- Statistics is the art of never having to say you’re wrong.

- A statistician is a person who draws a mathematically precise line from an unwarranted assumption to a foregone conclusion.

Statistician Folklore

Reliable economic data today is hard to come by nowadays. Which is surprising given the sheer amount of economic information out there on the web. The perennial problem with economic data is that it is lagging. The other problem is that various entities releasing that data learned to obfuscate it with statistical methods. Overuse of various seasonal adjustments, hedonic[1] adjustments of inflation have made a mockery of statistical methods.

Yesterday, we have seen two statistical machines collide and produce a minor explosion.

When Apple Inc. announced that they would stop breaking out revenue from iPhones and iPads, the news was received with dismay. After all, Apple is really mostly a company of the iPhone, nothing fundamentally new has been invented since the time of Steve Jobs. How are the investors in the public company supposed to analyze the success of the business, if they cannot understand how its flagship product is doing. CFO of Apple Luca Maestri said at the time that “number of units sold in a quarter is not representative of underlying state of business.” Huh, what? The number of iPhones sold by Apple is not representative? Apple suggested that they will still tell us about iPhone sales, but they will do it via ‘qualitative statements’ and only when they deem it ‘significant’. Of course, who cares about those boring numbers, especially as the growth slows.

Of course, Apple has very little on China in the way of painting a numerical picture. As one example, Chinese government recently forbade an air quality app from reporting, well, air quality in Chinese cities. I guess they will also give citizens qualitative updates when they are significant. As far as China GDP growth, it hasn’t varied by more than .1% on a year over year basis since 2015. By all accounts 2018 was a bad year for emerging markets and China could not be left unscathed. However, its GDP, according to official statistics, is again on track to hit the official goal of 6.5%[2]. Like a clock.

But yesterday, those two economic powerhouses collided. And the result was not pretty.

Apple issued guidance on revenue and it wasn’t pretty. Tim Cook said that Apple expects revenue of $84 billion in 2018 compared to $91 billion that was the consensus estimate. Apple itself estimated numbers between $89 to $93 billion just two months ago (incidentally, when it announced that we no longer need to know how many iPhones it sells). In the announcement Apple said that the economic weakness in emerging markets has been much more severe than expected only two months ago. And that iPhone upgrades (read sales) have been much weaker than expected. Simplistically, if Apple had real data on results through 3 quarters and thought that the annual revenue was going to be close to $90 billion and then two months later it ended up at $84 billion, that is a huge shortfall. A near 7% difference with three quarters of the year known probably means something like a 20% decline versus the expectations. So those iPhone sales do have some relevance after all!

The key is that such a major slowdown in a premium product like iPhone tells us that Chinese economy is really really hurting. It was not in great shape before the trade war and it is even worse now.

We could see two scenarios going forward. If President Trump makes a trade deal with China soon in 2019, then these worries could evaporate, at least for a year or so.

However, if the deal is not made soon, it is possible that Chinese corporate debt bubble will start unwinding.

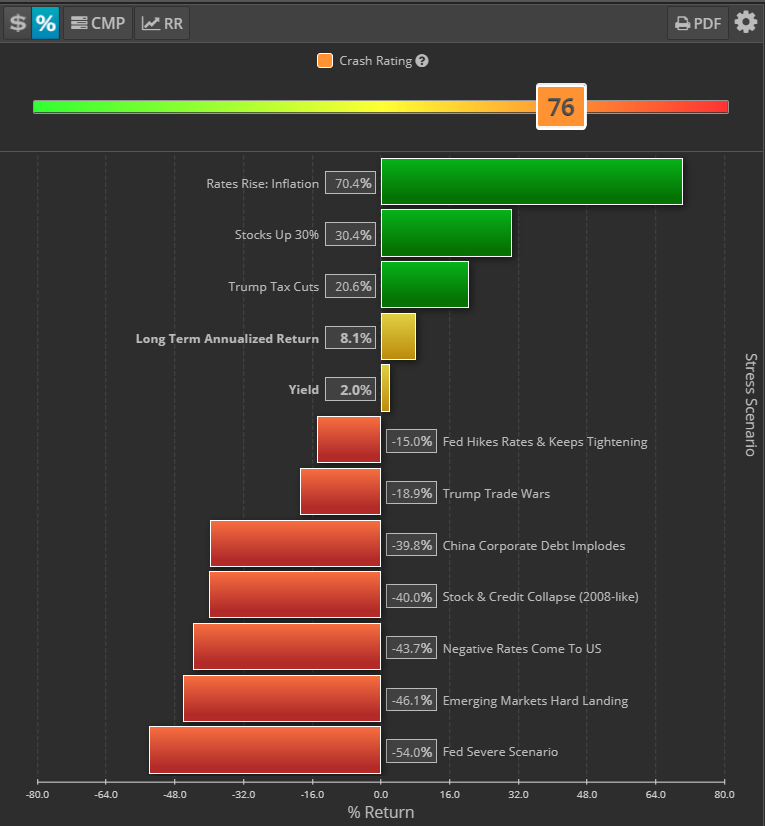

Use Portfolio Crash Testing To Understand Your Vulnerabilities

At Larkpur-RiXtrema we have a unique tool to help you get a handle on portfolio risks that your clients are facing. It is called Portfolio Crash Testing and you can use it to estimate impact of various events on any type of a portfolio. Risk management is not about making precise predictions, but rather understanding vulnerabilities. Here is a note I wrote sometime ago about the philosophy of risk management, I believe it can be quite useful in discussing risk with your clients (as you will no doubt have to in 2019): Stress Testing As a Distinction Between Clairvoyants and Risk Managers

Getting back to Portfolio Crash Testing, in 2017 we created scenarios for Trump Trade Wars and for Chinese Corporate Debt Implosion. The screenshot below shows how different scenarios from Portfolio Crash Testing affect portfolio that is 100% S&P 500. You can see that annualized impact from Trump Trade Wars was estimated to be 18.9%. With S&P 500 down about 6% for 2018, looks like we are in the beginning stages of drawdown if trade wars are not stopped.

However, the real danger is in the possible violent unwind of the Chinese Debt Bubble. In that case results could be catastrophic and would approach 2008 crash levels. We are still ways away from that and monetary authorities have lots of ammunition left. But you need to discuss risks with your clients and make them aware of all scenarios. Because all they heard on MSNBC over the last few years was buy, buy, buy and that the Fed can do no wrong.

Request Your Demo of Portfolio Crash Testing today and be equipped to discuss risk like a professional risk manager with your clients:

[1] Hedonic adjustments revise the price of a good downward if some measurable characteristic has increased. For example, an iPhone that increased in price from $700 to $1000 may actually be considered less expensive if processing power and/or memory increased by more than the 42.5% increase in price (from $700 to $1,000). Thus, it is counted as a reduction in price, thus offsetting any other increases in the price level.

[2] Of course, everyone does it to some degree and US unemployment as well as inflation statistics have serious credibility problems as well. But that is a separate topic.

Pingback : A Look Behind Berkshire's stunning $25.4B loss or How Warren learned to love the MOMO