People have been asking (a lot) for election scenarios. What will markets do if Biden wins? What will they do if Trump wins? And I have covered those topics here and here. As time ticks on and the situation changes (Supreme Court vacancy anyone?), prognostications may become further removed from actual results.

But thinking about portfolio positioning and ‘what-if’ scenarios is always a useful exercise. In fact, it is the main use of our Portfolio Crash Testing Pro.

So when our friends at TenViz sent this graphic along to me, I was intrigued.

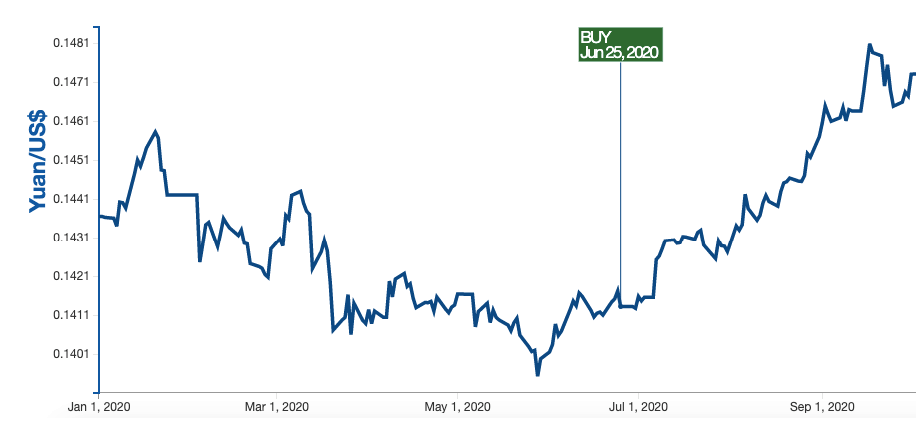

Exhibit 1: TenViz Yuan Graphic

Source: TenViz. Graphic and buy signal from TenViz software.

I will note that we have had a general US Dollar weakening since early June too, and that certainly has an impact here, but the dollar has held pretty steady since the end of July, so what gives with the Yuan?

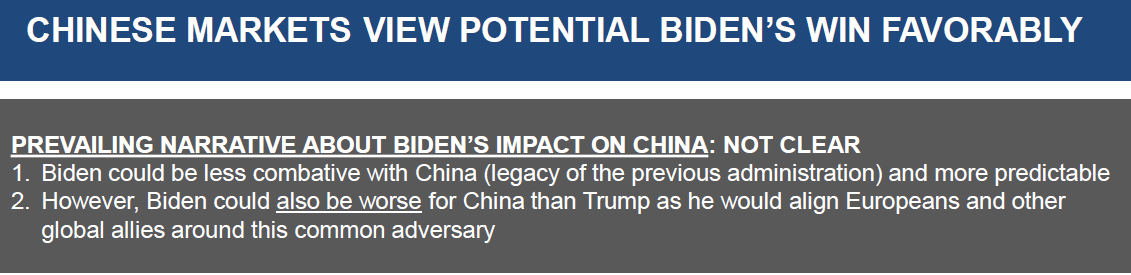

Well, there is certainly a bull case to be made for the Yuan in a Biden presidency, particularly when contrast against Trump’s aggressive stance and unconventional tactics against China. The argument could be made that just getting Trump out of office is good for China. And if you believe the FiveThirtyEight election forecast, Biden is favored to win the election. Plus, the performance of the Yuan since the first presidential debate and President Trump’s COVID-19 hospitalization strengthen that argument.

For the sake of this article, let’s assume that the TenViz thesis of a Biden win being good for China is true and the reason for the rally. And while TenViz is in the business of identifying buy/sell signals, we are in the business of measuring what happens to portfolios when certain events occur.

One scenario that naturally comes to mind, is that if we believe the rally in the Yuan is a result of the belief that Biden is likely to win the Presidency in the upcoming elections, what would happen to the Yuan if Trump wins re-election?

First, let’s take a look at what would have been predicted in a scenario where the Yuan appreciates 7.1% while the US Dollar falls by -5.8% (which is the actual performance of the assets from the May 27 trough in the Yuan through October 9th, the latest data as of this writing). Using our Portfolio Crash Testing (PCT Pro) application, we can do just that and then compare our ‘real’ scenario to the actual portfolio performance. My portfolio in this case, is a global 60/40 portfolio with 25% allocated to International stocks and 35% allocated to US stocks and only US Fixed Income. Only passive ETFs are used, and the only indexes stressed in PCT Pro are the Yuan and the US Dollar.

