How 401k Advisors can Prospect for Potential Business in Less Time with Plan Screener

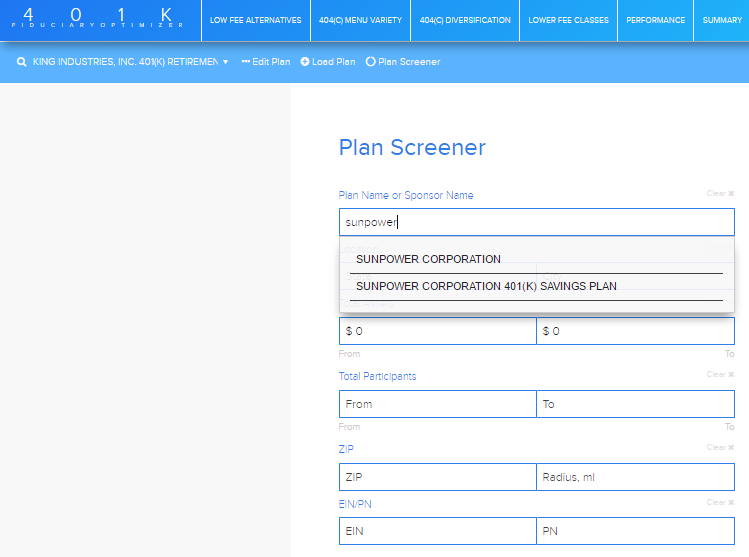

401kFiduciaryOptimizer is equipped with the Plan Screener, which is a powerful search engine that allows users to screen for any plans filed by the DOL through Forms 5500 that contain Schedules of Assets.

The Plan Screener provides users with searching flexibility by giving the ability to use different search fields, such as Plan Name or Sponsor Name, State or City, ZIP code, EIN/PN numbers, Retirement Plan Red Flags, etc.

Such flexibility is useful in achieving different goals. Users can easily find specific plans using a Plan Name or Sponsor Name, or typing in EIN/PN numbers. The ability to quickly discover any plan in any specific area gives users an opportunity to focus mostly on plan analysis and plan optimization.

One of the other Plan Screener searching advantages is the ability to create a list of plans that can be used by an advisor to prospect for a potential business. Such list can be made by searching either by State, City or using the ZIP Code box in order to find a specific place.

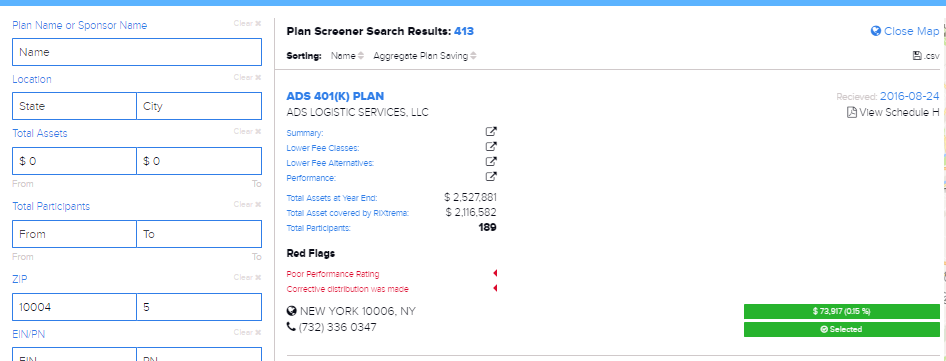

Whatever the goal is, searching for a specific plan to analyze/optimize a plan or compiling a list of plans for prospecting, the Plan Screener is the right tool to do it in the most efficient way. Moreover, the list of the plans can be further refined using our Retirement Plan Red Flags. The Retirement Plan Red Flags are search options provided by Larkspur Data, our partner. The Red Flags feature makes it possible to narrow the search list to a number of specific plans that might be of interest to the advisor.

