- Step 1 – Create Your Portfolio

- Step 2 – Crash Test Your Portfolio

- Step 3 – Manage Your Clients and Portfolios

- Step 4 – Tailor your Clients And Prospects Proposal With Risk Tolerance Rating By Deploying Risk Assessment Questionnaire

- Step 5 – Complement Your Portfolio Analysis With The Customizable PDF Output

- Step 6 – Take The Most Out Of Portfolio Crash Test Advanced Features

Portfolio managers and investment advisors work with clients in a number of capacities. They assess a client’s time horizon, performance objectives, and risk tolerance to determine which asset classes are the most suitable investments. Advisors are responsible for routine monitoring of investment performance and often execute orders, and also provide guidance in the areas of asset allocation and portfolio rebalancing.

Portfolio Crash Test PRO (PCT) provides financial advisors with top-notch portfolio analysis tools to support their clients and prospects in retaining full control over their portfolios and making their own investment decisions. As an advisor, it’s your responsibility to provide clients’ advisory and guide them to make the ultimate buy-and-sell decisions.

Portfolio Crash Testing is different from all other stress testing systems (including those available to institutions) for numerous reasons. Here are 14 Reasons Why Financial Advisors Should Use Portfolio Crash Testing

In this guide, we will be taking a quick tour of the PCT to get a grasp of its risk profiling and portfolio management features.

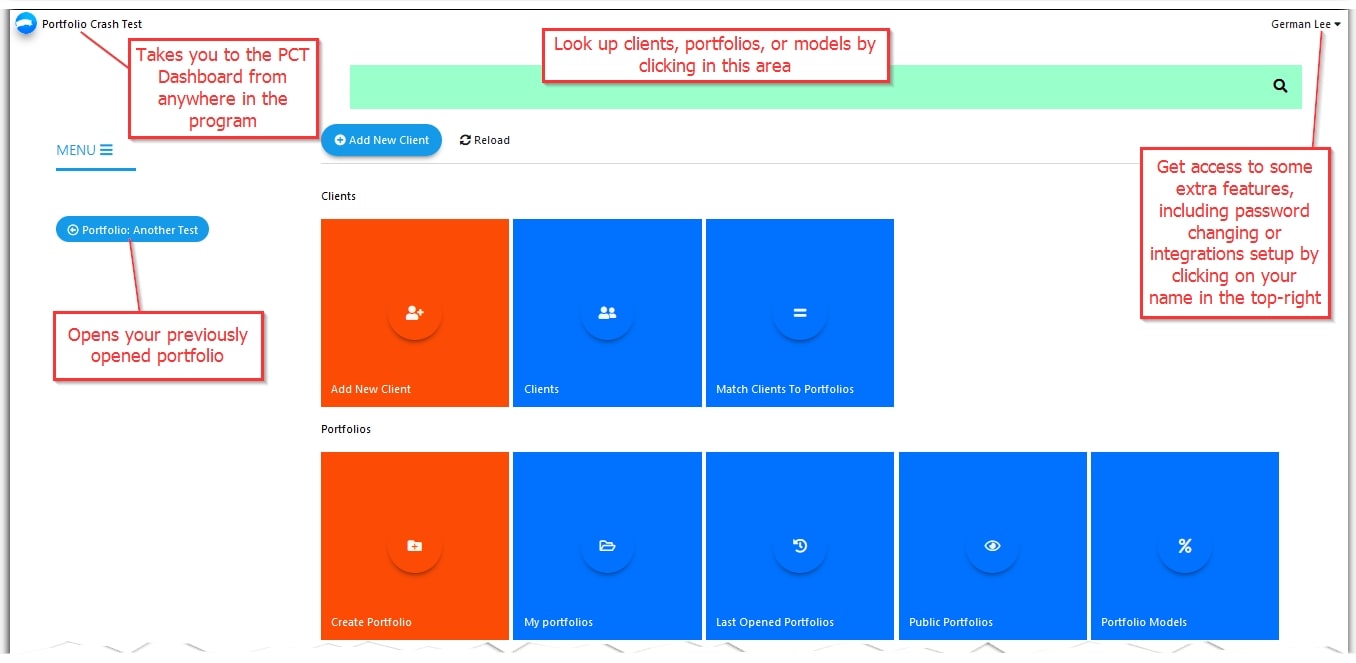

Upon entering the username and password the Dashboard comes up. It is organized to access different program features through several colored tiles.

Managing your clients and their portfolios, creating aggregates, communicating with leads about their risk assessment through a risk tolerance and capacity questionnaire, manage integrations and settings, and much more is available right at your fingertips from the Dashboard.

Take a look at the screenshot below to get a quick idea of where to:

- Quickly lookup clients and portfolios (search area at the top)

- Update your password and manage CRM and external portfolio management systems like TDA, Albridge, BlackDiamond, and others (click your name in the top-right and select My Profile

- Get back to the portfolio you worked with last time (click portfolio name button on the left)

- Click on the PCT button in the top-left (by the way, it’s a flying piggy bank!) to return to the PCT main screen

Please note that we recommend avoiding using the back and forward buttons of your browser for navigation because you might get accidentally logged out of the program. Instead, use the main screen, back arrows, and dedicated buttons to navigate to specific PCT areas.

Now let’s move through several quick steps and check the basics to achieve your specific goals with PCT.

Step 1 – Create Your Portfolio

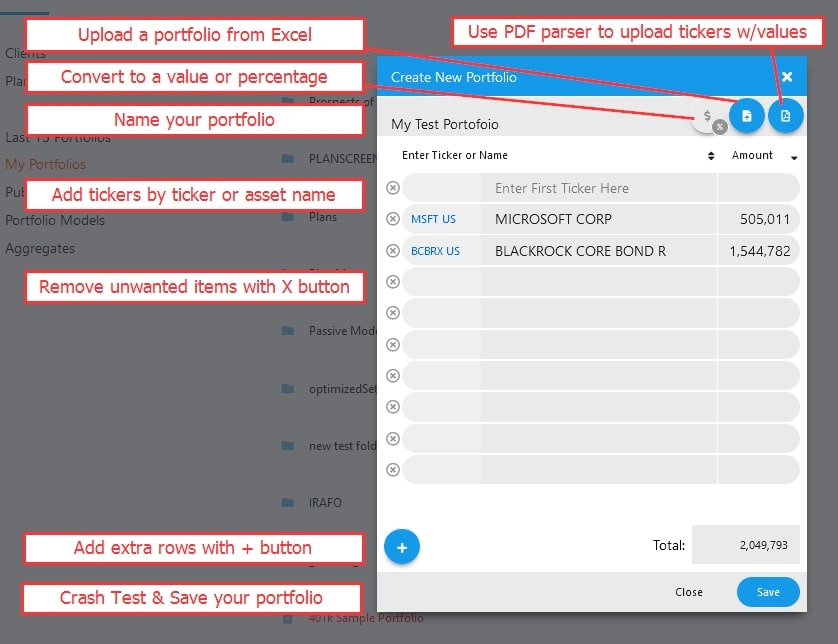

Start by creating your new portfolio: click on Create Portfolio tile and follow the screenshot below for available actions here:

Give it a name, add tickers and values. Decide if it will be a portfolio (with values) or a model (with % allocations) and use the switch for this in the upper-right corner. It’s also possible to upload a portfolio/model from an Excel format spreadsheet (CSV/XLS). For this prepare the Excel file with 2 columns: asset tickers and their respective values.

The PDF parser option allows you to parse through PDF statements and extract tickers with values on the fly and upload them as a portfolio to PCT. Hit the Save button to save your portfolio when done. This will take us to the 2nd step.