First, let’s take a look at what would have been predicted in a scenario where the Yuan appreciates 7.1% while the US Dollar falls by -5.8% (which is the actual performance of the assets from the May 27 trough in the Yuan through October 9th, the latest data as of this writing). Using our Portfolio Crash Testing (PCT Pro) application, we can do just that and then compare our ‘real’ scenario to the actual portfolio performance. My portfolio in this case, is a global 60/40 portfolio with 25% allocated to International stocks and 35% allocated to US stocks and only US Fixed Income. Only passive ETFs are used, and the only indexes stressed in PCT Pro are the Yuan and the US Dollar.

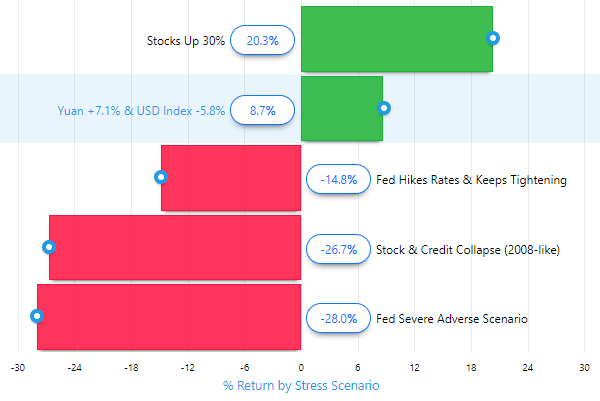

Exhibit 2: Yuan & USD Stress Test of a 60/40 Portfolio

Source: Portfolio Crash Testing Pro

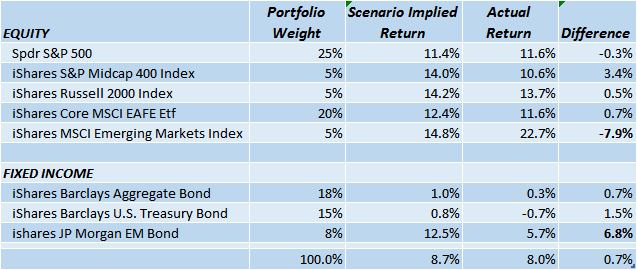

The actual 60/40 portfolio, as I constructed it, was up 8.0% over this period, where the PCT Pro model predicted an 8.7% increase. The biggest model misses were in the Emerging Markets – both Bonds and Stocks. So, the model overestimated the actual by 70bps, but remember, we only specified 2 currency moves, Yuan and USD while we are only investing in equities and bond ETFs, so I think 70bps is a pretty good result here.

Exhibit 3: Performance Between May 27, 2020 and October 9, 2020

Source: Portfolio Crash Testing Pro, Bloomberg

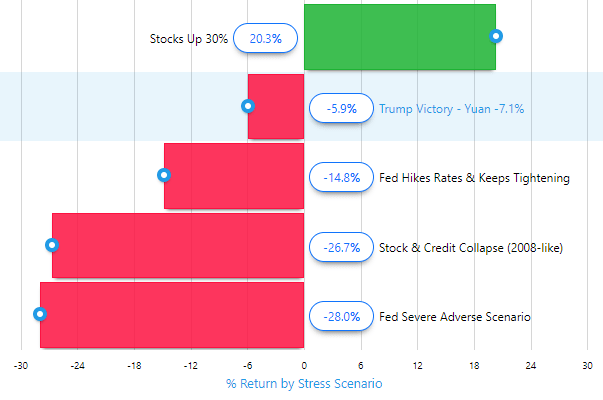

Now we can turn to the Trump Victory scenario. If Trump wins the November election the easiest to fathom scenario would be that the Yuan simply reverses the gains from the end of May to early October. Of course, markets are never that neat and tidy, but if the Yuan simply reversed course along with the US Dollar, the model predicts that our portfolio would return -3.02%.

While a case could be made for the Yuan reversing course in a Trump victory, I am less convinced that the corresponding move in the US Dollar is in anticipation of a Biden win, and would similarly reverse. A more likely scenario is that the Yuan would drop, potentially retesting and even surpassing the lows of May 27 while the USD would remain relatively unchanged. This scenario, where the Yuan drops by 7.1% and the US Dollar stays unchanged, would imply a -5.9% price return for the same 60/40 portfolio used above.

Exhibit 4: Trump Victory – Yuan Stress Test of a 60/40 Portfolio

Source: Portfolio Crash Testing Pro

While less correlated market moves will yield less reliable scenario results, we can utilize these factors to gain insight to what is expected of our portfolios when these moves occur. For example, while a rise in oil prices would generally be associated with a rise in equity prices, a more robust specification of the scenario will yield a more accurate result. For example, if the rise in oil is demand driven, that would generally be a bullish sign for equity, as opposed to a supply shock which would be bearish for equities. Adding an equity market shock will increase the reliability of the scenario.

In the Trump Victory scenario from above, a single factor stress test with only the Yuan implies that the US Equity markets would decline almost 8%. If a falling US equity market is not your base case, adding a US equity factor return to the analysis would allow you to more fully create the expected scenario.