To an investor who’s trusted an advisor with their retirement savings, they aren’t just any ordinary person anymore. The fiduciary duty of an advisor to their client is one of the most serious responsibilities out there. Of course, it may seem obvious but, how many of advisors help their clients to understand the vulnerability of their portfolios when unexpected events can strike in the future? As Prudential has reported in its research, “One-quarter of Americans feel powerless in that they don’t know what to think about the downturn.”

They also report significant portfolio losses, at 31% on average.” It has been shown that those who experience such devastating loss in their retirement portfolio prior to 5 years before retiring would never completely recover the losses, drastically reducing the chance for a comfortable, well-deserved retirement, forcing them either to continue to work or adjust their lifestyle they have planned on for their retirement.

As we know, no one has a crystal ball to foretell the future, but when it comes down to managing risk its important to keep in mind the proverb that says: “It is better to be approximately right, then precisely wrong.” In the Portfolio Crash Test application, we have many historical, current and future scenarios that can help to diagnose the risk level of the portfolio when it comes to extraordinary or extreme events. If advisors can explain to a client what can be expected if such and such event was to take place in the future, a client can think about his/her risk tolerance. If various possible events have been discussed ahead of time, then there will be enough time to make appropriate portfolio allocation changes to accommodate your client’s goals. You can read about one such example in a recently featured Larkspur-Rixtrema interview: How to Relate to Clients & Work with Plan Sponsors.

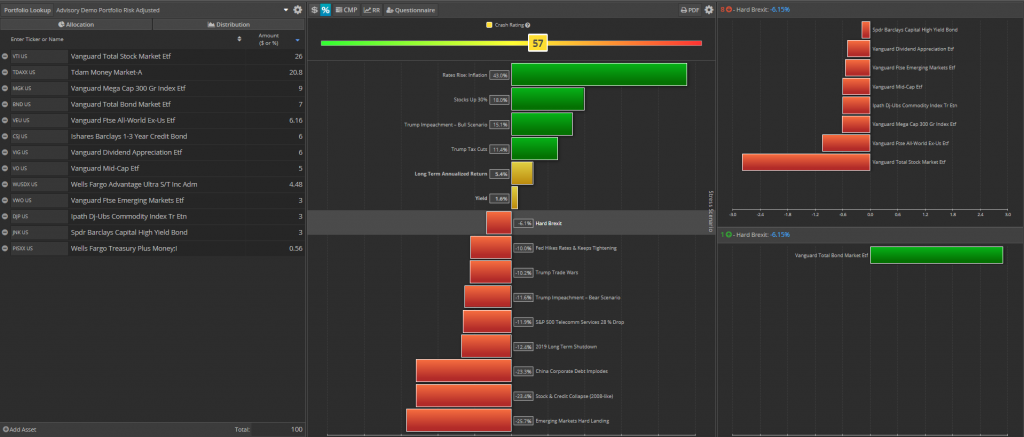

Recently, there was a historical vote on Brexit. Do you know how it may affect your client’s portfolio? At RiXtrema we have designed Brexit and Hard Brexit scenarios to show how portfolio can react to such events. I loaded diversified portfolio that consists of equity funds, bond funds, commodity funds and money market funds to see its performance in a Hard Brexit scenario.

The overall loss is not significant for such a diversified portfolio compared to other more significant events like Stock & Credit Collapse (2008-like). However, most of my assets would be losing money in a Hard Brexit event except for Vanguard Total Bond Market Etf (BND). Knowing such information can be important to a client’s peace of mind, to know that they can withstand downturns and keep their retirement money safe.