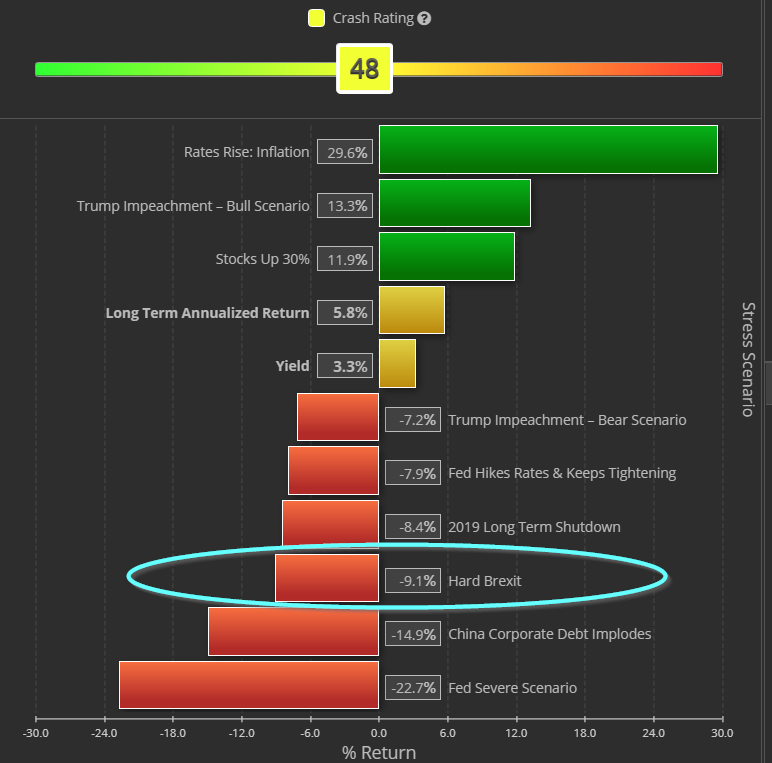

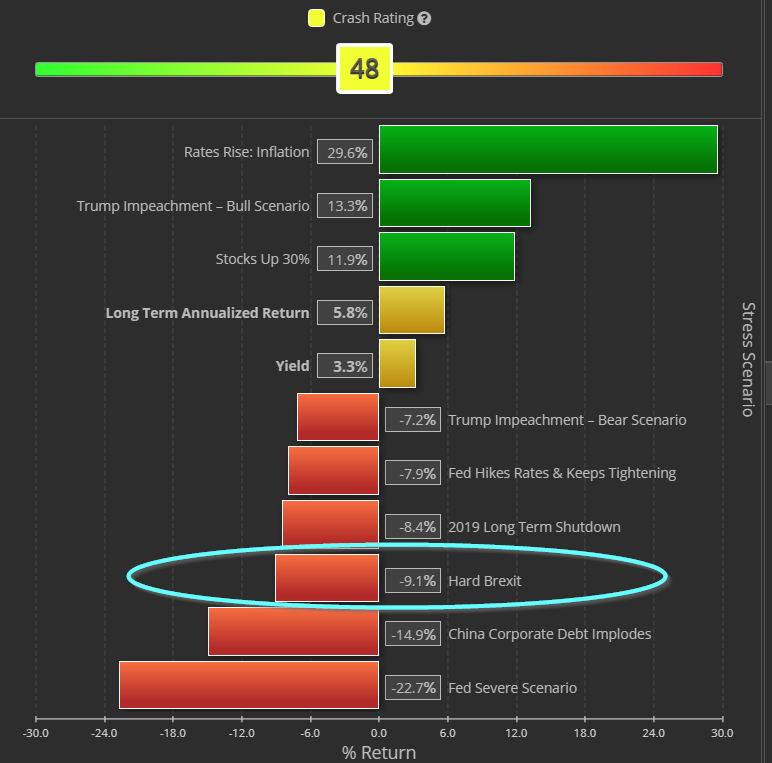

If the UK Government fails to approve the deal negotiated by PM May before March 29, 2019, that could trigger “Hard Brexit”. This would potentially cause severe short term (and even long term) market disruption for the UK and Euro region. We believe Hard Brexit has the potential to be very damaging to the UK, potentially pushing to into recession and having significant negative impacts to the UK stock market (-40%) and currency (-20%).

Of course, the UK won’t suffer in a vacuum, and if a country like the UK is pushed into a recession, others will suffer too. The Euro area could see a -15% decline in the Euro, but a more muted -25% decline in equity markets. Much like we have seen the past few years, the US would fare relatively well, but not come out unscathed. While the US Dollar would appreciate, the equity markets would take a bit of a hit at around -10% and long term bond yields would fall as investors seek safe havens. What does this all mean for your client portfolios? We’ve created a new scenario in PCT to find out:

For our “Hard Brexit” scenario in the Portfolio Crash Tester, we’ve used the following stresses:

- Britain Equity Markets: -40%

- Euro: -15%

- France Equity Markets: -15%

- British Pound: -20%

- Germany Equity Markets: -15%

- United States Equity Markets: -10%

Pingback : How You can Answer the "What if" Question When it Comes to Your Client's Portfolio