Step 2 – Crash Test Your Portfolio

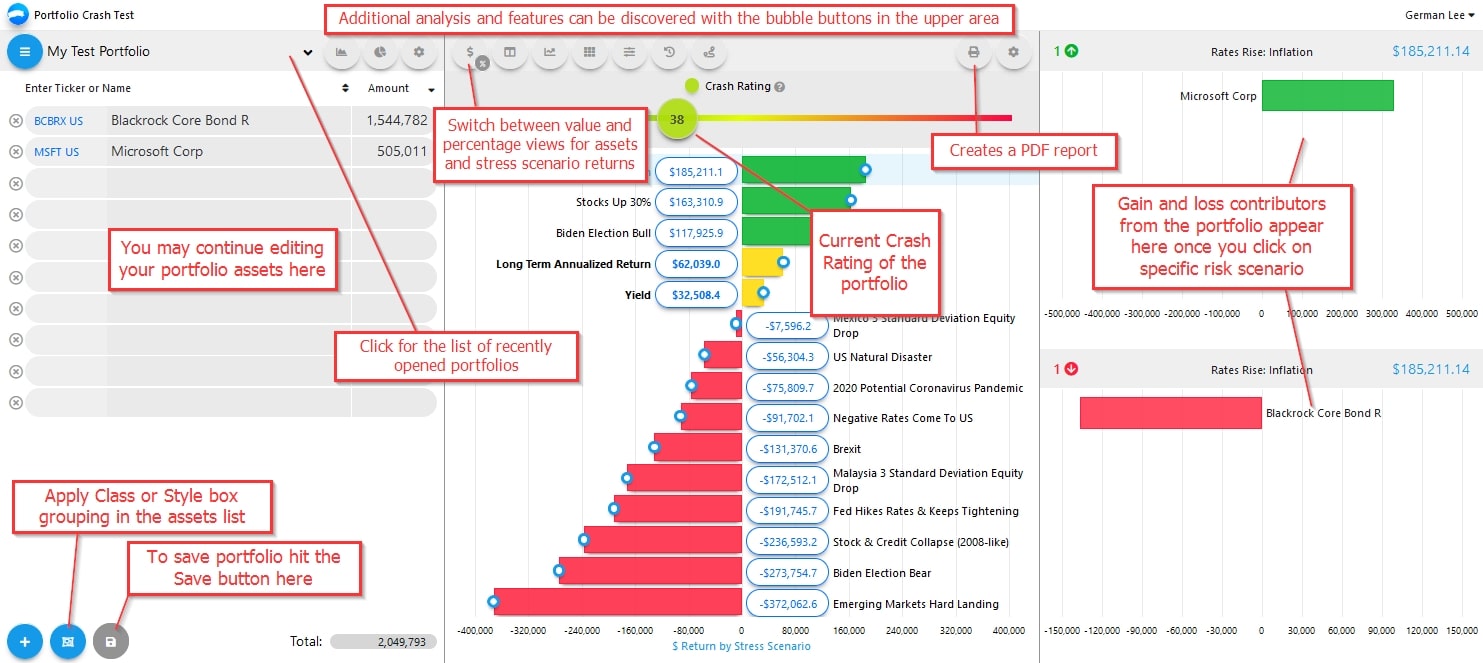

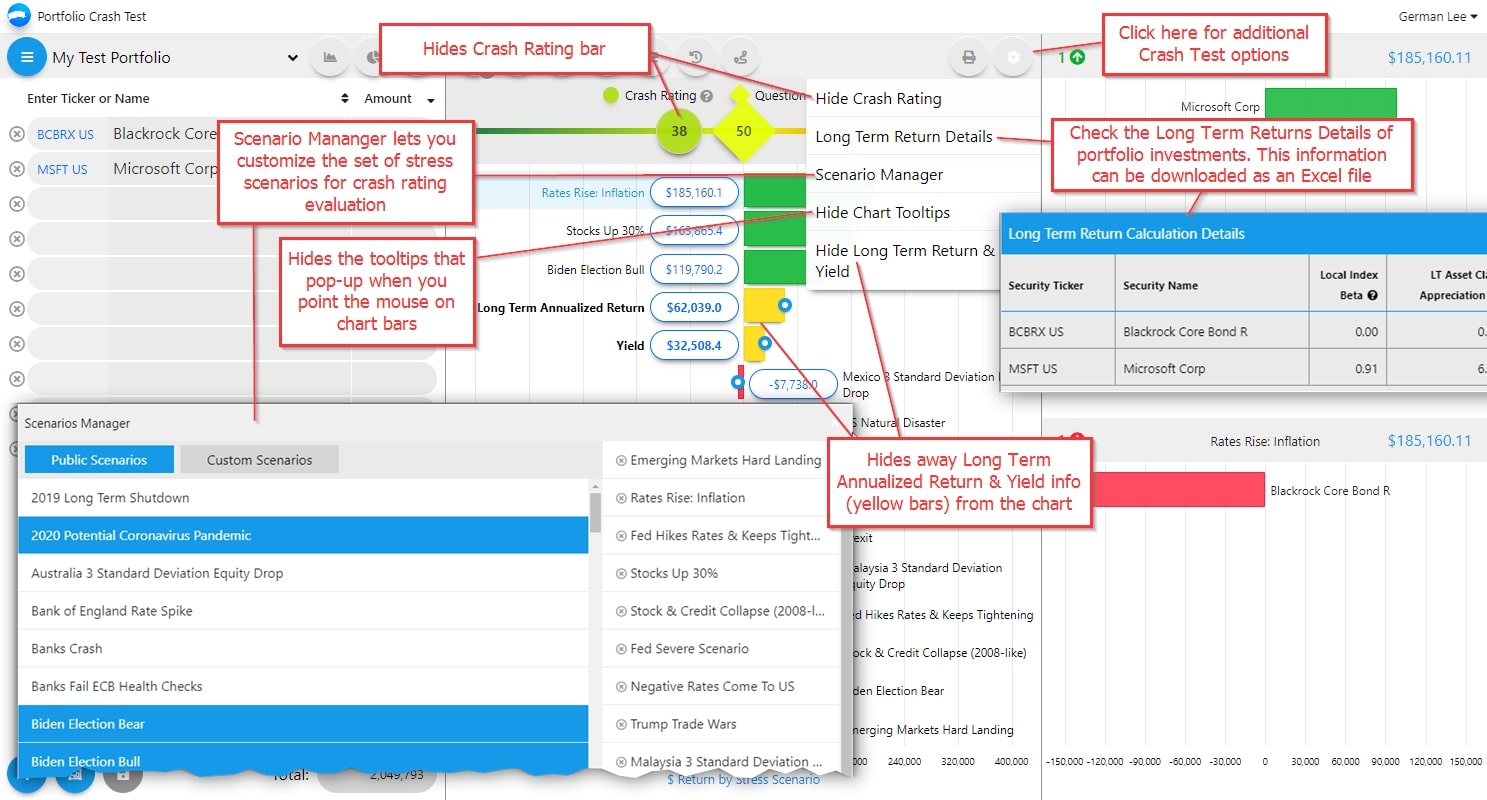

We are now at the screen that provides the core functionality of the Portfolio Crash Test program. Your portfolio has been crash-tested against several stressful scenarios, and the Crash Rating has been calculated. It’s displayed on the upper colored bar as a circled number. The coloring of the circle depends on the rating which could stretch from 1 to 100, where the higher number means a higher risk for the portfolio (thus the red warning color on the right edge).

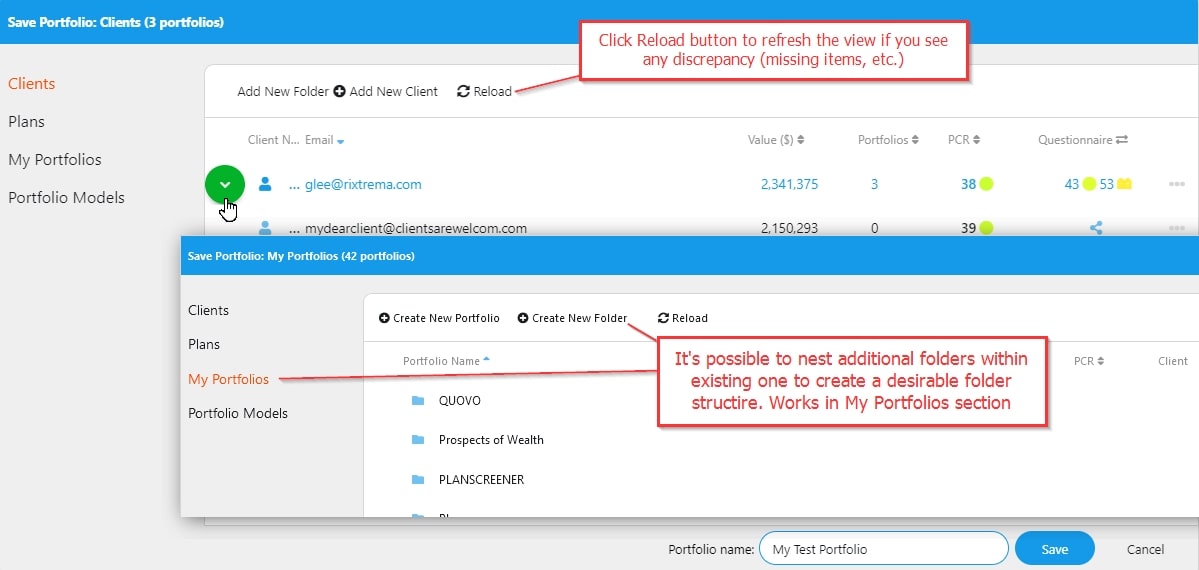

First off, save your portfolio with the Save button in the bottom left corner. You will have a choice to save it as new or overwrite an existing portfolio. For ease of navigation we suggest saving your portfolios to the My Portfolios folder, and Models – into the Portfolio Models folder. You can also save the portfolio directly under an existing client folder or create a new client folder and save it there. This will automatically link your new portfolio with that client and save it in the My Portfolios folder.

Note: if you are saving an Aggregate portfolio, it will be saved in the client’s folder and the Aggregates folder. Further below in this guide we will cover the use of aggregates in more detail.

