As inflation continues to soar more people are cutting back on their retirement savings. Moreover, many are even afraid to check their 401K and long-term saving plan balance amid the inflation and contracting growth.

The anxiety & fear is natural, but just ignoring them doesn’t mean the problem is going to get better. It is better to understand the risks associated with your investments than hoping & praying that everything works out well. A lot of people haven’t really understood what they really own in their 401K accounts, they don’t really understand what those boxes that they check in their 401K forms mean.

Now is a great time to look over & understand what you own in your 401K accounts and make sure you’re still on track for your retirement goals.

At Rixtrema, we encourage investors to evaluate & quantify the risk of their investments regularly to ensure they don’t lose sight of their investment goals.

The Risk Capacity feature in Rixtrema’s portfolio crash test application is a powerful tool which empowers advisors with capabilities to quantify risk & discuss expected outcomes of investment fund lineups, enabled with capabilities to change the fund line up’s, periodic contribution amounts, investment horizon & rate of return indicators to assess different outcomes under various market scenarios. It helps advisors to propose & implement changes & manage investment expectations with greater precision.

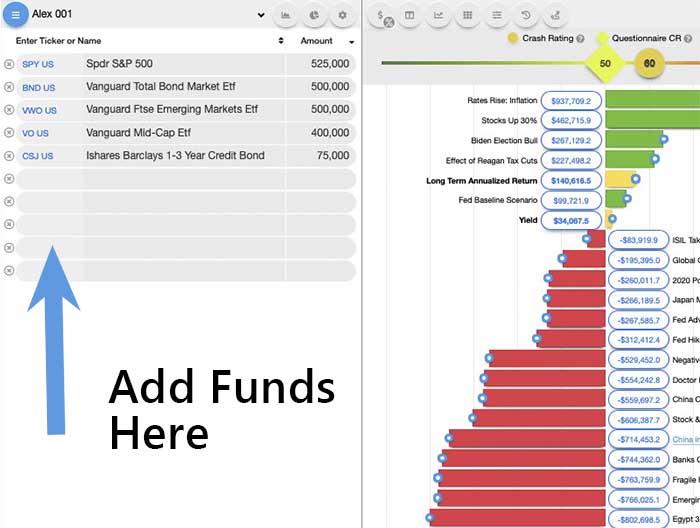

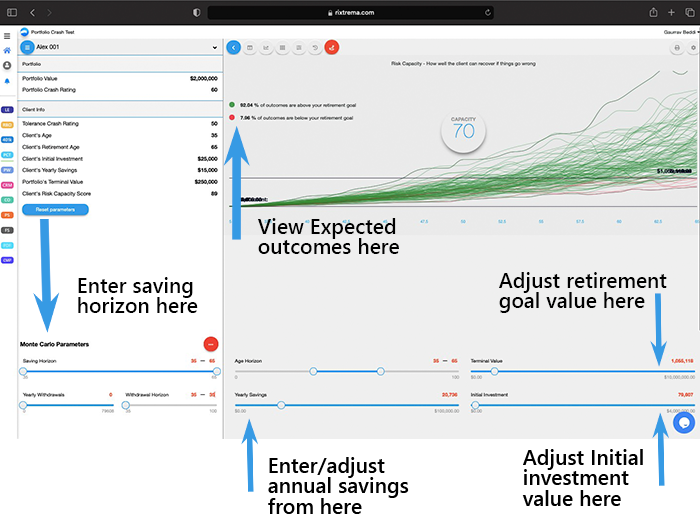

Refer to the screenshots to see the features available to fiduciaries with Rixtrema’s Risk capacity functionality:

Screen Shot 1: Add your investment fund lineup

Screen Shot 2

Custom adjusts plan features such as Rate of return, Portfolio tenure, Annual Contributions, and Investment amounts to check for expected outcomes and manage investment goals with investors to discuss various outcomes

Book a Free Demo for Rixtrema’s Portfolio crash test and avail a free one-week trial by clicking on the link below.