According to coinmarketcap.com, as of April 2021, there were more than 9,000 cryptocurrencies that facilitate peer-to-peer transfers of data and value. Where does this leave the individual who believes in the future of these crypto-assets but can’t figure out how to invest in them?

The vast majority of advisors don’t recognize them as an investable asset class; therefore, many are not able to talk about them in depth with their clients and prospects.

More than 6,700 different cryptocurrencies are traded publicly, according to CoinMarketCap.com. And cryptocurrencies continue to proliferate, raising money through initial coin offerings, or ICOs. The total value of all cryptocurrencies on April 20, 2021, was more than $2.2 trillion, according to CoinMarketCap, and the total value of all bitcoins, the most popular digital currency, was pegged at about $1.2 trillion. So it is slowly coming to a time when your clients will be probably going to be asking about this, if they haven’t already. Some financial advisors have found that being knowledgeable about investing in cryptocurrency is a way to bridge the gap with younger generations of their clients’ families.

So to become a trusted advisor you will sooner or later start talking about the major aspects of adding cryptocurrency to a client’s portfolio.

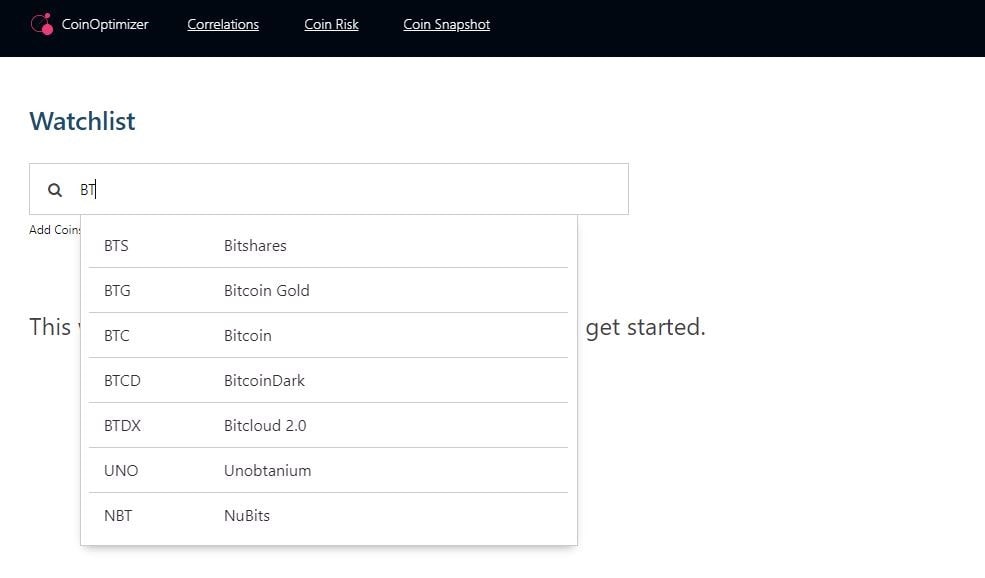

At your first login you will see an empty Watchlist. There are hundreds of coins that could be added for further analysis and comparison. Simply start typing a name or abbreviation of the coin or token you would like to add.

