One of the recurring themes through the presidential elections and the speech yesterday were the tax cuts that are coming to businesses and middle class individuals.

We in RiXtrema decided to examine what are the possible impact on the US economy.

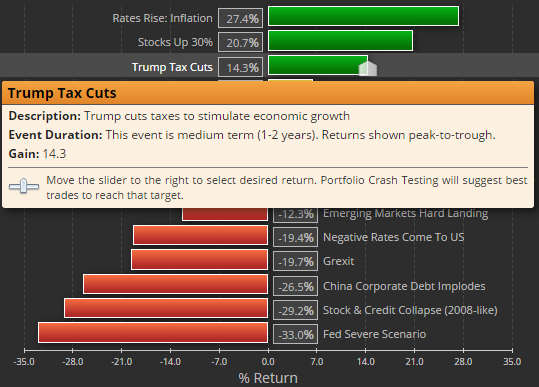

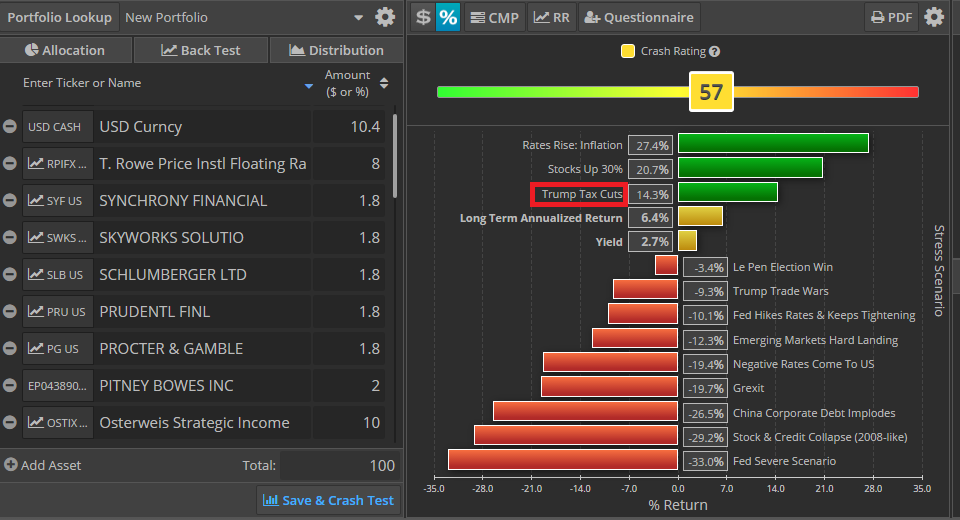

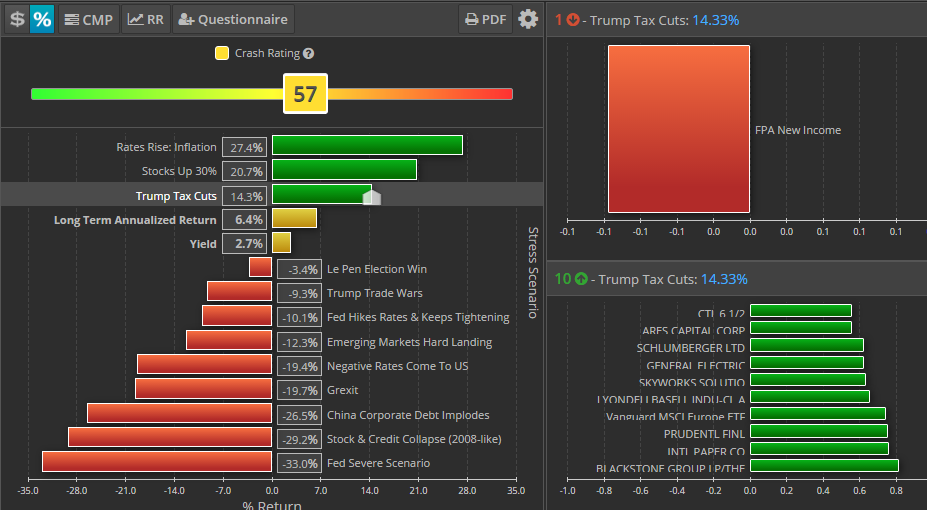

In our opinion the tax cuts should boost growth and positively stock market while be bearish on bonds because of the stimulus those cuts might bring.

The major drivers of asset prices in the US economy are the stock market which is represented by S&P and government bonds that represent a large chunk of fixed income portion of the economy and dictate the pricing of mortgages and IG corporate bonds. Thus we chose to stress both of those factors. Looking on historical tax cuts from the Reagan era we estimate a rapid rise in the S&P of 15%. The treasury rate should increase because of an additional stimulus and based on the latest market events.