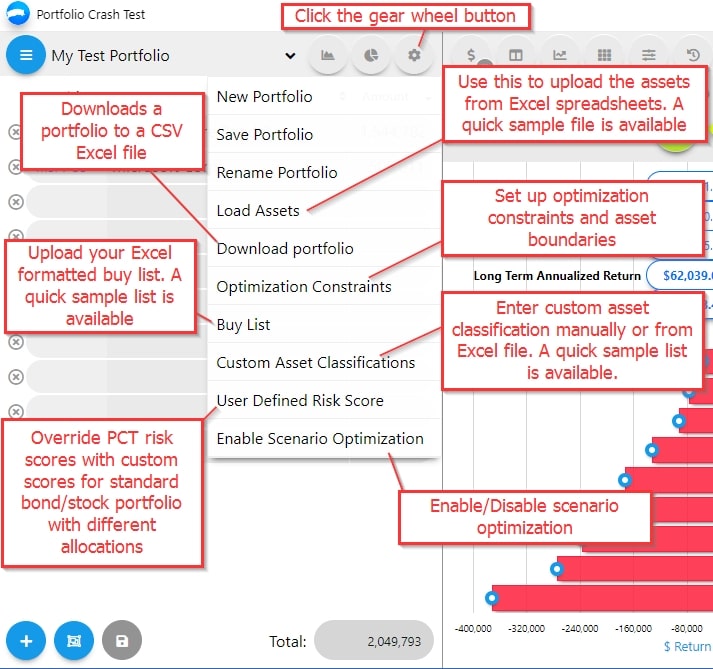

Additional portfolio controls are available in the portfolio view. Locate the gear wheel button in the upper left, and explore the options. Here is a quick recap of what is available in that menu:

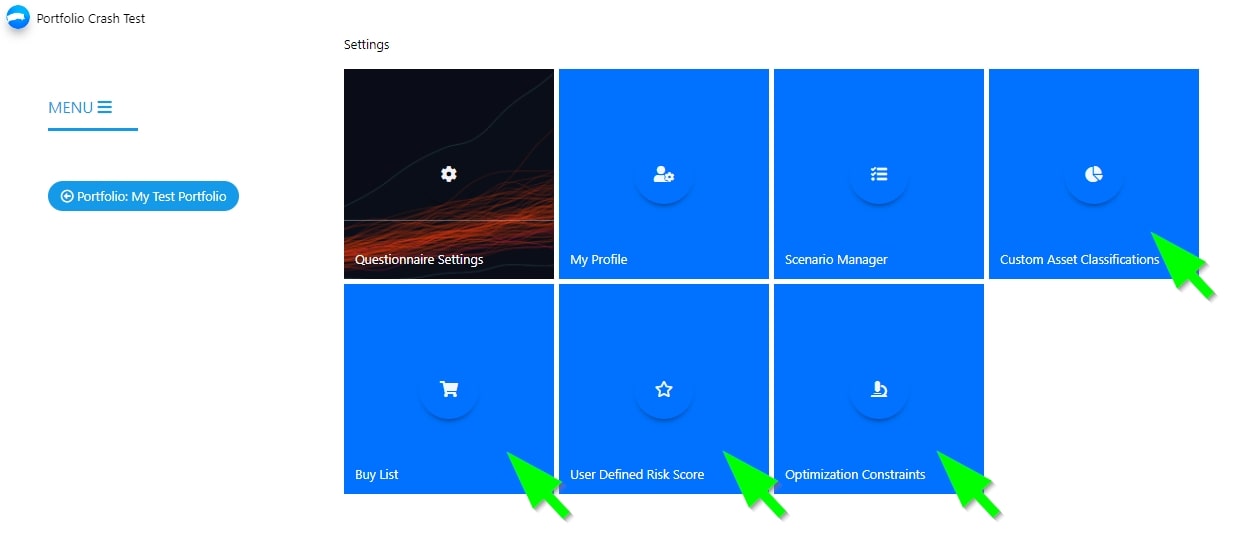

Note that some of these portfolio settings are accessible from the PCT Dashboard too. Just scroll to the bottom of the main screen to Settings and find separate buttons for Custom Asset Classifications, Buy List, User Defined Risk Score, Optimization Constraints sections.

PCT crash test view offers a few more additional options, let’s take a look below:

Let’s move on and check how we can incorporate your clients’ structure further.

Step 3 – Manage Your Clients and Portfolios

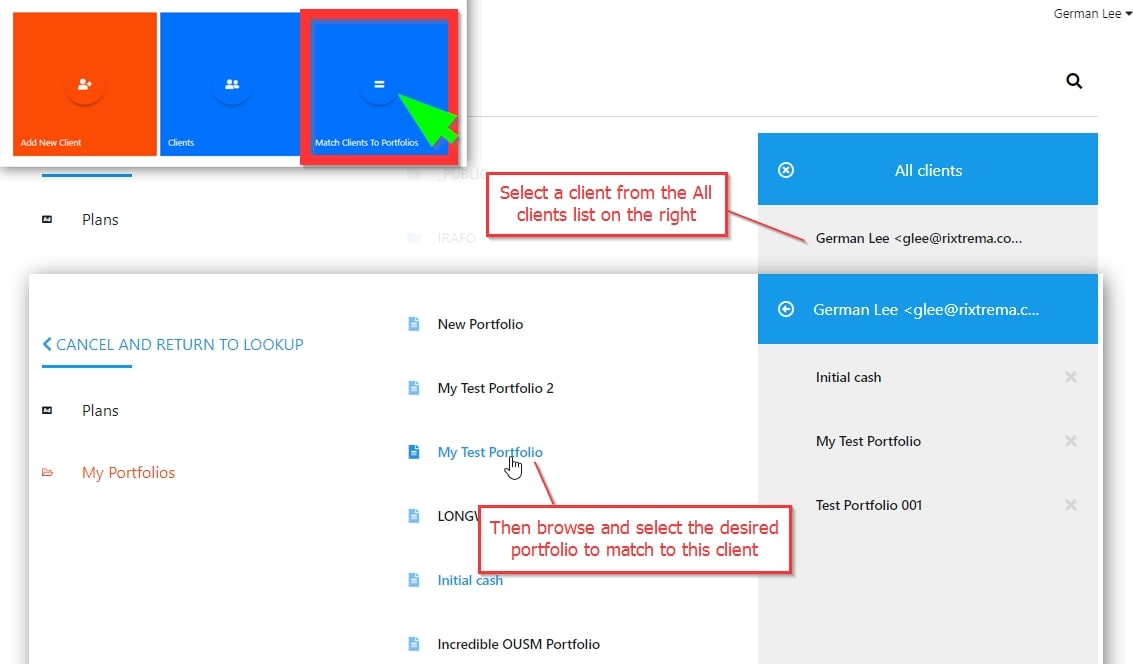

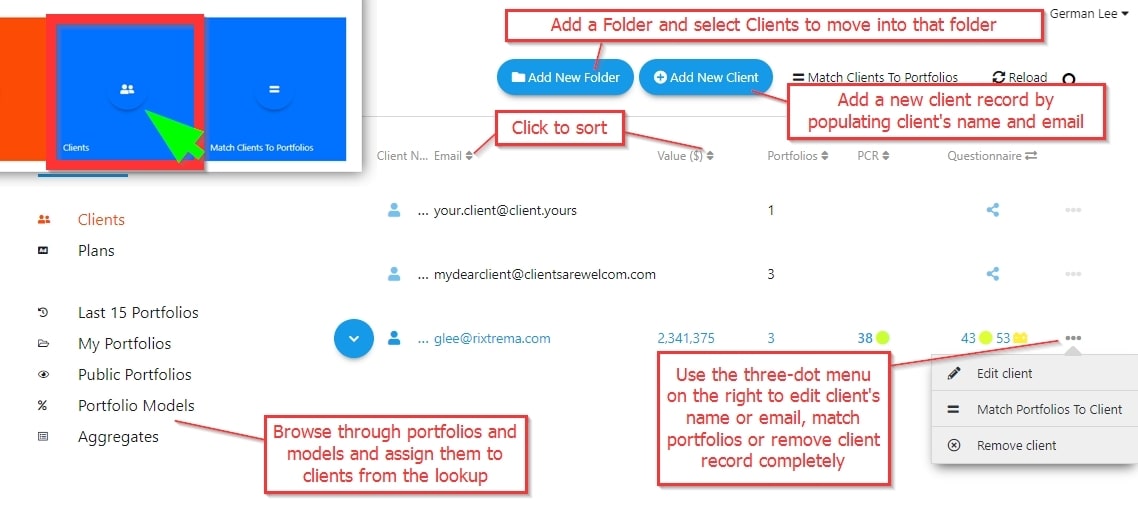

As mentioned before the uploaded portfolios can be assigned to client folders or, to make it short, clients, directly from the Save As option in the Portfolio Crash Rating view. This can be also done using the respective Clients section buttons on the PCT Dashboard – Match Clients to Portfolios:

or from within the Clients area that also has other client management options:

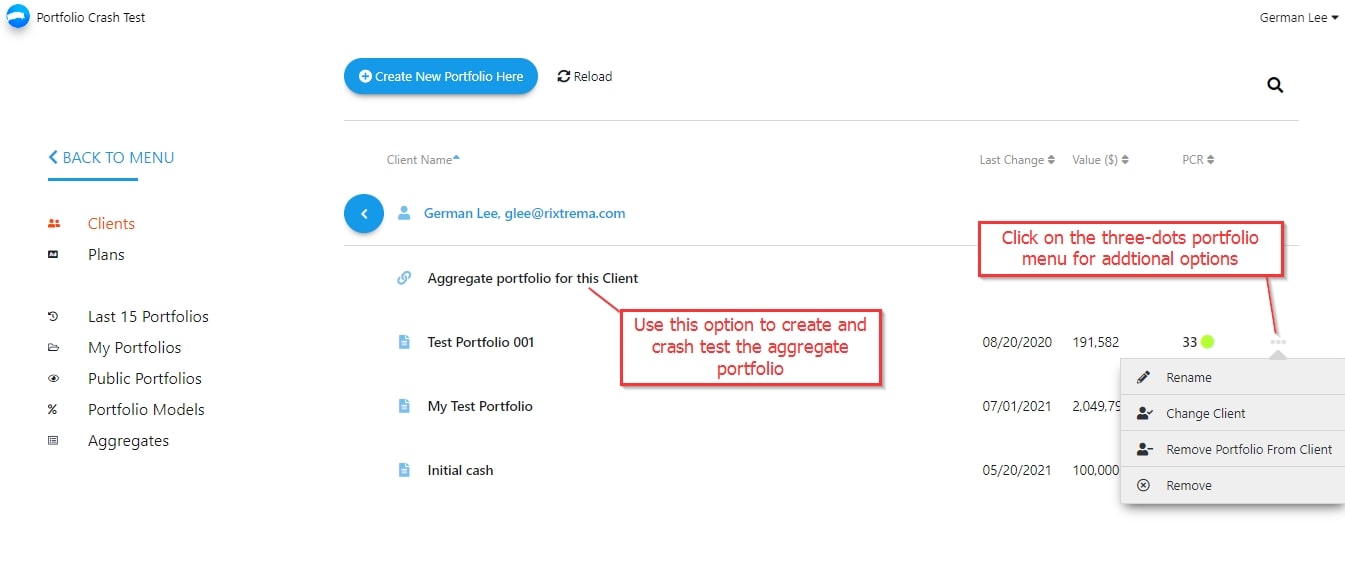

More client controls, such as the client’s portfolios aggregation, reassigning or removing portfolios, are available when you click and open the client record:

Note that any removal action can’t be undone, so use it with precaution.