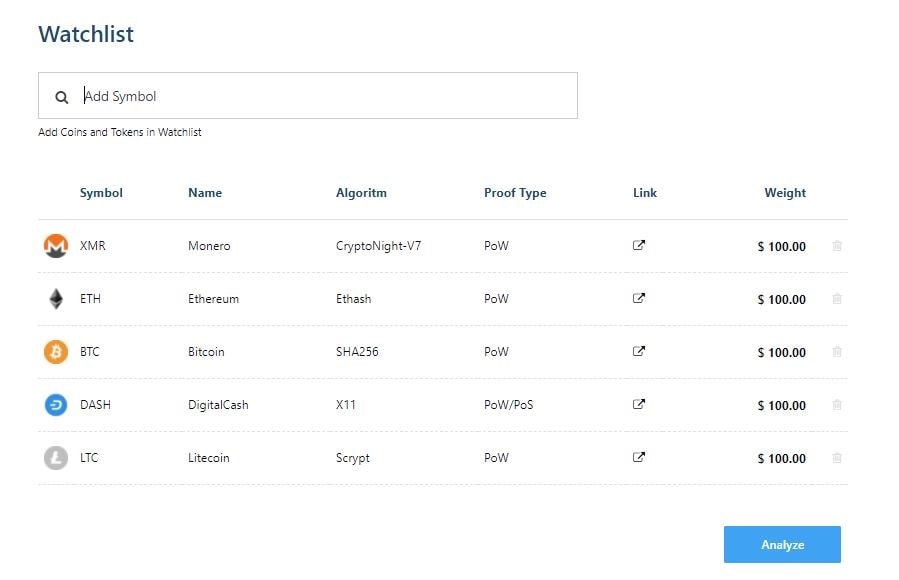

Let’s add a bunch of some popular crypto coins, for example Monero XMR, Ethereum ETH, Bitcoin BTC, DigitalCash DASH and Litecoin LTC. Some basic info, including Name, Algorithm, Proof Type and the links to cryptocompare.com with detailed coin statistics, will be displayed as soon as you add new items in the list. Any coin can be removed by clicking on the Trash icon on the right.

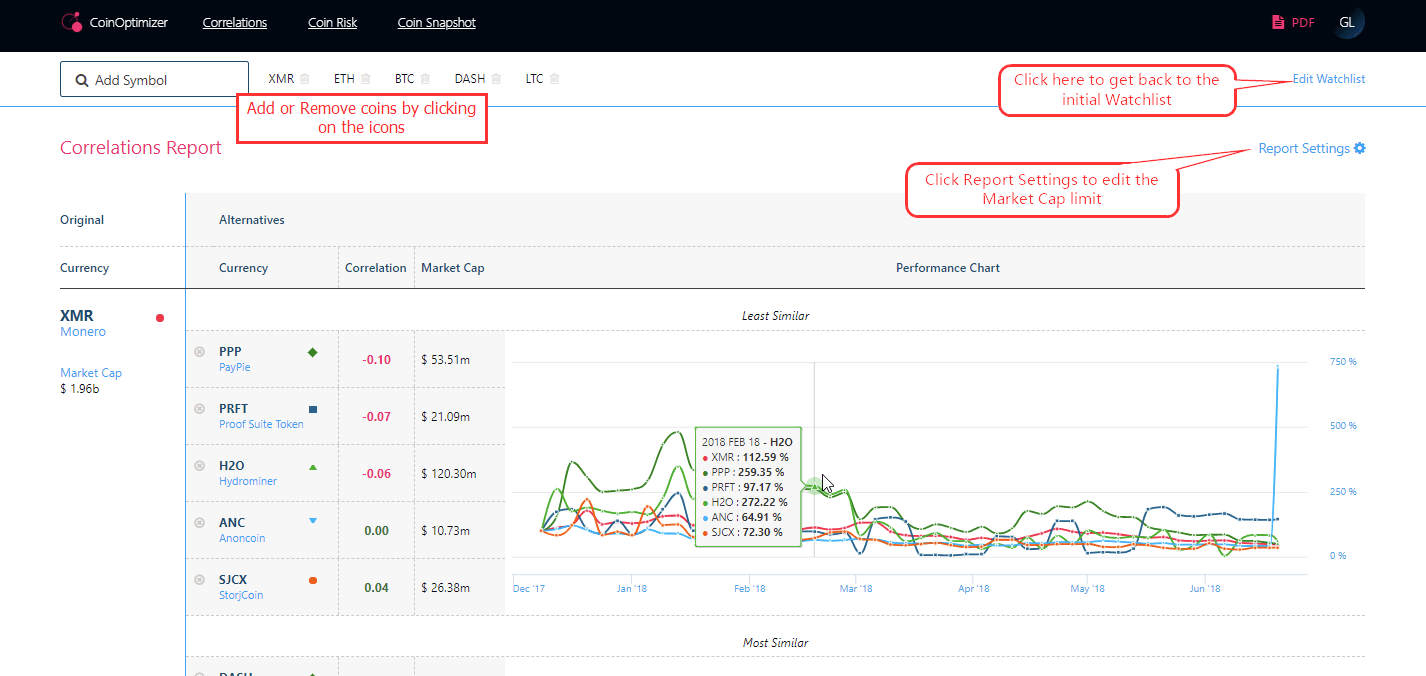

Hitting Analyze button takes you to the Correlations report. The Correlations report will show you the most positively and negatively correlated coins for each chosen cryptocurrency. In other words, we will see similar and dissimilar coins for any given cryptocurrency. You can review and compare by a correlation level, market capitalization of each coin and performance charts.

Now, proceed to the Coin Risk report.

