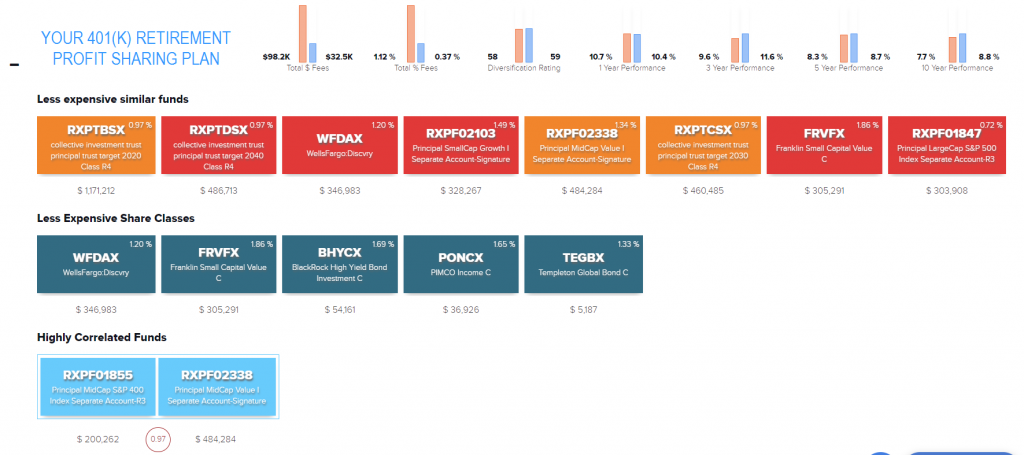

Plan Monitor, which is part of the 401k Fiduciary Optimizer, would provide the advisor with the dashboard to keep track of the health of their existing clients’ retirement plans by notifying them if any immediate action is necessary to avoid a fiduciary breach. It provides three areas to monitor which are Less Expensive Similar Funds, Less Expensive Share Classes and Highly Correlated Funds.

For example, knowing that less expensive share classes are available and being quickly able to discuss it with the plan sponsor makes a plan fiduciary prudent in his/her effort to act in the best interest of the client. Moreover, Plan Monitor creates a process that documents all steps undertaken to fulfil the fiduciary duty to the client by keeping track of recommendations, actions taken to enhance the menu, results provided based on the advice.

The watchlist shown in the Plan Monitor can provide a quick and easy to use report for funds that you may need to keep an eye on in your plan. We’ve color coded different funds so you can focus on those that may require urgent attention, while not losing track of funds that aren’t as severe a problem.

Figure 1. Screenshot of Plan Monitor.

These days a digital tool like Plan Monitor is a necessity, to be helpful to the plan sponsor and plan participants, in order to fulfill a fiduciary role. It is also important for a plan fiduciary to know that the detailed and prudent process of screening and monitoring the retirement plans will protect his/her assets from fiduciary liability in case there is a lawsuit.

Additionally, the Plan Monitor will continuously keep an eye on your plans. It sends weekly updates to make sure that you are always in the loop. If a problem ever arises in one of your plans, the Plan Monitor will ensure that you will know about it right away. Even if just a cheaper share class appeared for a fund, you will find out in your next weekly update of the Plan Monitor. It will help to prevent any potential problems down the line right as they happen. This way you can quickly and easily resolve it. You will be helping to protect the best interest of your clients by making sure they are in the best options available, even as they are ever changing.

Pingback : How Much Do You Really Know About Avoiding Fiduciary Liability?

Pingback : Reasons Quarterly Review is Not Enough After Tibble vs Edison

Pingback : Case Study: Here is How a Prudent Process Approach Prevails