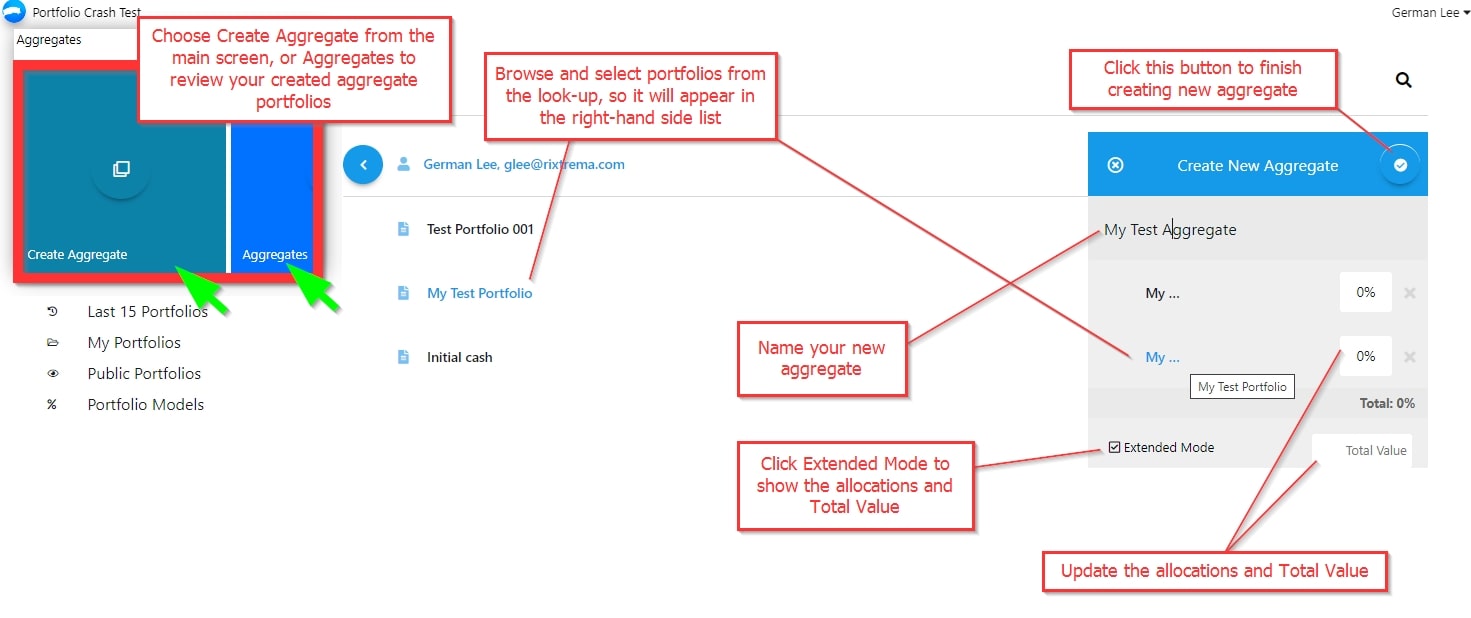

As we mentioned before, PCT offers a portfolio Aggregation feature. It’s possible to aggregate several portfolios of one client or create aggregate portfolios across several clients. The aggregation feature is pretty easy to use as you can run a quick aggregation of portfolios from the client’s folders, as highlighted in the above screenshot, or from a dedicated Aggregates section from the Dashboard. Let’s take a quick look below:

Once you create and save the aggregate, you can further crash test it and assign it to a specific client. For this use the Save As button in the bottom-left corner on the Crash Rating view.

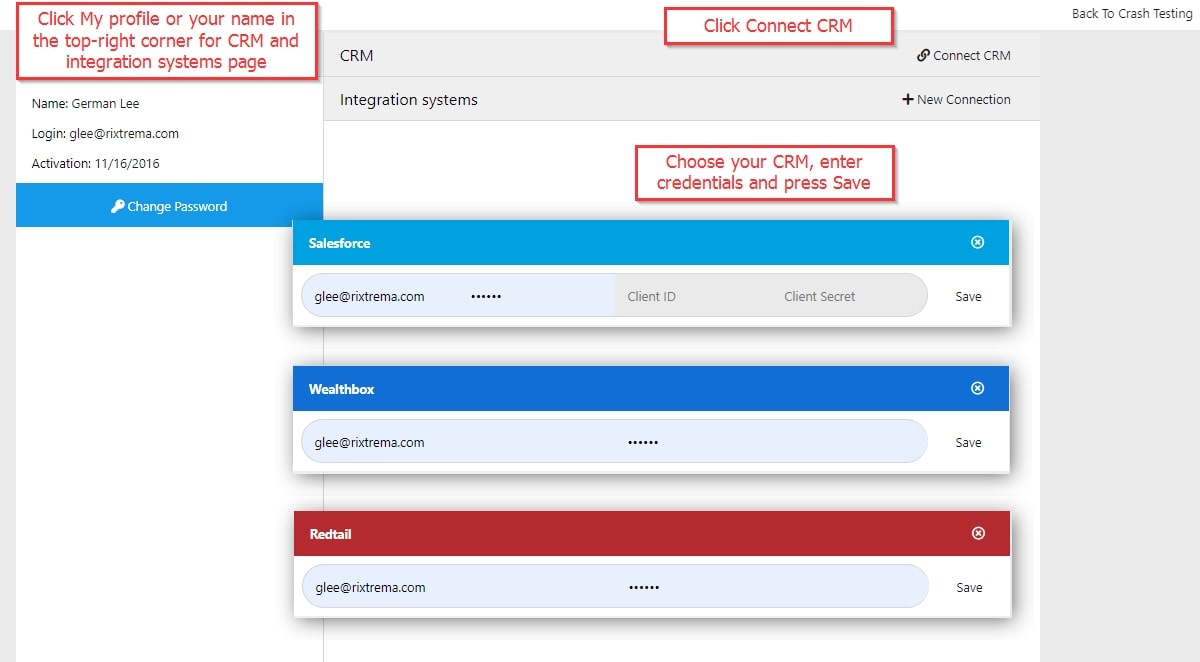

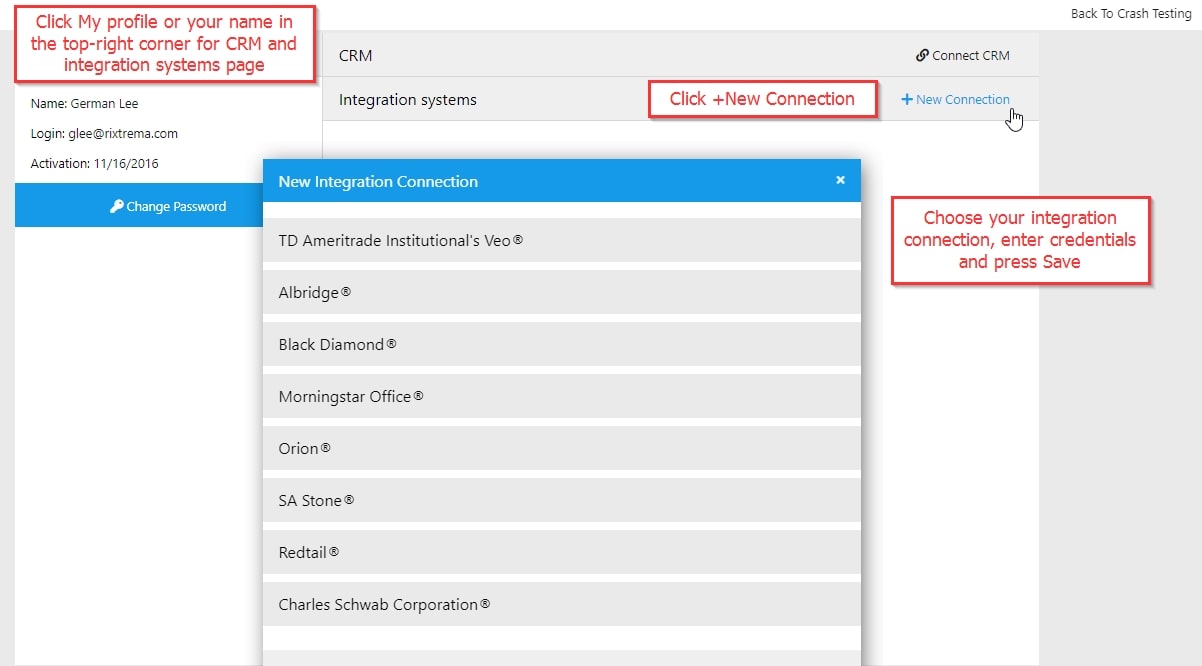

Third-party portfolio management systems and external CRM users can take advantage of Portfolio Crash Test seamless integration with their systems. The integration setup is available from the top-right menu, My Profile page, or directly from the Dashboard, Add Integration button.