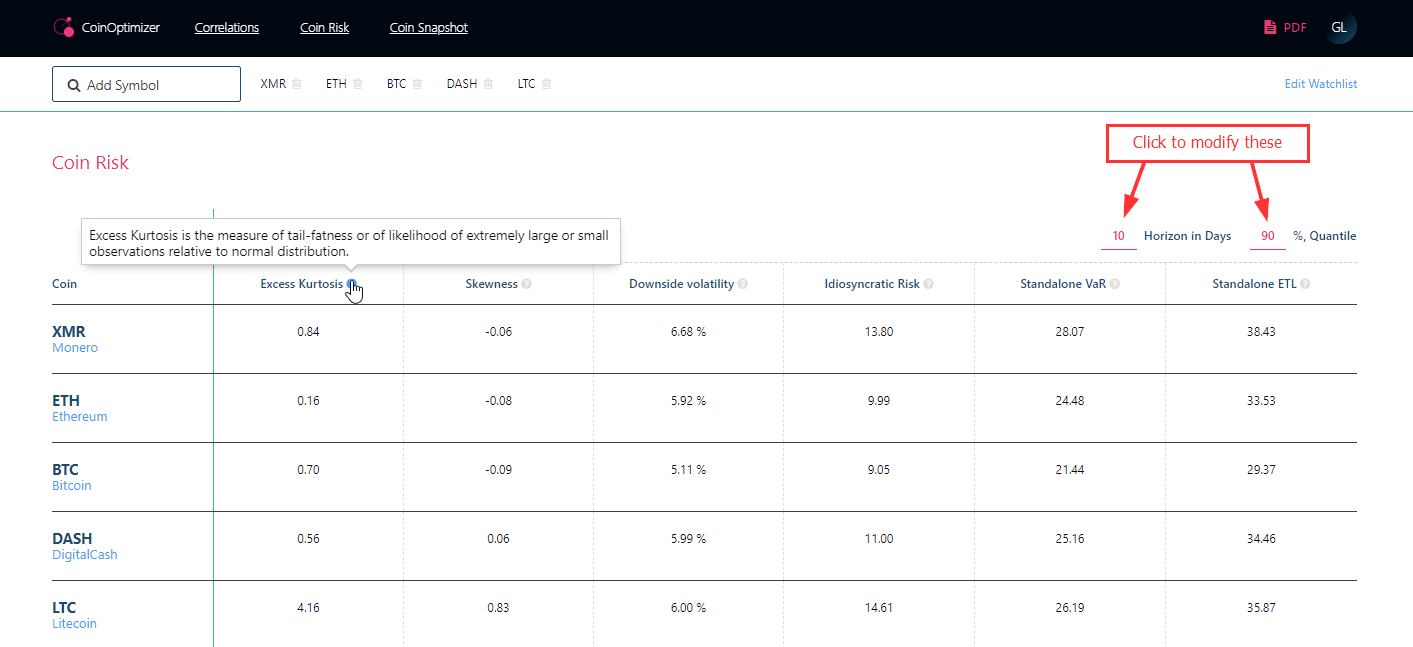

Coin Risk report will show you important statistics on behavior of each coin, including Excess Curtosis, Skewness, Downside Volatility, Idiosyncratic Risk, Standalone VaR and Standalone ETL, to help you explain the differences between cryptocurrencies. Hover your mouse pointer on the question symbols next to each parameter to see a brief description (you can scroll to the bottom of the report to see the same details too). The Horizon and %, Quantile fields can be modified.

