- PROVE COMPLIANCE WITH THE SUMMARY REPORT

- COMPARE ROLLOVER FEES

- PULL IN RETIREMENT PLAN DATA

- PRESENT CLIENTS WITH A COMPLETE COST PICTURE

- CRASH RATING PROVES YOUR RECOMMENDATION CONSIDERS THE CLIENT’S UNIQUE FINANCIAL PROFILE

- COMPARE YOUR FEES TO YOUR COMPETITORS

- MANAGE YOUR ADVISORS WITH THE ADMIN PORTAL

When the SEC knocks, how will you prove compliance?

With an estimated $11k price tag and loads of new documentation requirements Reg-BI can be overwhelming. But, we will help you make sense of this and comply with RegBI for a fraction of the cost.

We know RegBIoptimizer is a top advisory tool because a top financial securities law firm reviewed the program for compliance.

The firm concluded that RegBI optimizer contains information similar to what courts have traditionally found necessary for fiduciary compliance. The same compliance firm found that RegBIoptimizer will create a Report that Broker-Dealers and Investment Advisors can use to prove a recommendation meets the best-interest obligations.

You need the best to protect yourself in a post RegBI world. That’s why top fiduciary attorneys review our product for compliance. So, when the SEC knocks, you can open the door with peace of mind.

Now let’s get onto the software.

Prove Compliance with the Summary Report

First, let’s take a look at what RegBIOptimizer’s comprehensive Summary report. It’s your bread and butter for compliance because reviewing this page and providing it to your client shows that you prioritize your clients’ best interest when making a recommendation. That is what RegBI is all about – proof.

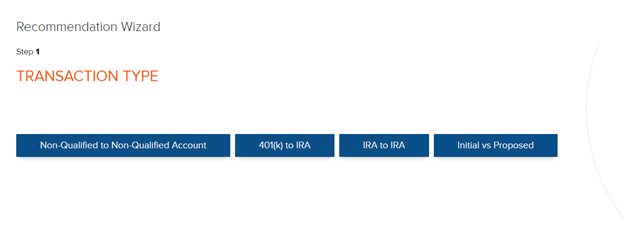

To create this report, let’s jump into Recommendation Wizard. You can see that there are reports for many types of recommendations covered by RegBI, including rollovers, non-qualified accounts, and even existing clients; that’s the Initial vs. Proposed button right there (Figure 1).

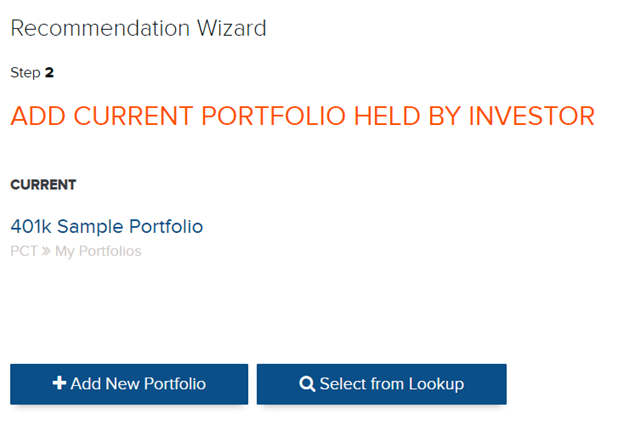

Once you make a selection, a series of steps guide you. We’ll look at a rollover this time. To start with, add the current portfolio of the investor, I preloaded it here – 401k Sample Portfolio (Figure 2). And in the next step, we add a proposed allocation. If I select from lookup, I will choose a Moderate Rollover.

Compare Rollover Fees

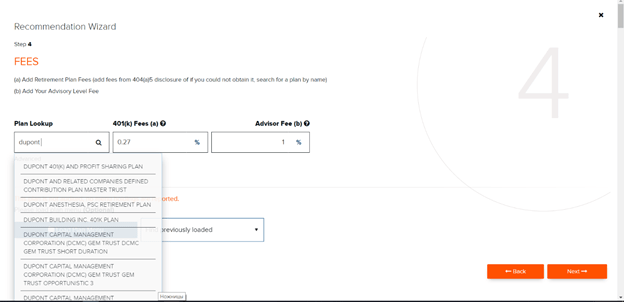

The next step is to outline your fees.

Pull in Retirement Plan Data

Because this is a rollover transaction, RegBIoptimizer will automatically pull in retirement plan data for the plan from which you are rolling over. Our database contains over seven hundred thousand retirement plans already prepopulated. Just type a name and pick a plan (Figure 3).

Present clients with a complete cost picture

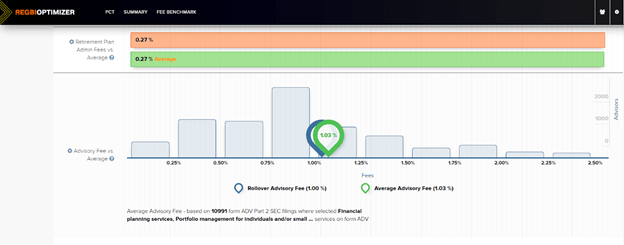

Don’t forget your advisory fee, in this case, 1%. RegBIoptimizer contains an advisor fee benchmarking database called FeeComp. We based FeeComp on tens of thousands of SEC filings, we’ll see it a little bit later.