As of now, PCT supports integrating with the following third-party CRM systems:

- SalesForce

- Wealthbox

- Redtail

Here is a quick case study we put together about setting up your integration with Wealthbox CRM in a bit more detail – click here to read RiXtrema integrates with Wealthbox CRM

Integration with the following portfolio management tools could be setup:

- TD Ameritrade Institutional’s Veo

- Albridge

- Black Diamond

- Morningstar Office

- Orion

- SA Stone

- Redtail

- Charles Schwab Corporation

Note that the process of setting up integrations with some of the portfolio management systems might require additional authorization and electronic forms sign-off. Please consult with us at clientsuccess@rixtrema.com or (800) 282-4567 before setting up an integration.

After successful integration, your folder lookup will have an additional portfolio folder named after the respective portfolio management tool. The synchronization will then commence and you will have to wait for some time until the sync process is finished.

For additional guidance on working with system integrations please contact us directly. We are now moving to the next step of evaluating your client risk tolerance and acquiring leads through the Risk Tolerance and Capacity questionnaire.

Step 4 – Tailor your Clients And Prospects Proposal With Risk Tolerance Rating By Deploying Risk Assessment Questionnaire

Here is a great guide we published to help you working with the questionnaire in PCT – Capture Your Client’s Risk Profile with the PCT Questionnaire

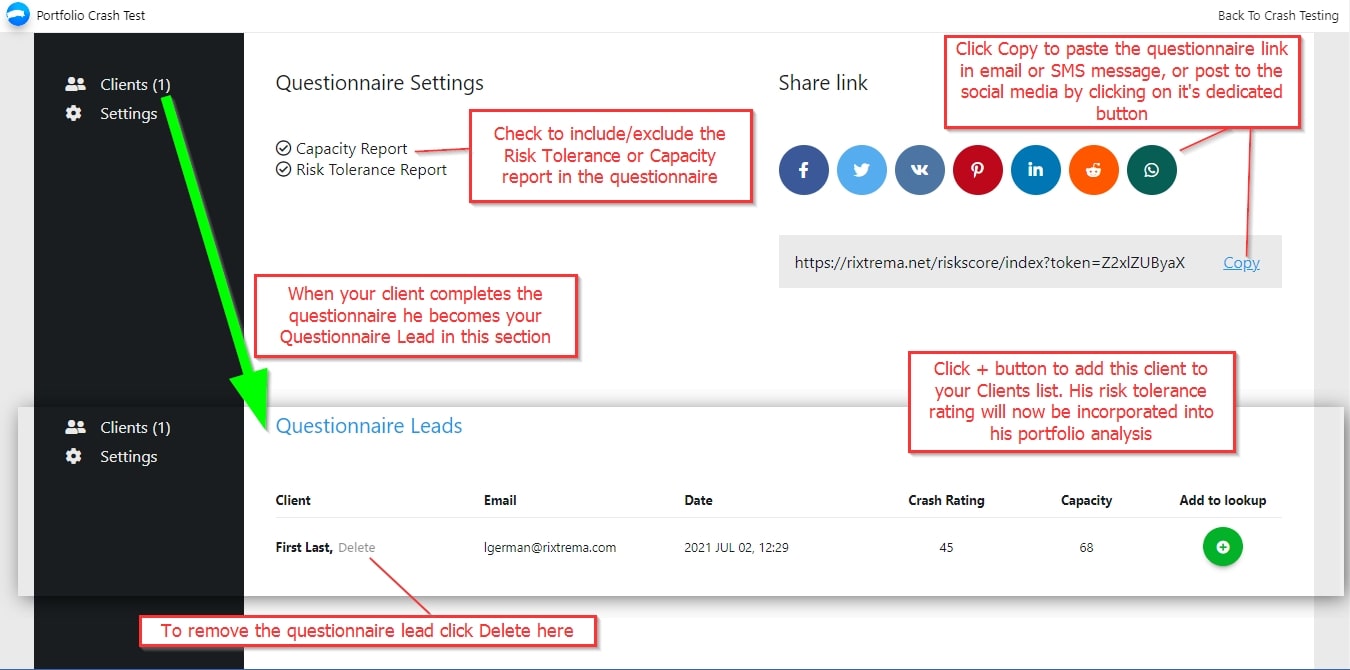

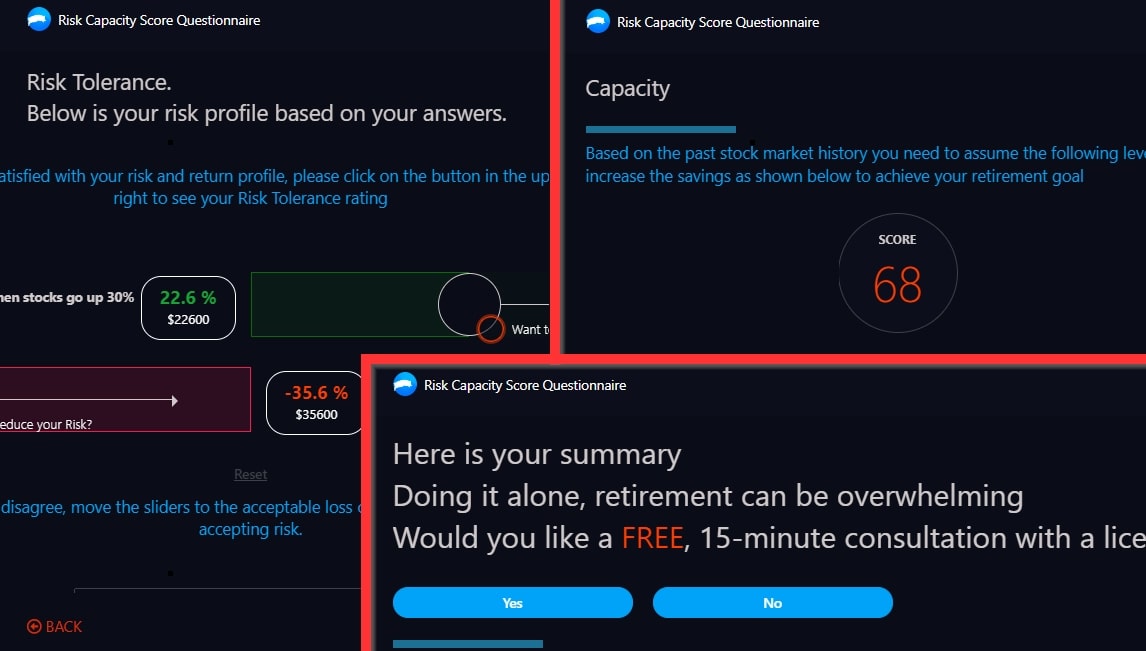

We will take a quick look at the basics of using the questionnaire below. Scroll to the bottom part of the Dashboard, and locate the Questionnaire Settings tile. The same section is available by clicking on your name in the top-right corner. RiXtrema’s Risk Tolerance questionnaire consists of two parts: the Risk Tolerance assessment and the Risk Capacity measurement. We suggest you include both sections while sending the questionnaire link to your clients, to get the holistic picture of their portfolio and retirement savings expectations.

PCT’s Risk Capacity is a great complement metric RiXtrema added recently, designed to improve upon the flaws of traditional risk questionnaires by giving financial advisors a picture of their investor client’s retirement situation and emotional response to risk. Here is a quick introduction to it – read in RiXtrema blog: Case Study: Here’s why your Risk Tolerance Questionnaire is failing you & Case Study: Understanding Risk Capacity

The Risk & Capacity questionnaire can be a great prospect magnet too. Simply post the questionnaire link to your social media platforms profile pages or your company website, and it will start accumulating leads with all of their risk profiling info right at your fingertips in PCT. This will give you a tremendous opportunity to initiate a conversation about their financial situation (you will have their contact info, including the email and phone number too!)