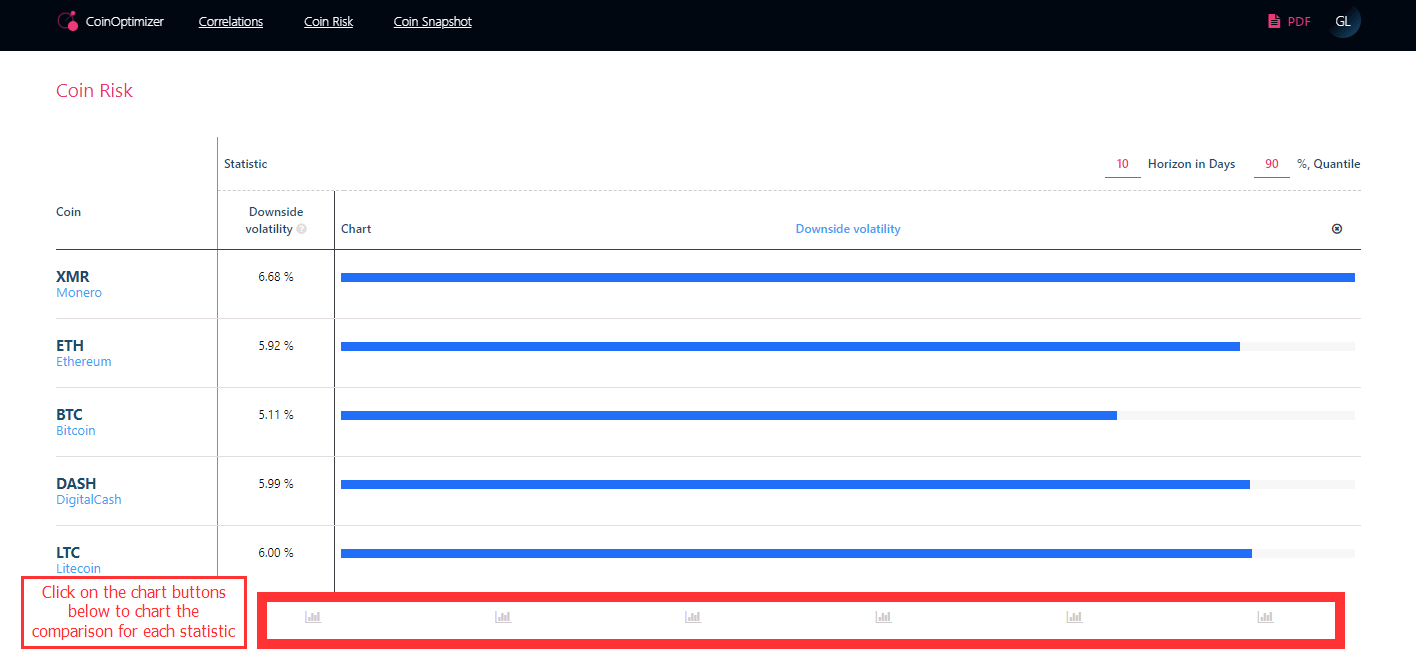

Also, below the list there are chart buttons for each statistic that helps to review the comparison between the coins in a convenient chart form.