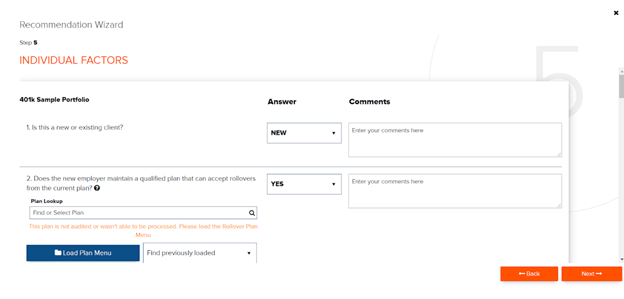

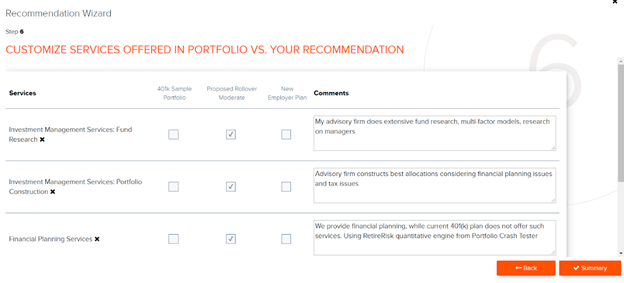

The next section is all about Individual Factors required to establish “best interest.” (Figure 4) And last but not least are custom services that you will offer in a transaction. Showing custom services is crucial because even if your fees go up, your services will justify them.

Now let’s jump into the Summary report (Figure 5).

It’s that easy!

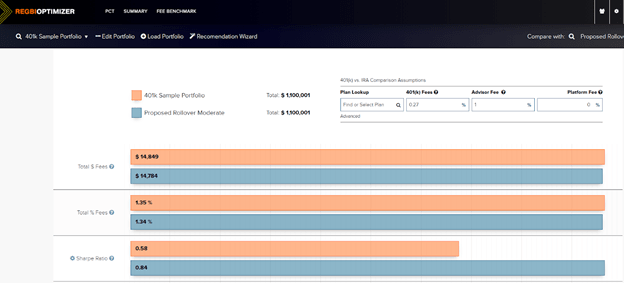

The summary report will pull in all required data for both initial and proposed allocation and will calculate all fees, including any plan admin fees, advisory fees, investment fees, etc.

It also contains risk-adjusted return measures and risk profiling information. You can compare the total fees of the investor and the services they get before and after they move their assets to you.

The red bar for the total fees is the current retirement plan portfolio. The current portfolio fees are $14,784, including the advisory fee of 1%, investment fees, 401(k) fees, and possibly a platform fee. Total fee assessment is crucial for any demonstration that you are acting in the client’s best interest (Figure 6).

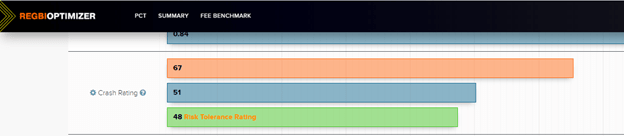

Now let’s consider the portfolio risk analysis and risk assessment for this client. First comes the Crash Rating section in the Summary report (Figure 7). Crash Rating is a number measuring the risk of the portfolio on a scale from 1 to 100. As you can see, the retirement plan crash rating is 67, while the risk tolerance of this investor is only 48, is the green bar. So, the current retirement portfolio assumes more risk than the investor is comfortable. The report clearly shows that the pre-rollover portfolio is not suitable for this investor.

Crash Rating proves your recommendation considers the client’s unique financial profile.

You can use a variety of risk tolerance questionnaires in RegBIoptimizer, including RiXtrema’s questionnaire, the one from FinaMetrica, and many others. Going back to our risk analysis, we can see that the suitable portfolio for this client should be closer to the tolerance level of 48, and in this case, our proposed collection is closer with a rating of 51 (the blue bar). So, this demonstrates due diligence to regulators and proves to the client why the rollover transaction is in their best interest, even if the fees are not necessarily lower.

Compare your fees to your competitors

The next section will help benchmark your advisory fee. The benchmark (the green droplet) shows 1.03% – that is, the average for this type of portfolio and services across the country based on tens of thousands of SEC filings. That benchmark is higher than the 1% advisory fee we chose for the transaction (it is the blue droplet behind the green one – See Figure 8).

So we are all good there. Again, this proves that your fees are not arbitrary but are grounded in reality.

This next section is specific only to rollover transactions, so it contains crucial retirement plan information, Red Flags (Figure 9). After that, we see the section on individual factors that we’ve already seen and the questionnaire answers.

Next, we go to the section of Services comparison between the current account and the one we are proposing. Regardless of whether we are talking about qualified or non-qualified accounts, showing relevant services is critical to justify “best interest” (screenshot for Services is above).

The Summary Report also includes some information about the composition of each portfolio. All of this data is integrated seamlessly into your CRS form for compliance purposes.

Manage your advisors with the admin portal

If you work as a team and you have a compliance officer, RegBIoptimizer also includes an admin portal. The admin portal shows all the advisors in the firm and all the reports they created to demonstrate “best interest.” If you work as a team, you can utilize the admin portfolio, and then you can set alerts to find transactions that might present compliance risk. If your advisors breach the rules, then the compliance team can receive a notification to step in and correct the situation.

SEC estimated that it would cost over $11K for a single advisor to comply with RegBI. RegBIoptimizer will slash that cost significantly and make workflow changes a breeze.

So, when SEC knocks, how will you prove compliance?

Contact our client success team with any questions regarding Reg-BI or RegBIoptimizer at clientsuccess@rixtrema.com. Click HERE to read more about Reg-BI compliance in our ebook.