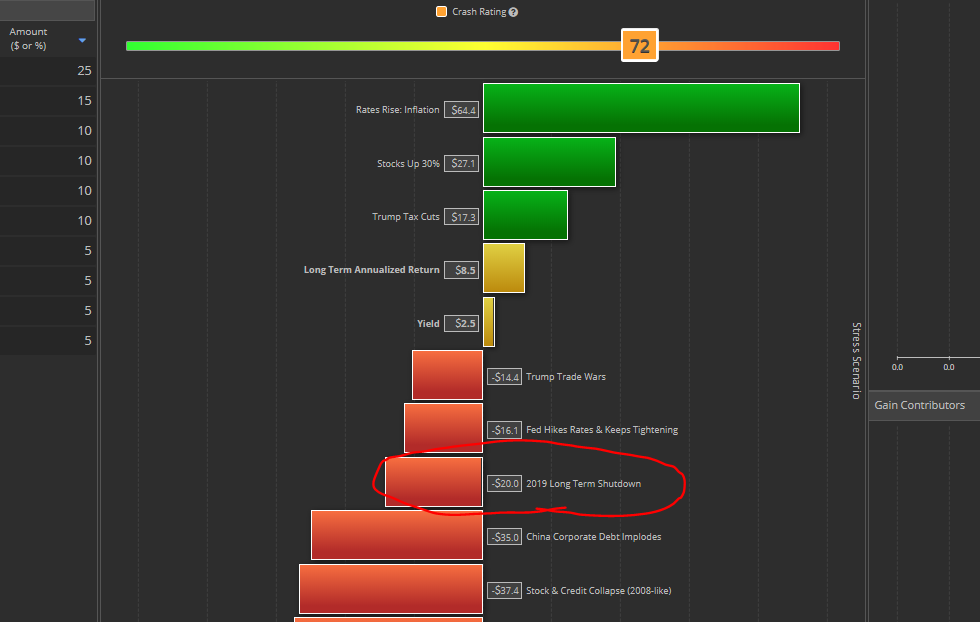

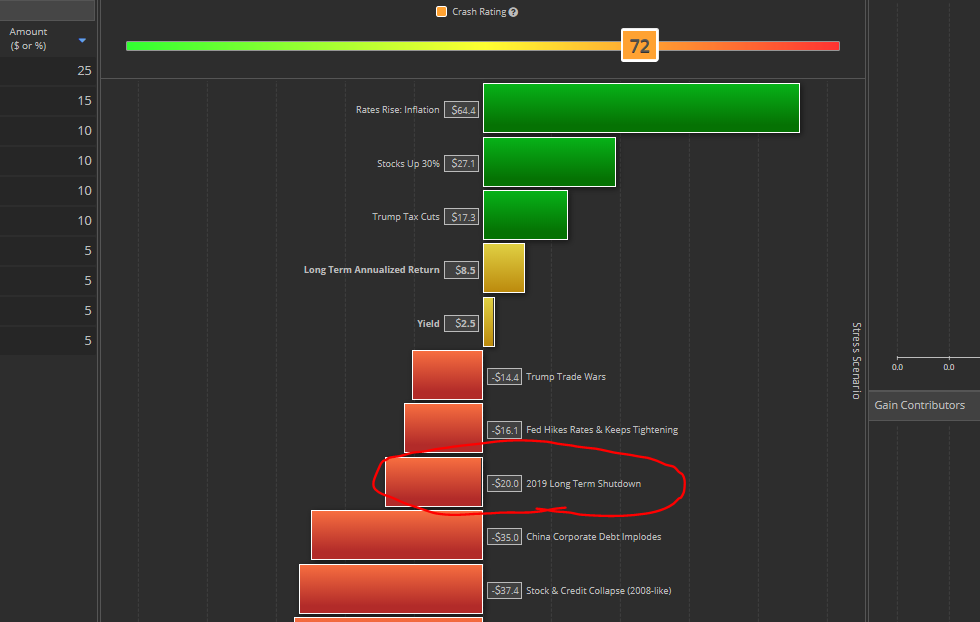

A scenario where there is a long-lasting shutdown, where the President does not declare a state of emergency, and the two sides don’t give in would have the biggest impact on your client’s portfolios. Economic effects of shorter shutdowns are generally minor and made up for once Federal workers (and contractors) receive back-pay. But a long shutdown, say into April, is uncharted territory and would have broader consequences for the economy.

This would affect the stock and bond markets particularly if conversations about the debt ceiling are hampered as a result. The already jittery equity markets would fall about 20% from current levels, US 10 Year interest rates would rise about 50bps as investors lose confidence in the US Government and BBB Credit spreads would increase 100bps. This is a particularly negative scenario as the equity market falls as rates rise, undermining the performance of the traditional safe havens. I believe that this is a low probability event.

With this in mind, we have loaded a new scenario into Portfolio Crash Test(PCT) with the following stresses:

2019 Long Term Shutdown

US Equity Markets: -20%

US 10Y Treasury: +50bps

BBB Credit Spreads: +100bps