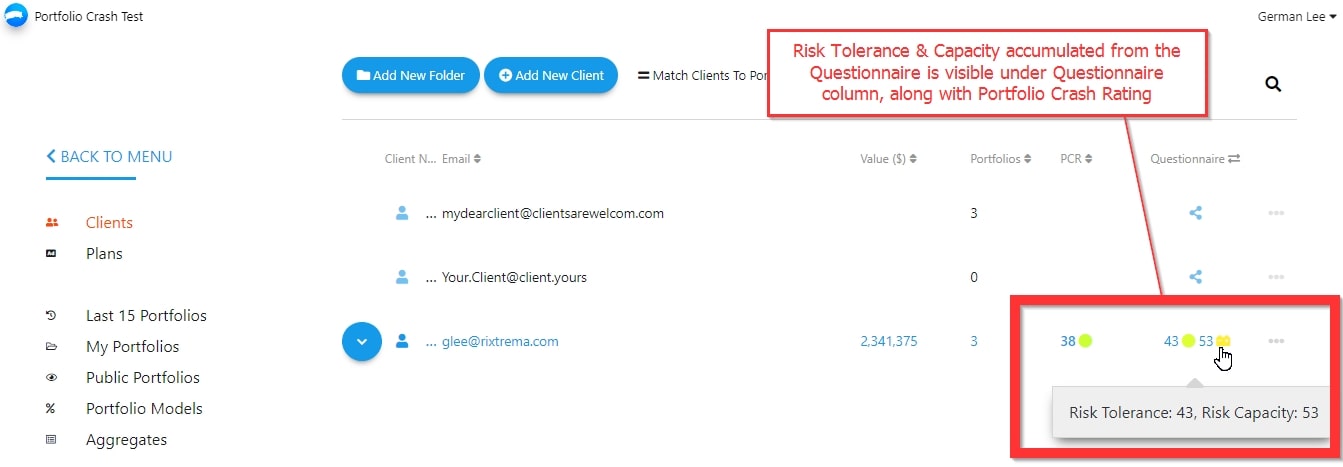

After you have acquired your client’s Risk profile it is time to reiterate their portfolio analysis with the Risk tolerance rating. The clients who provided their risk assessment will have their questionnaire ratings populated in the lookup:

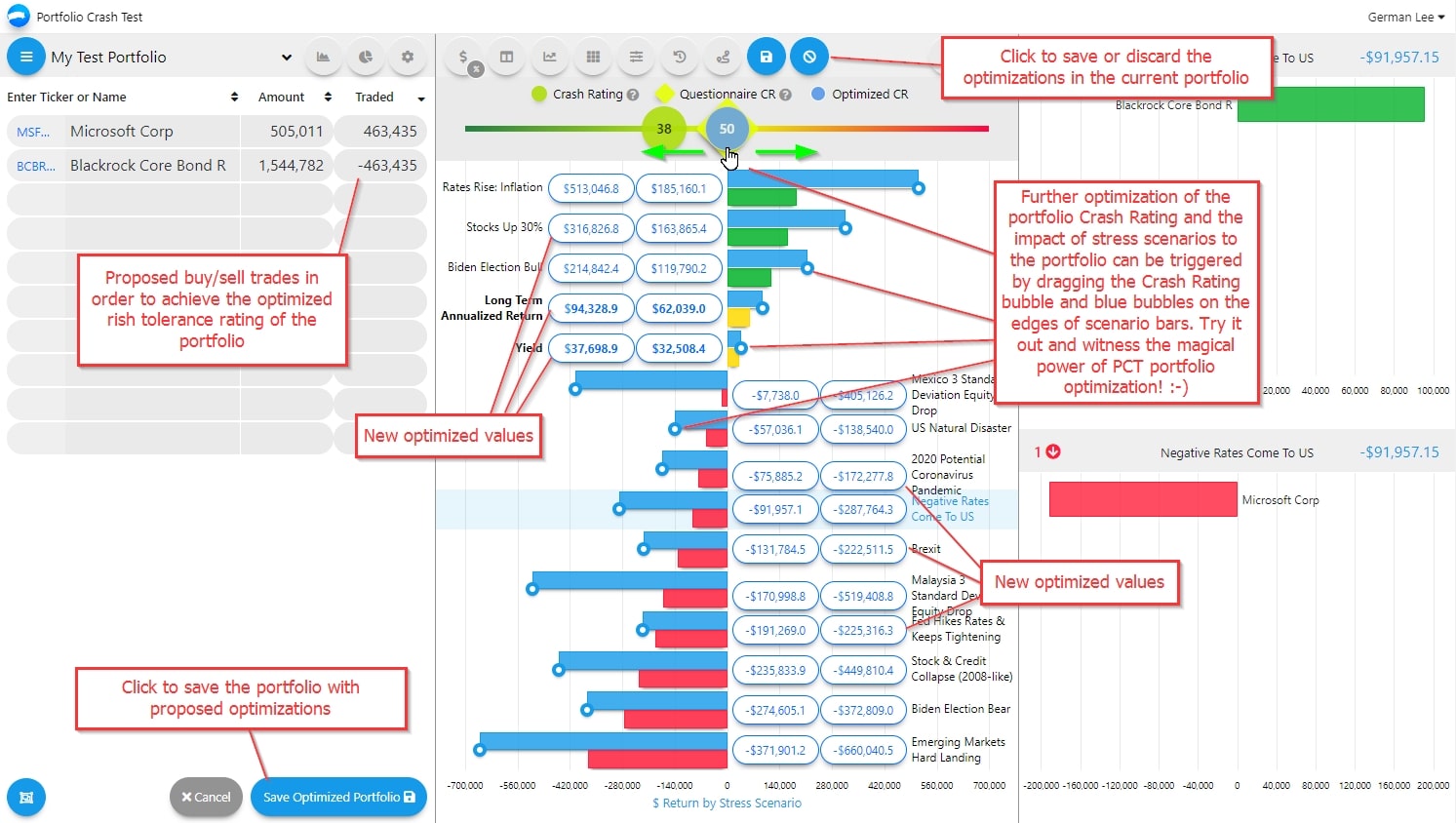

Portfolio Crash Rating analysis can be further optimized in light of the client’s risk tolerance rating. During the optimization, PCT will show you how the impact of stress scenarios can be re-evaluated if we consider the client’s questionnaire rating. To initiate the optimization simply use your mouse to move the current portfolio crash rating (number in the circle) closer to the questionnaire rating (number in the diamond box). PCT will recalculate the stress test impact on the portfolio and propose the buy and sell trades to tailor the client’s portfolio investments to achieve questionnaire rating expectations. The optimized values and charts will be displayed in blue:

Hit the blue Save Optimized Portfolio button to keep and save the portfolio optimizations, and we are now ready to put the current and optimized portfolio evaluations into a nice colored PDF document to accompany your client or prospect conversation/proposal.

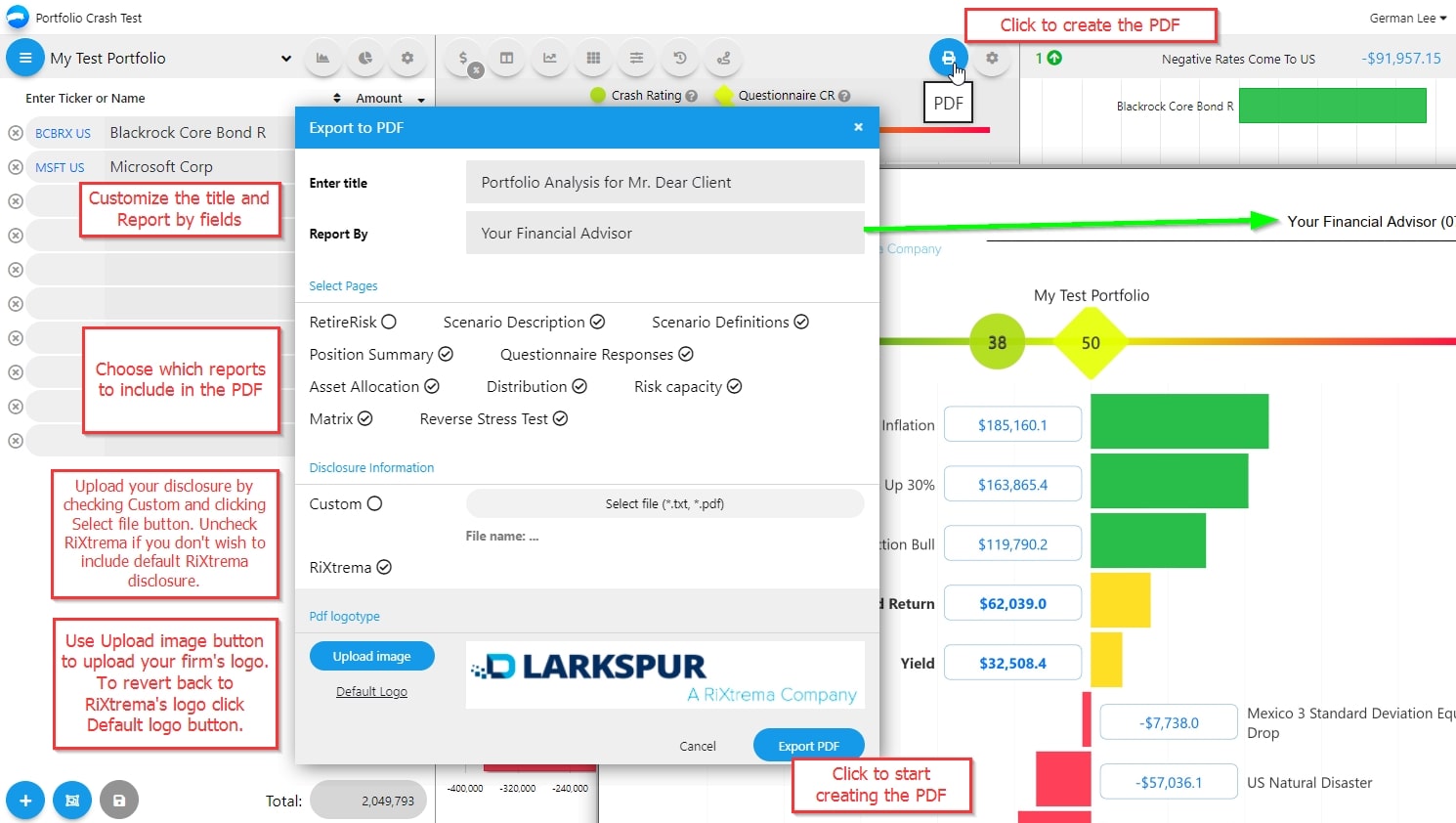

Step 5 – Complement Your Portfolio Analysis With The Customizable PDF Output

The PCT provides flexible Export to PDF functionality. The PDF report can be branded with your firm’s logo along with necessary disclosures from RiXtrema and your custom disclosure in various formats.