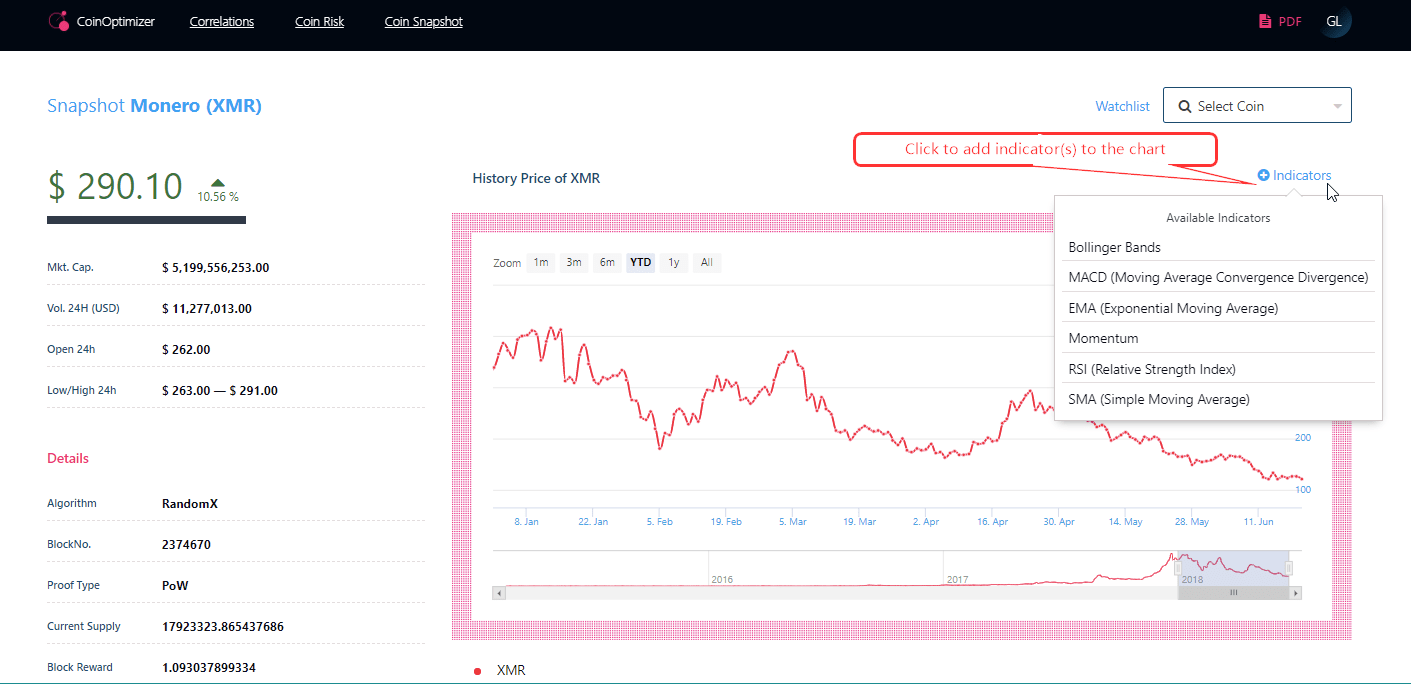

At any time you can click on the coin abbreviation or the Coin Snapshot button at the top and you will see the technical analysis of the coin including momentum and other more sophisticated indicators.

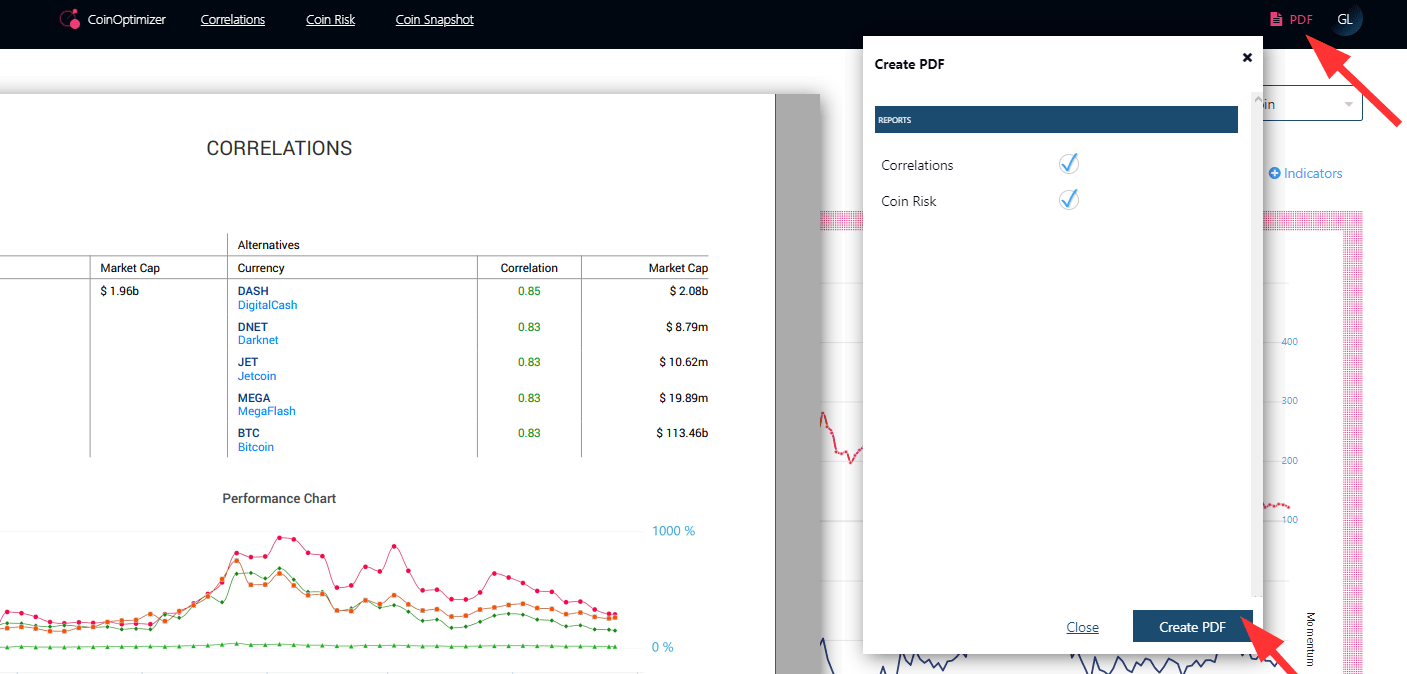

Hit PDF button in the top-right corner to create a convenient PDF document that will include each coin details along with Correlations and CoinRisk reports, that could be further emailed as an attachment or hard-copied for book keeping purposes.

For any further questions or suggestions please contact us at clientsuccess@rixtrema.com or dial (212) 513-7070 or (800) 282-4567.