- The Pandemic is a Supply Shock

- It’s a TRAP! A Liquidity Trap!

- So, who provides the growth?

- Odysseus’ Choice

- More risk scenarios in Portfolio Crash Test Pro (Banner Below)

In my native state, North Carolina, protestors gather to resist the Governor’s stay-at-home order. Regardless of your political leanings, we can agree that such gatherings are at least in part related to a collective frustration at the prospect of an economic crisis.

Well, in addition to other quarantine coping mechanisms, I finished reading Circe by Madeline Miller that reminded me of Odysseus’ dilemma: to steer close to the 3-headed rock monster, Scylla, or brave Charybdis, a tremendous whirlpool certain to swallow ships whole.

Deciding when to reopen certain sectors of the economy and slowly allow people to reintegrate back into their “normal” routines is sort of like Sophie’s choice. On the one hand, people will become ill and die from Coronavirus, and, on the other, shutting down is not without health risks. Neither alternative is pleasant or without negative consequences, but the longterm magnitude of a nationwide pandemic seems to be greater than an economic crisis.

The Pandemic is a Supply Shock

Not only did the pandemic interrupt supply chains, but the quarantine puts millions of people in positions where they can’t produce at the same capacity. Just as inflation is not a short-term risk, restoring confidence in the economy to boost consumption i.e. aggregate demand will not be enough to restart the economy.

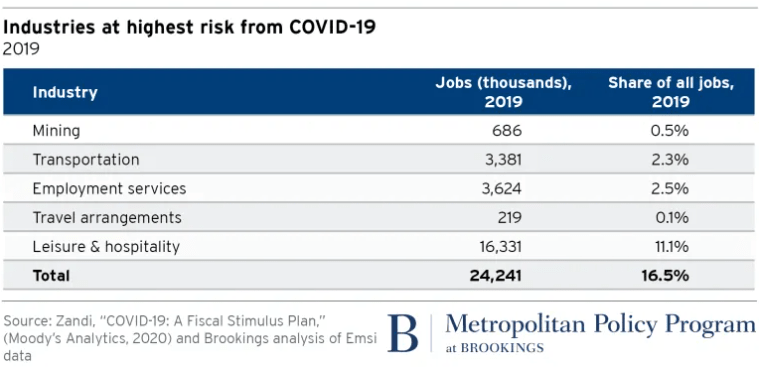

Industries will not experience the crisis equally. As the Brookings Institute reported, hospitality and leisure makeup 11.1% of all 2019 jobs and will be among the highest risk industries. They note though that:

“In the event that the pandemic tips the economy into a significant nationwide recession, very few places or industries will emerge unscathed. And if that happens, other large sectors—including construction, manufacturing, retail, education, and even the motion picture industry—will be affected regardless of geography.”

It’s a TRAP! A Liquidity Trap!

As a basic monetary policy review, let’s remember how monetary policy intends to work. The fed dumps cash into the money market to lower interest rates. Lower interest rates, assuming consistent demand for cash i.e. spending, leads to more demand for investment.

Is all this sounding familiar?

During the Great Recession, the Fed deployed all of its traditional tools without avail and cooked-up quantitative easing to directly give “key” financial institutions assistance by purchasing corporate debt.

A liquidity trap occurs when people prefer holding liquid money, cash, rather than purchasing bonds. Holding cash may not seem like a bad idea, but investment in future growth is an essential part of the US economy. These conditions, in many ways, already existed prior to the pandemic.

So, who provides the growth?

Again, the Fed has already deployed its traditional mechanisms to lower interest rates. The US Government is heavily leveraged and giving cash to its citizens to help them pay their bills. So, the tools of a market recovery i.e. fiscal and monetary policy are constrained.

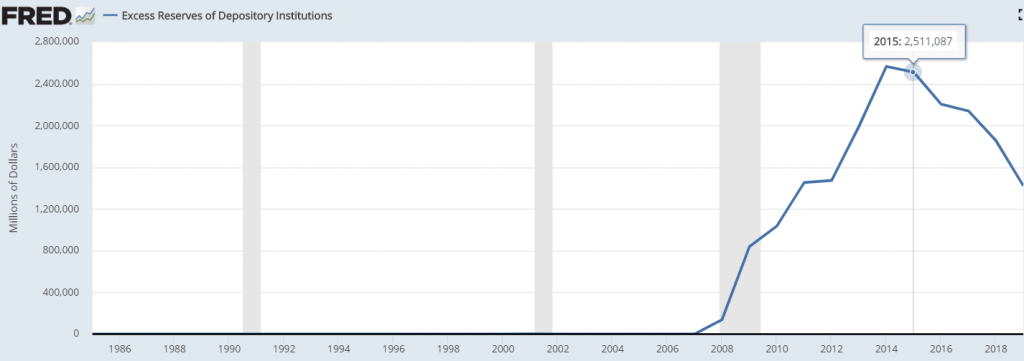

Some good news comes in the fact that this crisis is not affecting financial institutions like The Great Recession. Instead, in fact, the financial sector is better capitalized and banks have the liquidity necessary to remain solvent (Figure 1). Perhaps that will mean a swift recovery because the means to distribute essential capital and kickstart growth are ready to go.

The CARES Act shows this financial confidence because it contains little to revitalize banks and other financial institutions. Alexandr and I both wrote articles on the basics of the CARES Act and how it intends to boost the economy.

That kickstart, though, is tricky to identify. As I mentioned before, households and consumers are already overburdened in ways they weren’t prior to the Great Recession. Small businesses may have been in the same leveraged boat, as seen by the Small Business Loans already needing to be replenished by a new $484 billion stimulus package.

Odysseus’ Choice

As Homer recalls, Circe advises Odysseus to travel away from Charybdis and face Scylla instead. The choice is to lose a handful of men or risk the whole ship. Indeed, Odysseus loses 6 men to the 3-headed rock monster, but he and much of the crew return to Ithaca. Albeit, if you recall, Odysseus is never in a real hurry and spends 7 years in love with Calypso.

Back in November, Yon and I wrote an article wondering which economic sources will provide for future growth and identified some potential vulnerabilities in corporate debt markets. Keep an eye out for an update to that article on our blog.

More risk scenarios in Portfolio Crash Test Pro (Banner Below)

Our risk narratives pair well with the thousands of scenarios a click away in Portfolio Crash Test Pro. (Probably pairs well with bourbon, too). It even has a pandemic stress scenario.

If you’re feeling the pressure from clients facing a decline in their portfolio and an uncertain future, then PCT has all of the tools and figures you need to show that you’ve considered many possible alternatives. You’ve already spent the time to build a trusting relationship, so don’t neglect the tools to show your clients that they’re in safe hands.

Click the banner below to request a quick demonstration