To start Export to PDF press the printer icon in the upper area while in the Portfolio Crash Rating view:

We recommend using high-quality image files for your logo, JPG or PNG formats are preferable. Once exported the PDF file will be saved to your computer, My Downloads folder by default. It will look great if printed in color as a hard copy.

Step 6 – Take The Most Out Of Portfolio Crash Test Advanced Features

The Portfolio Crash Test PRO version came to replace the initial Portfolio Crash Test tool more than two years ago. The initial PCT still co-exist and you can freely run both of them and choose the one that suits you most. But what makes the PRO version shine are the advanced risk profiling and capacity features. In short, some of the biggest upgrades we’ve made with the newer PCT PRO include

- Improved Risk Tolerance questionnaire

- New Risk Capacity questionnaire

- Enhanced Retire Risk module

- Ability to create your own Custom Stress Tests

- Interface redesign for a brand new look (new Dark Theme included)

In the next couple of paragraphs, we will take a quick overview of these features.

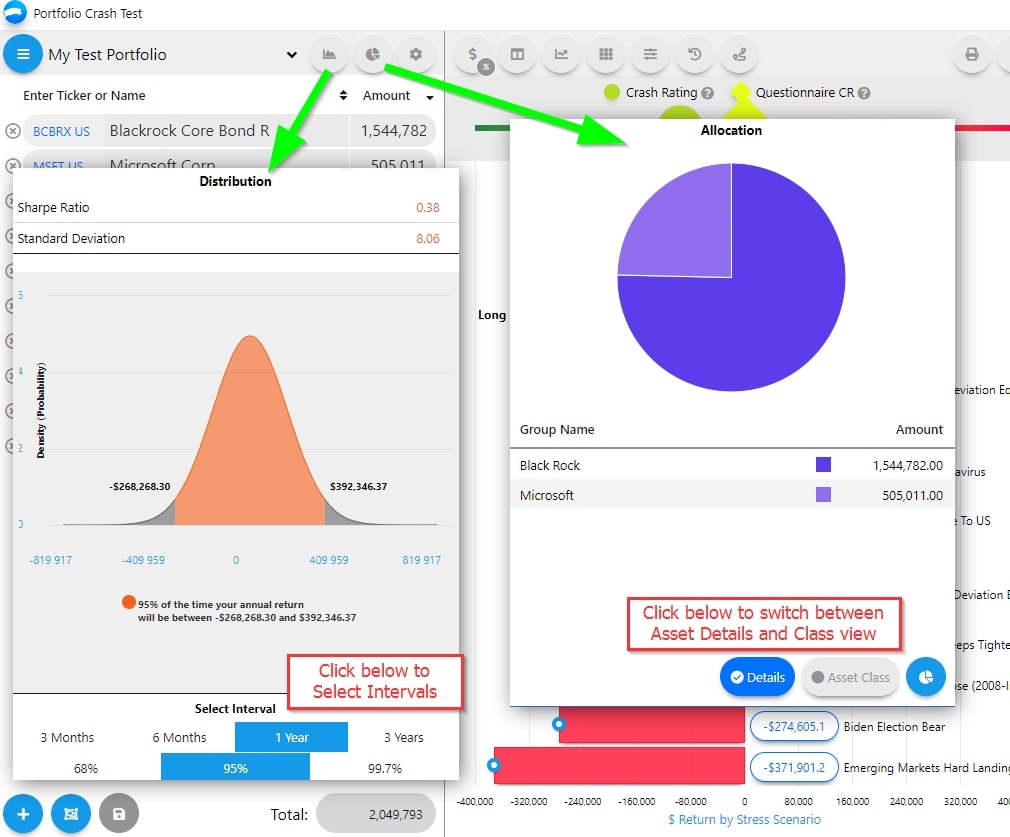

In the portfolio crash testing view we have Distribution and Allocation areas for the portfolio advanced analysis:

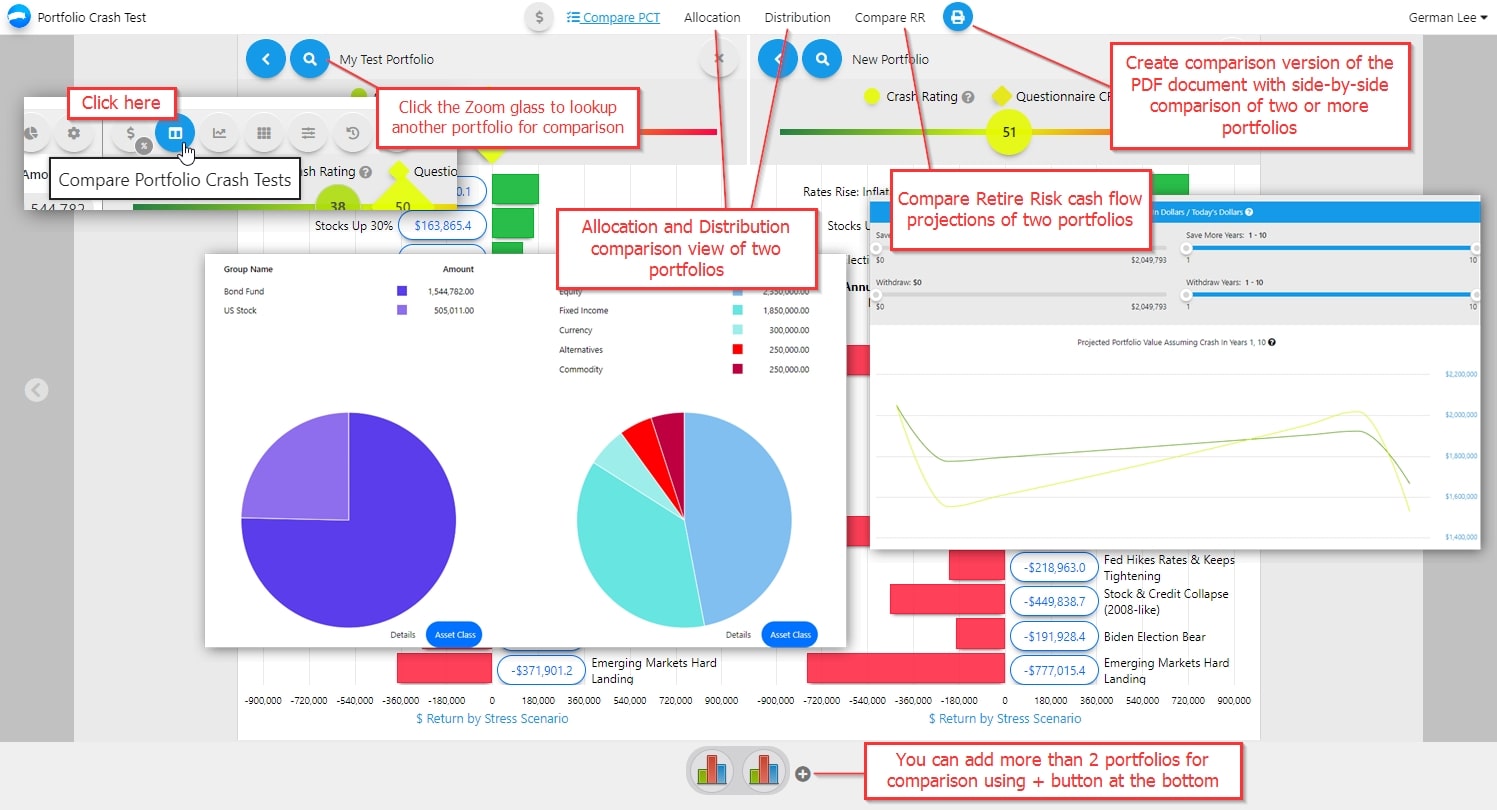

The Compare Portfolio Crash Tests feature is useful to compare portfolio characteristics and risk behavior of two or more portfolios in a side-by-side before-after manner:

