sooner, specifically around 2013.

So we can say that Amazon of 2018 is Facebook of 2015. But is Amazon of 2021 going to resemble Facebook of 2018 (massive stock price losses). I actually doubt that. Facebook has to stay afloat by constantly buying up more dynamic competitors like Instagram. It also has to monetize personal data of customers, because it doesn’t actually sell anything. Amazon realistically sells everything, so it doesn’t need to sell the data. It can just quietly use the massive amount of data it already has to take over the market further.

Also, the technological barriers to entry are quite low in social network business (though scale is hard). With today’s technology a team of five great developers can build 85% of Facebook’s useful features in 10 months. Not the same with Amazon. The incredible infrastructure that Amazon developed on the ground makes it virtually unbeatable for decades to come.

Exhibit – Facebook Trailing-Twelve-Month Profit Margin

Incidentally, this analysis can also explain the negative profit margin for Amazon in Europe (remember, it is -3%). The reason is that in Europe market share is not high enough to start extracting value. Yet.

Alexa, why are you laughing?

Pingback : 3 Reasons Why Google's Days May be Numbered: A Book Review of Life After Google by George Gilder

Pingback : How Cryptocurrency Can Still Take Over The Internet: Part II