Be sure to learn about other unique features of 401kFiduciaryOptimizer: How to Find and Use the Fee Benchmark Feature of 401kFiduciaryOptimizer

For example, if an advisor starts the search with entering a zip code 10004 and specifying the search area radius of 5 miles around it, the search results will show about 3000 plans in the area. If the Poor Performance red flag is used as a fiter to narrow down the search, the number of the plans will be reduced to 413. The advisor can use this list to reach out to the plan sponsor to offer his/her service and emphasize his/her expertise for the plan performance improvement.

Furthermore, the search results can be refined by adding additional parameters into Total Assets and/or Total Participants field to allow users focusing on the plans that are in the scope of their interest.

The Plan Screener search results section provides valuable information on the found plans. It gives you the idea about the total amount of the plan assets, number of the participants in the plan, contact information for the plan sponsor, the amount of money (basis points per annum) that can be saved with the optimized plan, the link to view the original Schedule H filed by the DOL.

The Plan Screener search results can be downloaded in a Comma Deliminated Value (csv) file. This option provides users the ability to sort the data in order to prioritize the prospecting efforts. For example, the advisor can download the list of the prospective plans and filter it out by total assets to focus his/her efforts on plans of the specific size.

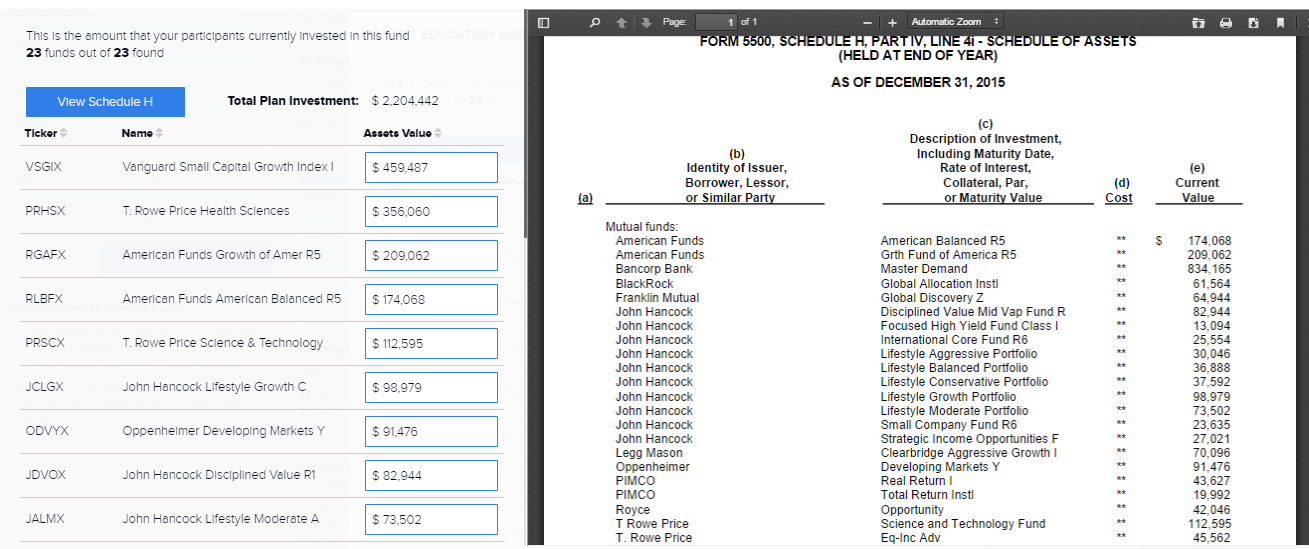

Users can eventually select a specific plan from the search result page by clicking on “Select and Create Proposal” button. Before saving a plan to the Plan Screener directory, the user can review all funds in the plan and compare them with the original Schedule H filed by the Plan Sponsor.

Request a personal tour of 401kFiduciaryOptimizer and other tools today:

Pingback : Case Study: How to Find Retirement Plans with Specific Investment Names

Pingback : Case Study: Create the Ultimate Optimization Report for a Plan Sponsor

Pingback : Case Study: Diversifying 401(k) Plans as a Great Prospecting Opportunity

Pingback : Case Study: Working with Non-Audited Plans in 401kFiduciaryOptimizer