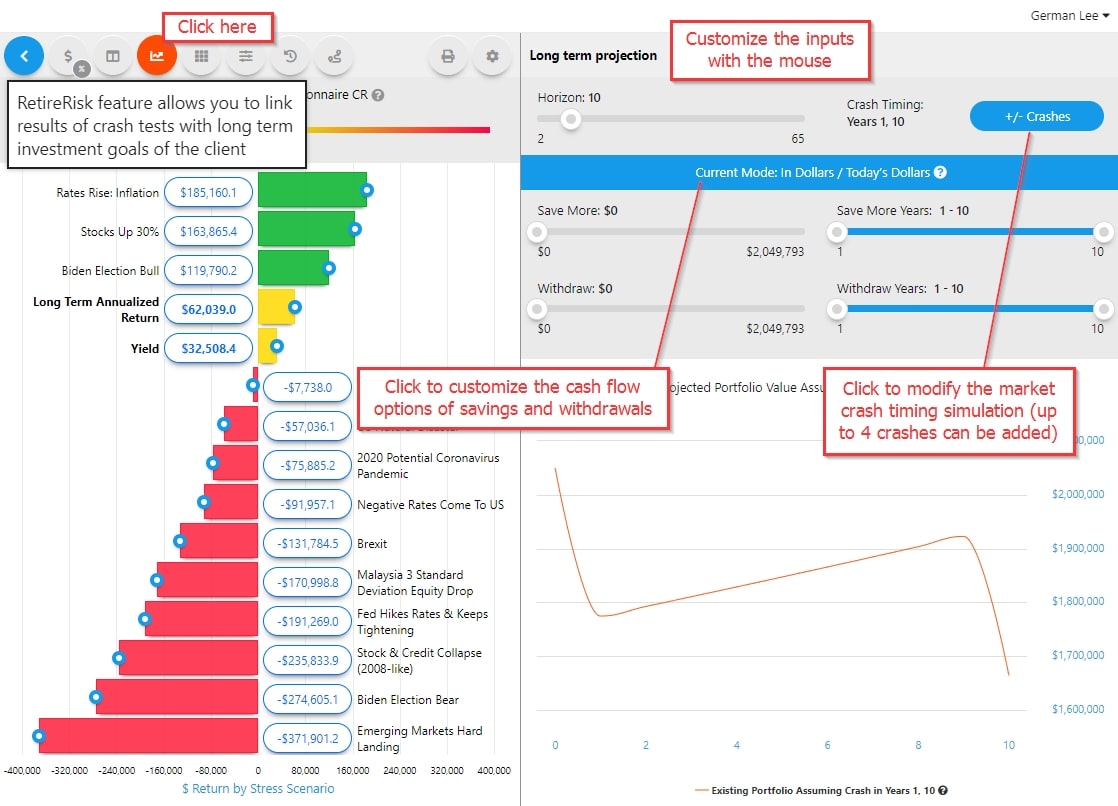

The enhanced Retire Risk feature allows you to link the results of crash tests with the long-term investment goals of the client. We have put together this great article that covers the RR module in greater detail – PCT Pro Using RetireRisk To Plan Cashflow In Retirement

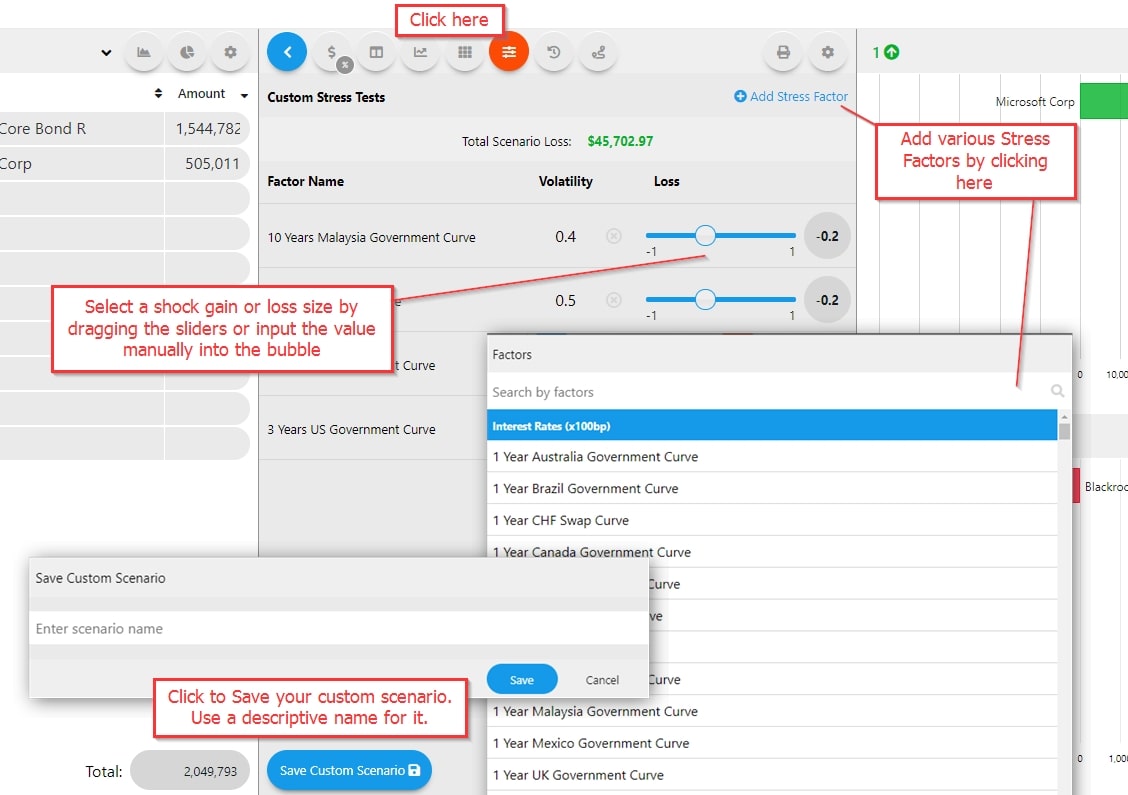

In PCT PRO you can now create your own scenarios with the new feature called Custom Stress Tests. Here is a blog entry we posted about it – Add or Create your own Custom Stress Tests

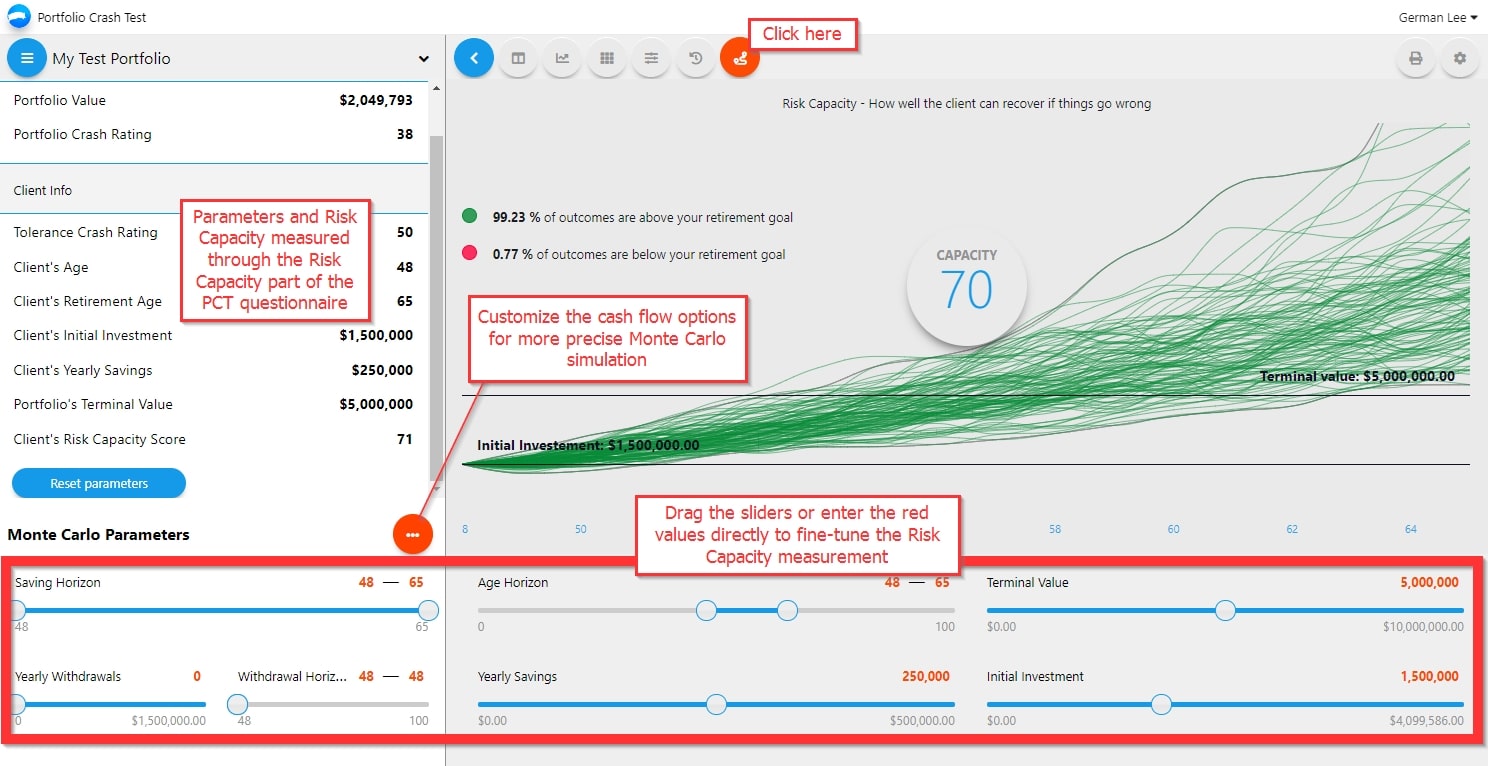

As mentioned above in the questionnaire part of this guide we have enhanced the traditional risk tolerance evaluation with the Risk Capacity that helps to measure the emotional readiness of the individual to take the risk. Along with the questionnaire which helps to increase the engagement of your clients and prospects with your services through a series of questions, PCT PRO enables the fine-tuning of the Risk Capacity measurement from the Risk Capacity module. Open and run the Risk Capacity after you crash test a client’s portfolio to enhance your proposition.

We hope you will find this guide helpful and take advantage of the powerful Portfolio Crash Test PRO features.

As always, you’re more than welcome to contact us through the online support chat (blue chat bubble in the bottom-right corner), or at clientsuccess@rixtrema.com or (800) 282-4567

If you’re new to Portfolio Crash Testing, we’d be glad to show you around – REQUEST YOUR PERSONAL DEMO TODAY.